- Equity Espresso

- Posts

- 2025's Gains Erased | Star Warns of Suspension

2025's Gains Erased | Star Warns of Suspension

Good Evening,

Welcome to Equity Espresso’s Market Recap.

All that hard work to start 2025 has been wiped away as the February sell-off continued on the last trading day of the month.

The S&P/ASX 200 index lost 95.8 pts. or 1.16% to 8,172.40, the largest one-day sell-off in four weeks, hitting lows not seen since late December.

February was a torrid month for Aussie equities. The major index lost 4.22%, the sharpest fall since September 2022!

There was lots of red on the board, with 10 of the 11 sectors finishing lower. Technology (-2.86%) stocks were hit hardest, following the NASDAQ in the U.S, which fell by 2.78%. Wisetech Global (-4.78%) fell below $90 for the first time since August 2024. Life360 (+7.18%) was the one bright spot in the sector after it beat earnings guidance.

Star Entertainment Group (-11.54%) has warned its shares could be suspended from trading on Monday, with the casino operator's board unable to finalise its half-year financial accounts without securing urgent liquidity solutions. The company confirmed it is "continuing to explore possible liquidity solutions" and expects to receive one or more proposals today that could "materially increase the Group's liquidity position."

Star said its half-year financial report can only be finalised if these liquidity proposals are "sufficiently capable of being progressed to finalisation" to determine whether the company can continue as a going concern.

If the report isn't lodged by the end of today, as required by ASX Listing Rules, Star shares will be automatically suspended from trading starting Monday, March 3. The suspension will continue until the report is filed and the ASX approves reinstatement.

ASX Company News

Australian Finance Group (-4.73%) reported a 6% increase in first-half net profit as revenue jumped 11% on record residential loan settlements of $31.8 billion, up 13% from the previous interim period. The mortgage broker services provider, which supports 4,100 brokers nationwide, will pay a fully franked interim dividend of 3.8¢ per share. CEO David Bailey highlighted the company's expanding distribution network, with broker numbers reaching an all-time high.

Endeavour Group (-7.13%) reported falling first-half sales despite strong Christmas trading. Total sales slipped 0.7% to $6.6 billion, and retail sales dropped 1.5% to $5.5 billion.

Life360 (+7.18%) beat its earnings guidance and is approaching 80 million global users for its family-tracking app. The San Francisco-based company, which owns the Bluetooth tracker Tile, reported an adjusted EBITDA of US$45.5 million ($73 million), exceeding its US$42 million guidance. Annual revenue grew 22% to US$371.5 million for the year ending December 31.

Harvey Norman (+2.55%) posted a slight increase in half-year profit, rising by $6.6 million to $310.5 million, as total sales revenue reached $4.8 billion. The white goods and electrical retailing giant benefited from stronger franchisee sales, particularly in November and December, with franchisee sales revenue climbing 5.5% to $3.3 billion.

Neuren Pharmaceuticals (-6.83%) reported a decline in full-year profit to $145.6 million from $156.9 million. However, the drug developer noted that retaining Australian dollars as its reporting currency significantly impacted its figures despite changing its functional currency to U.S. dollars.

PEXA (+8.08%) posted a 24% jump in interim earnings as the settlement exchange company grew its market share and reduced international cash outflows. While revenue rose to $202.5 million from $161.8 million, the company reported a widened loss of $32.7 million compared to $4.6 million previously, attributed to the impairment of a minority investment.

TPG Telecom (+2.43%) posted an annual net loss of $107 million compared to a $49 million profit a year earlier. A $250 million write-down hit the telco on regional mobile network assets, $20 million in transaction costs, and $6 million in redundancy expenses.

Vista Group (+16.44%) reported a dramatic 62% surge in 2024 earnings to $21.6 million, up $8.3 million from the previous year, as the data analytics provider saw a significant increase in clients moving to its cloud solutions.

ASX Indices | ASX Sector Performance |

Wall Street

U.S. markets plunged Thursday, with the S&P 500 (-1.59%) falling sharply, the Nasdaq (-2.78%) tumbling even more, while the Dow Jones (-0.45%) declined at a more modest pace. The sell-off was severe enough to erase all of the S&P 500's gains for 2025, pushing the benchmark index into negative territory for the year.

Nvidia (-8.48%) sparked the rout, wiping out $274 billion in market value despite posting an upbeat revenue outlook. Investors instead focused on weaker-than-expected gross margin forecasts, which failed to sustain Wall Street's A.I. enthusiasm. The Technology (-3.79%) sector was hardest hit, in its worst session since the recent DeepSeek-induced sell-off.

Teladoc Health (-13.56%) shares plunged 13.6% after the virtual healthcare provider reported a wider-than-expected quarterly loss of 28 cents per share versus the anticipated 24 cents. Investors were disappointed by the weak first-quarter revenue guidance of $608-629 million, falling short of analysts' $632.9 million forecast.

Nvidia shares plunged despite the A.I. chipmaker beating Wall Street expectations with fourth-quarter revenue of $39.33 billion and adjusted earnings of 89 cents per share. The sell-off came as investors focused on declining gross profit margins and the smallest revenue beat in two years, overshadowing the company's strong first-quarter guidance of approximately $43 billion. While this forecast still represents an impressive 65% year-over-year growth, it marks a significant deceleration from the 262% growth rate seen a year earlier.

U.S. Indices | Fear & Greed Index |

S&P 500 Sector Performance

Economic Data

Australia’s Private sector credit increased by 0.5% month-over-month in January 2025, compared with the market consensus of 0.6%, which was also the growth rate recorded in the previous four months.

