- Equity Espresso

- Posts

- 8,000 in Sight: Baby Bunting Bounces and Yancoal Yanks Dividends

8,000 in Sight: Baby Bunting Bounces and Yancoal Yanks Dividends

Good Evening,

Welcome to Equity Espresso’s Market Recap.

The Australian share market continued its upward trajectory, marking an impressive eight-day winning streak and inching ever closer to the coveted 8,000 milestone. The ASX 200 index climbed 17.3 points, or 0.2%, to close at 7,997.70 following the release of the Reserve Bank's meeting minutes. More on that late

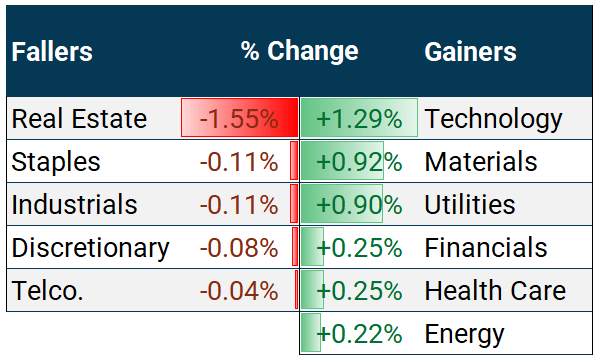

Technology (+1.29%) stocks emerged as the day's champions, mirroring the NASDAQ's strong performance in the U.S. overnight. The sector rose with standout performances from Wisetech Global (+2.51%), Xero (+1.90%), and Nuix, which jumped an impressive 8.90%.

Despite ongoing declines in iron ore prices, which have dipped below US$98.00 per tonne, the Materials sector defied expectations with a 0.92% gain. Industry giants Fortescue (+1.47%), BHP Group (+1.31%), and South32 (+1.69%) led the charge. Meanwhile, gold continued to shine as a safe-haven asset, maintaining its position above US$2,500 per tonne. This stability bolstered gold miners, with Evolution Mining and Perseus Mining seeing their share prices climb by 1.43% and 1.98%, respectively.

The Reserve Bank of Australia (RBA) released its minutes from the August meeting, maintaining its cash rate at 4.35%, marking the sixth consecutive hold. While this met market expectations, the board expressed ongoing concern about inflation, which remains above the 2-3% target range and is not expected to reach the midpoint until 2026. The minutes emphasised vigilance towards inflation risks, with the RBA keeping its options open and basing future decisions on incoming economic data.

In company news:

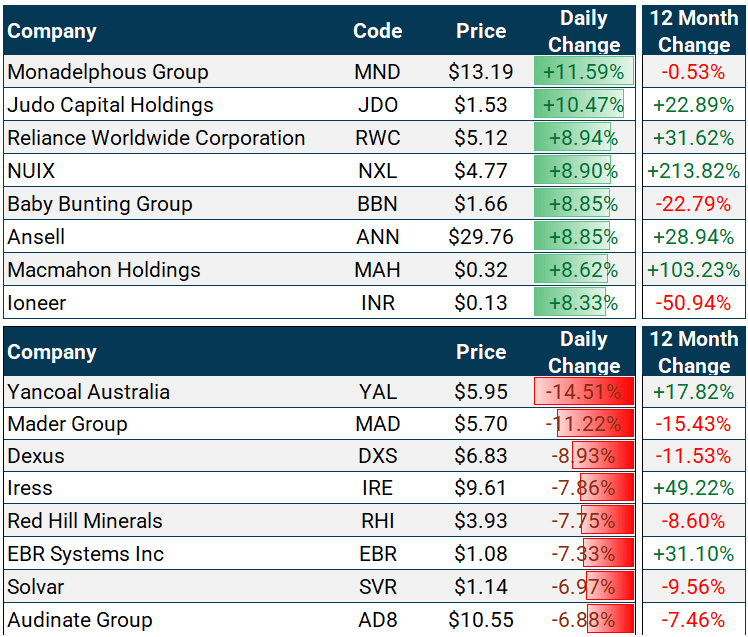

Ansell (+8.85%) reported that the COVID-19 PPE surplus has subsided but faced challenges, with net profit dropping 49% to $US76.5 million and EBIT margins slipping to 12.1%. The company reduced its final dividend by 16% and implemented cost-cutting measures, including 1,330 manufacturing job cuts as part of increased automation efforts.

