- Equity Espresso

- Posts

- 8,000 Reasons to Smile

8,000 Reasons to Smile

Good Evening,

Welcome to Equity Espresso’s Daily Market Recap.

The Australian market broke new ground on Monday, with the ASX 200 index climbing above 8,000 for the first time on expectations of an imminent rate cut in the United States. The main index added 58.3 pts. or 0.7% as all 11 major sectors finished higher, closing at 8,017.60.

Technology (+1.39%) stocks were the best performers, following the positive lead from the NASDAQ on Friday. WiseTech Global (+2.47%) and Xero (+1.42%) continue to lead the way. Wesfarmers (+2.09%) hit new heights, hitting the $70.00 mark, who, along with Aristocrat Leisure led the Discretionary (+1.37%) sector higher.

The rise in our market came despite weaker than expected economic data from China. Chinese GDP rose by 4.7% year-on-year during the second quarter, below expectations of a 5.1% increase.

In company news:

Lifestyle Communities (-18.06%) slumped after a report from the ABC that accused the company of unethical conduct from its residents.

Aussie Broadband (-14.01%) shares fell after lowering its earnings guidance for the coming year to between $125 million and $135 million. This was down from the previous guidance of $135 million and $145 million.

Atturra (+10.96%) lifted after it said it expects FY24 revenue to increase by 35% to $240 million. Underlying EBITDA is expected to increase by 19% on the pcp for the full year to $25 million to $26 million

ASX Indices | ASX Sector Performance |

Wall Street

Wall Street finished higher on Friday, with the S&P 500 (+0.55%) and Dow Jones (+0.62%) hitting intraday record highs as investors bet on an interest rate hike in September. The NASDAQ (+0.63%) also climbed after mega-cap technology stocks Apple (+1.31%) and Nvidia (+1.47%) rebounded after starting the week in the red.

10 of the 11 major sectors on the S&P500 finished in the green, led by Consumer Discretionary (+0.96%) and Materials (+0.93%), while Communication Services (-0.75%) was the sole sector to close lower.

Bank quarterly earnings were the big news story, with Wells Fargo (-6.02%) the big loser on the day, after it reported a 9% drop in net interest income. Wells Fargo recorded $11.92 billion in net income, which was below the $12.12 billion expected by analysts. Citigroup (-1.8%) and JPMorgan (-1.2%) both also fell on the day.

U.S. Indices | Fear & Greed Index |

S&P500 Sector Performance

Economic Data

U.S. Producer Prices increased 0.2% month-on-month in June, beating forecasts of a 0.1% rise after a flat reading in May.

U.S. Consumer Sentiment fell for the fourth consecutive month to 66 in July, down from 68.2 in June, hitting the lowest mark since November last year.

China’s GDP expanded 4.7% year-on-year during Q2 of 2024, below forecasts of 5.1% and down from the prior quarters growth of 5.3%

Sponsor

Learn from investing legends.

Warren Buffett reads for 8 hours a day. What if you only have 5 minutes a day? Then, read Value Investor Daily. We scour the portfolios of top value investors and bring you all their best ideas.

Quick Singles

🌎️ Around The Globe

Argentina's will purchase just over $1.5 billion from the central bank to pay the total interest on the country's "Globales" and "Bonares" bonds which are due in January 2025.

AT&T suffered a hacking incident as data from about 109 million customer accounts containing records of calls and texts from 2022 was illegally downloaded in April.

Costco is increasing its annual membership fees for the first time since 2017. U.S. and Canada memberships will increase by $5 to $65, and Executive Memberships will jump by $10 to $130.

Apple and Microsoft announced they would no longer be observers of OpenAI’s board, likely due to growing antitrust scrutiny in the U.S. and Europe.

Tesla will reportedly push back the unveiling of its robotaxi vehicle to October, originally slated for August, according to Bloomberg.

Uber has announced it will be offering boat services in Ibiza, Venice, Athens, Paris, Corfu and Santorini. Users will have the ability to book private yacht excursions or order boats as a taxi service through the Uber app.

Markets

ASX Company Movers

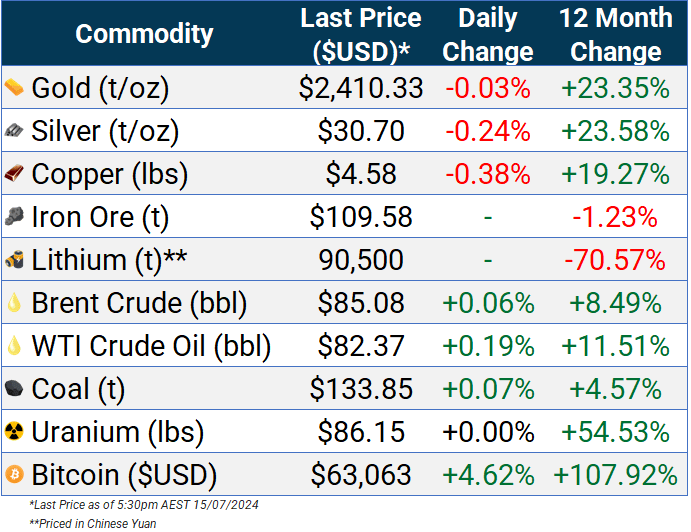

Commodity Prices

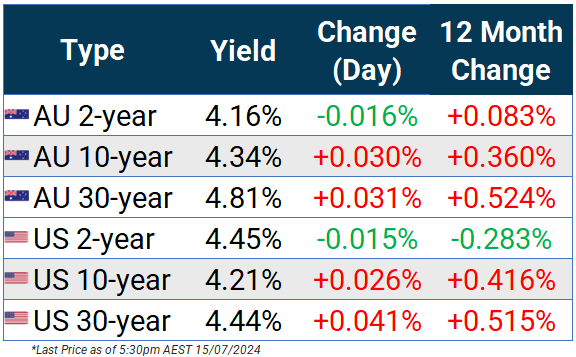

Bonds

Forex

Global Health Check

The Last Word

How are we doing?

We always love hearing from our readers and are constantly seeking feedback.

How are we doing with Equity Espresso?

Is there anything you’d like to see more of or less of?

Which aspects of the newsletter do you enjoy the most?

Hit reply and say hello - or leave us feedback in the poll below:

If you enjoyed this newsletter, forward this e-mail to a friend.

If you’re that friend, subscribe here.

DISCLAIMER: Please note that the information provided in this newsletter is for educational purposes only and should not be considered financial advice. It is not intended to encourage you to buy/sell assets or make economic decisions. We strongly recommend conducting your research before making any investment.