- Equity Espresso

- Posts

- Rio's Second Shot at Mega Mining Deal

Rio's Second Shot at Mega Mining Deal

Good Evening,

Welcome to Equity Espresso’s Market Recap.

The Australian share market closed lower on Friday after trading relatively flat in the early parts of the session. The S&P/ASX 200 Index fell 0.2% to 8,310.4 points, following Thursday's 1.4% gain. The decline was primarily driven by weakness in the Financial (-0.99%) sector, with all major banks experiencing losses: Commonwealth Bank was down 1.19%, NAB fell 1.74%, ANZ dropped 1.77%, and Westpac declined 1.53%.

The Industrials (+0.74%) sector was the day’s best performer, with Transurban (+1.32%) and Computershare (+1.21%) a couple of the better performers. The Utilities (+0.51%) sector was another strong performer, with notable gains from Origin Energy (+0.27%), AGL Energy (+0.69%), and APA Group (+0.87%).

The big news came overnight, with Bloomberg reporting that mining giants Rio Tinto (-0.73%) and Swiss-based Glencore have engaged in preliminary merger discussions. The proposed merger would create a US$158 billion company, surpassing BHP as the industry's largest. A source revealed that Glencore approached Rio Tinto in late 2024, though talks were brief and have since ended. This mirrored a similar scenario from 2014 when Rio Tinto rejected Glencore's previous merger attempt to create the world's biggest mining company.

Company News

Aussie Broadband (+5.50%) has announced that CEO Brian Maher will lead the company as managing director, with co-founder Phillip Britt planning to retire on February 28. After stepping down, Britt will transition to a non-executive director role and special technical adviser.

Insignia Financial (+6.49%) has received an increased takeover bid from CC Capital at $4.60 per share, valuing the company above $3 billion. This bid competes with Bain Capital's matching $2.9 billion offer, and the board is now reviewing the proposal.

Lynas Rare Earths (-0.85%) reported Q2 FY25 sales revenue of $141.2M, up from $120.5M in Q1 and $136.2M year-over-year, driven by the new Kalgoorlie Facility. Despite low market prices and weak Chinese demand, revenue grew, though total rare earth oxide production dipped to 2,617 tonnes.

Telix Pharmaceuticals (+3.06%) gained European marketing approval for Illuccix’s prostate cancer imaging agent. The company will proceed with country-specific authorisations, with CEO Kevin Richardson expressing optimism about the upcoming European commercial launch.

ASX Indices | ASX Sector Performance |

Wall Street

U.S. markets retreated on Thursday following the previous session's robust rally, with the Nasdaq (-0.89%) leading declines, while the S&P 500 (-0.21%) and Dow Jones (-0.16%) saw more modest losses. The pullback came as investors processed Wednesday's gains, which had marked the strongest single-day performance since November 6th.

UnitedHealth Group's (-6.04%) stock fell after missing Q4 revenue expectations at $100.81b; however, the company beat earnings estimates. The company faced higher medical costs, with its medical cost ratio rising to 85.5%. Morgan Stanley (+4.03%) stock rose after it exceeded Q4 expectations with earnings of $2.22 per share and revenue of $16.22B. Profit more than doubled to $3.71B as investment banking grew 29% and trading performance surpassed forecasts.

U.S. Indices | Fear & Greed Index |

S&P500 Sector Performance

Economic Data

Australia’s Unemployment Rate increased to 4.0% in December 2024 from November’s eight-month low of 3.9%, matching market estimates. The number of unemployed rose by 10.3k to 604k.

China’s GDP expanded by 5.4% yoy in Q4 2024, accelerating from 4.6% in Q3 and surpassing market estimates of 5.0%.

China's Retail Sales rose 3.7% year-on-year in December 2024, faster than November's 3-month low of 3.0% and above the market consensus of 3.5%. S

U.S. Annual Inflation rose for a 3rd consecutive month to 2.9% in December 2024 from 2.7% in November, which was in line with market expectations.

U.S Annual Core Consumer Price inflation, which excludes items such as food and energy, eased to 3.2% in December 2024, down from 3.3% in the previous three months and slightly below market expectations of 3.3%.

Sponsor

Pay No Interest Until Nearly 2027 AND Earn 5% Cash Back

Some credit cards can help you get out of debt faster with a 0% intro APR on balance transfers. Transfer your balance, pay it down interest-free, and save money. FinanceBuzz reviewed top cards and found the best options—one even offers 0% APR into 2027 + 5% cash back!