ARB Corporation (+5.22%) reported a 17.1% profit increase to $142.7 million for FY24, with sales revenue up 3.3% to $693.2 million. The company raised its full-year dividend, declaring a final fully franked dividend of 35¢ per share, bringing the total to 69¢, an 11.3% increase from the previous year.

Baby Bunting (+8.85%) shares rose after reporting improved sales volumes post-FY2024. The company's $3.7 million underlying net profit met downgraded guidance despite cutting its final dividend due to lower sales and profits. While statutory profit fell 83% to $1.7 million and annual sales dropped 5%, same-store sales showed improvement in the fourth quarter.

Dexus (-8.93%) reported a $1.58 billion statutory loss for FY2024, down 110% from the previous year, driven by significant portfolio devaluations. Adjusted funds from operations reached $516.3 million, aligning with guidance but 7% below last year, equating to 48¢ per security.

Hub24 (+1.28%) reported impressive growth in FY24, with funds under administration rising 30% to $104.7 billion. Record net inflows of $15.8 billion contributed to this surge. Earnings increased 15% to $118.0 million, while profit jumped 24% to $47.2 million/

Ingenia Communities (+5.7%) added 5.7 per cent to $5.37 after posting a 20 per cent jump in revenue to $472.3 million in FY24.

KMD Brands (+6.82%) reported improving Rip Curl and Kathmandu store sales. However, preliminary results show year-over-year declines, with Kathmandu sales expected to drop 14.5% and Rip Curl sales 7.3%.

Monadelphous (+11.59%) shares surged following a 16% increase in annual net profit to $62.2 million. Despite losing $75-$85 million in forecast revenue due to Albemarle's contract cancellations, the company increased its full-year dividend by 18% to 58¢ per share.

Reliance World Corporation (+8.94%) rose despite a 21% drop in annual net profit to US$110.1 million. Sales remained flat at US$1.245 billion. The company forecasts a flat December half and plans to intensify cost-cutting measures.

Yancoal (-14.51%) shares fell after the company decided to retain its $420 million half-year profit for potential acquisitions, including Anglo American's Queensland coal mines, instead of paying dividends. Despite a strong cash balance of $1.55 billion and no debt, the company prioritised growth opportunities over shareholder returns.

ASX Indices | ASX Sector Performance |

Wall Street

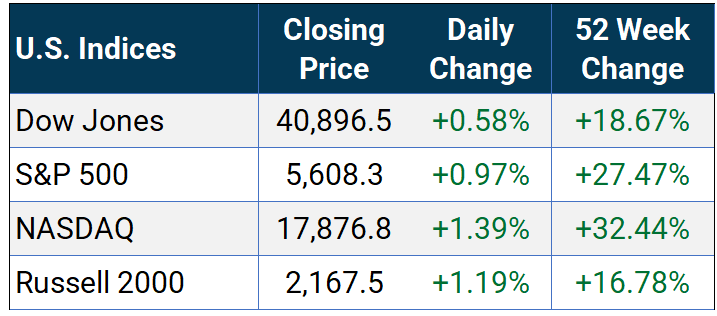

U.S. stocks rallied on Monday, extending their strongest weekly performance of the year as investors turned their attention to the upcoming Jackson Hole Economic Symposium. The tech-heavy NASDAQ (+1.39%) led the charge, buoyed by significant gains from industry giants Nvidia (+4.35%) and Alphabet (+2.28%).

The S&P 500 and Nasdaq extended their winning streaks to eight consecutive sessions, marking their longest rally in 2024. This continued rebound comes after a sharp sell-off two weeks ago, fueled by recession concerns. The S&P 500 posted a solid gain of 0.97%, while the Dow Jones Industrial Average climbed 0.58%, further solidifying the market's recovery.

Advanced Micro Devices (+4.52%) stock rose after the company announced plans to acquire server builder ZT Systems for $4.9 billion, using a mix of cash and stock. The deal, expected to close in the first half of 2025, aims to strengthen AMD's position in the server market.