U.S. GDP expanded by an annualised 2.3% in Q4 2024, the slowest growth in three quarters, down from 3.1% in Q3 and in line with the advance estimate.

U.S. Initial Jobless Claims soared by 22,000 from the previous week to 242,000 on the third week of February, the most in over two months and well above market expectations of 221,000.

Japanese Retail Sales grew by 3.9% YoY in January 2025, up from a downwardly revised 3.5% growth in December 2024, slightly below market expectations of a 4% rise.

Sponsor

AI-ighty Potential

Dubbed the "the rocket fuel of AI" by Wired, this groundbreaking innovation has sparked fervent excitement across Wall Street. And with projections soaring to a potential market cap of $80 trillion – equivalent to 41 Amazons – the magnitude of its impact cannot be overstated.

But here's the real deal: nestled within this tech revolution lies an opportunity for sharp investors to invest in a remarkable company poised to dominate its corner of this burgeoning market.

And thanks to The Motley Fool, the full narrative of this extraordinary tech trend has been compiled into an exclusive report, designed to arm you with the insights needed to make informed investment decisions.

Quick Singles

🌎️ Around The Globe

Costco is expanding with nine new warehouse stores globally, including six in the U.S. that will be opening in the coming weeks. The company is planning 29 total openings during the fiscal year 2025, with 10 locations outside the U.S. and three being relocations. An additional store is planned for Ardeer, Australia, later this year, though no specific opening date has been announced.

Eli Lilly will invest over $50 billion in U.S. drug manufacturing, doubling its previous $23 billion commitment. The maker of obesity drug Zepbound says this represents the largest pharmaceutical investment in domestic manufacturing in the past decade.

FTX's bankruptcy proceedings have accumulated nearly $1 billion in costs, placing it among America's most expensive Chapter 11 cases ever. Court records show approximately $948 million already paid to legal and financial firms, with over $952 million in fees approved.

Instagram is reportedly exploring launching a standalone Reels app for short-form video content. This potential move comes as TikTok's future in the U.S. market faces uncertainty.

Nissan is reportedly preparing to replace CEO Makoto Uchida following disappointing earnings results and the breakdown of merger talks with Honda.

YouTube's most popular creator, MrBeast, wants to raise hundreds of millions in funding that would value his business empire at approximately $5 billion. Jimmy Donaldson has reportedly engaged with financial firms and wealthy individuals about investing in his holding company.

Markets

ASX Company Movers

Commodity Prices

Bonds

Forex

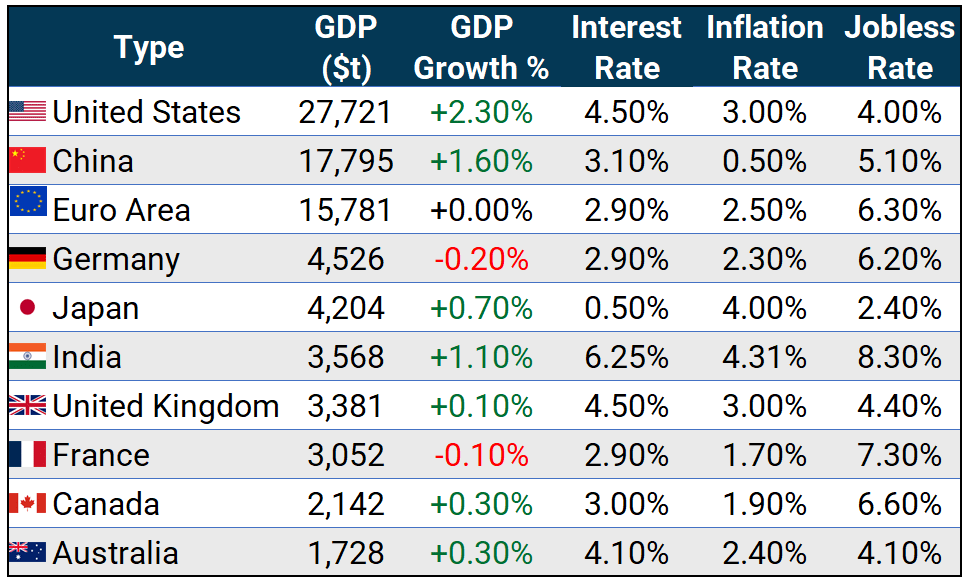

Global Health Check

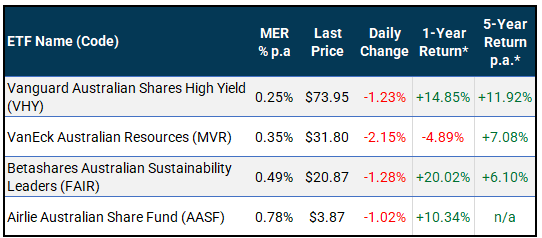

ETF Prices

🔍️ ETF Watch

Australian Index

Australian Sectors

Global Indices & Sectors

Global Strategy

Property & Infrastructure

Fixed Income

Mixed Assets

Geared

*1-year, 3-year and 5-year returns are calculated as of January 31, 2025.

The Last Word

How are we doing?

We always love hearing from our readers and are constantly seeking feedback.

How are we doing with Equity Espresso?

Is there anything you’d like to see more of or less of?

Which aspects of the newsletter do you enjoy the most?

Hit reply and say hello - or leave us feedback in the poll below:

If you enjoyed this newsletter, forward this e-mail to a friend.

If you’re that friend, subscribe here.

DISCLAIMER: Please note that the information provided in this newsletter is for educational purposes only and should not be considered financial advice. It is not intended to encourage you to buy/sell assets or make economic decisions. We strongly recommend conducting your research before making any investment.