Quick Singles

🌎️ Around The Globe

BP plans to reduce its workforce by 4,700 employees and 3,000 contractors in 2025, representing over 5% of its 90,000 staff. Following recent business acquisitions, the oil company cites a need to streamline operations, lower costs, and improve competitiveness.

Goldman Sachs CEO David Solomon indicated the firm's Apple Card partnership might end before its 2030 contract expiration. The collaboration significantly reduced Goldman's return on equity in 2024, though improvements are expected in 2025-2026.

Google has partnered with The Associated Press (AP) to incorporate real-time news updates into its Gemini A.I. chatbot. While launch details remain undisclosed, this follows AP's earlier OpenAI deal and aims to enhance Gemini's response accuracy with current information.

Hindenburg Research, known for successful short-selling and exposing corporate fraud, announced its closure on Wednesday. Founder Nate Anderson launched the firm in 2017, gaining prominence after exposing Nikola's misrepresentation in 2020, which led to its founder's imprisonment.

The FTC has launched legal action against John Deere over repair restrictions, alleging its software locks create an illegal monopoly on equipment repairs. The lawsuit claims the company's previous agreement to improve repair access was inadequate and designed to avoid right-to-repair laws.

TikTok's potential ban will be handed over to incoming President Trump's administration to deal with, according to Biden officials.

Markets

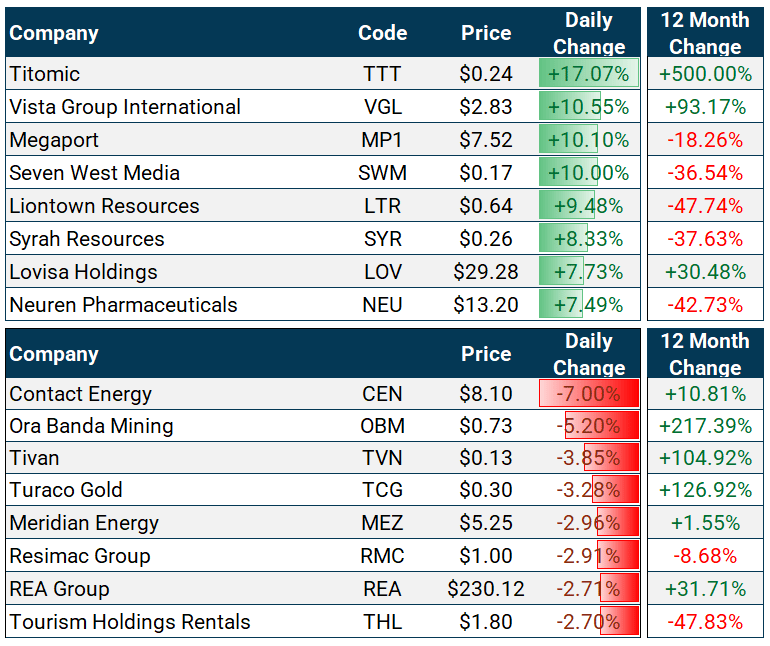

ASX Company Movers

Commodity Prices

Bonds

Forex

Global Health Check

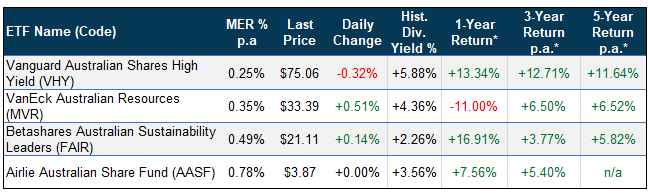

ETF Prices

🔍️ ETF Watch

Want to see how one of your ETFs compares to the rest?

Please reply to this e-mail and tell us an ETF or two you want to be included in the tables below.

Australian Index

Australian Sectors

Global Indices & Sectors

Global Strategy

Property & Infrastructure

Fixed Income

Mixed Assets

Geared

*1-year, 3-year and 5-year returns are calculated as of November 30 2024.

The Last Word

How are we doing?

We always love hearing from our readers and are constantly seeking feedback.

How are we doing with Equity Espresso?

Is there anything you’d like to see more of or less of?

Which aspects of the newsletter do you enjoy the most?

Hit reply and say hello - or leave us feedback in the poll below:

If you enjoyed this newsletter, forward this e-mail to a friend.

If you’re that friend, subscribe here.

DISCLAIMER: Please note that the information provided in this newsletter is for educational purposes only and should not be considered financial advice. It is not intended to encourage you to buy/sell assets or make economic decisions. We strongly recommend conducting your research before making any investment.