Estée Lauder's (-2.23%) stock dropped following disappointing fiscal 2025 guidance and news of CEO Fabrizio Freda's retirement at year-end. The company projected annual sales between -1% and +2%, significantly below analysts' 6.4% growth estimate. Adjusted profit forecasts also fell short of expectations, ranging from $2.75 to $2.95 per share.

U.S. Indices | Fear & Greed Index |

S&P500 Sector Performance

Economic Data

China's central bank kept key lending rates steady in August, as expected. The one-year loan prime rate remained at 3.45%, while the five-year rate, which influences mortgage rates, stayed at 3.85%.

German Producer Prices dropped by 0.8% YoY in July 2024, slowing from a 1.6% fall in June, which was in line with market forecasts.

Denmark’s GDP grew by 0.6% in the second quarter of 2024 after contracting by 1.0% in the previous quarter.

Sponsor

Whiskey: The Tangible Asset for Your Portfolio

Most people fail to diversify their investments.

They invest all their money in intangible assets like stocks, bonds, and crypto.

The solution - fine whiskey.

Whiskey is a tangible asset, providing a unique appeal compared to other investments. Casks of whiskey have measurable attributes like size, age, and weight, making their value indisputable. This physical nature allows for clear identification of issues and adjustments to safeguard future value.

Vinovest’s expertise in managing these tangible assets ensures your whiskey casks are stored and insured to the highest standards, enhancing their worth over time. Discover how this tangible, appreciating asset can enhance your investment portfolio.

Quick Singles

🌎️ Around The Globe

General Motors is cutting over 1,000 salaried positions globally in its software and services division, including about 600 jobs at its tech campus. This reduction, affecting approximately 1.3% of GM's global salaried workforce, follows a review aimed at streamlining the unit's operations.

Perdue, a major U.S. poultry and meat processor, has recalled approximately 167,171 pounds of frozen ready-to-eat chicken breast nuggets and tenders due to possible metal contamination. The Food Safety and Inspection Service announced the recall, which affects a significant portion of Perdue's product line.

Rivian has temporarily halted production of its Electric Delivery Vans (EDVs) for Amazon due to a parts shortage. Once the supply issue is resolved, the electric vehicle manufacturer expects to recover all missed production.

Twitter/X is winding down its operations in Brazil and removing staff following a legal dispute with the country's Supreme Court. The social media platform claims a top judge threatened to arrest its legal representative if certain accounts accused of spreading election-related misinformation were not removed.

Texas Instruments will receive up to $1.6 billion in U.S. Commerce Department funding under the CHIPS and Science Act to build three new facilities: two in Texas and one in Utah. The company has committed over $18 billion to these projects through 2029 and expects to create 2,000 manufacturing jobs.

Venu Sports, a joint venture by ESPN, Fox, and Warner Bros., faced a setback as a federal judge temporarily blocked its launch on antitrust grounds. The $42.99/month service, offering 15 live sports channels, was challenged by competitor FuboTV, which accused the media giants of creating a monopoly.

Markets

ASX Company Movers

Commodity Prices

Bonds

Forex

Global Health Check

ETF Prices

🔍️ ETF Watch

Want to see how one of your ETFs compares to the rest?

Reply to this e-mail and tell us an ETF or two you want to be included in the tables below.

Australian Index

Australian Sectors

Global Indices & Sectors

Global Strategy

Property & Infrastructure

Fixed Income

Mixed Assets

*1-year, 3-year and 5-year returns are calculated as of 31 July 2024.

The Last Word

How are we doing?

We always love hearing from our readers and are constantly seeking feedback.

How are we doing with Equity Espresso?

Is there anything you’d like to see more of or less of?

Which aspects of the newsletter do you enjoy the most?

Hit reply and say hello - or leave us feedback in the poll below:

If you enjoyed this newsletter, forward this e-mail to a friend.

If you’re that friend, subscribe here.

DISCLAIMER: Please note that the information provided in this newsletter is for educational purposes only and should not be considered financial advice. It is not intended to encourage you to buy/sell assets or make economic decisions. We strongly recommend conducting your research before making any investment.