- Equity Espresso

- Posts

- Anglo's Coal Calamity Fuels Rivals' Rally

Anglo's Coal Calamity Fuels Rivals' Rally

Good Evening,

Welcome to Equity Espresso’s Daily Market Recap.

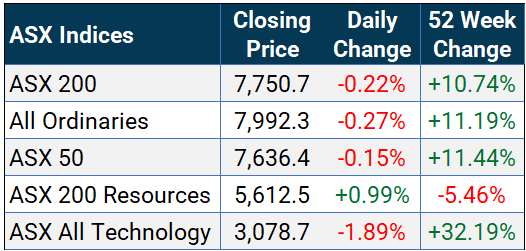

Markets started the day well down but clawed back some of the early losses thanks to a lift in the coal sector, with the benchmark ASX 200 index falling by 16.8 pts. or 0.2% to finish 7,750.70.

Four sectors finished in the green, with Materials (+1.03%) being the best performer. Coal companies were the big movers after Anglo American suspended production at its Grosvenor steelmaking coal mine in Queensland following an underground coal gas ignition incident on Saturday. Shares in the Britsh-listed company were down by over 2% in the early part of Monday's trade.

Coronado Global Resources (+8.86%) and Whitehaven Coal (+6.28%) were some of the companies whose share price benefitted from the news that coal production could tighten due to the mine closure.

The Technology (-2.21%) sector was the worst performer following the NASDAQ’s fall on Friday in the U.S. WiseTech Global (-5.18%) shares fell back below the $100 mark after two directors, including founder and CEO Richard White, sold a combined $45 million worth of shares in late June.

In economic news, Australian job advertisements declined by 2.2% month-over-month in June 2024, following a 1.9% fall in May, according to data from ANZ-Indeed. It was the fifth straight month of job ads falling amid easing labour demand due to a slowing economy and high borrowing costs.

In company news:

Lendlease Group (+4.07%) shares rose after announcing the sales of its U.S. Military Housing business for $480 million. The sale will lift the company’s Operating Profit After Tax (OPAT) by $105 to $120 million in H1 FY25.

Brambles (-2.00%) fell after CHEP Americas' CEO, Xavier Garijo, left the company after only six months in the position.

ASX Indices | ASX Sector Performance |

Wall Street

U.S. stocks started Friday's session positively before fizzling out in the afternoon, sending all the major indices lower. The NASDAQ (-0.71%) fell the most, with Meta Platforms (-2.95%) and Amazon (-2.32%) seeing the biggest falls. The S&P 500 (-0.41%) and Dow Jones (-0.11%) both also finished the session down.

Seven of the 11 major sectors finished in the red, with Communication Services (-1.63%) and Consumer Discretionary (-1.36%) stocks fairing the worst. Real Estate (+0.62%) and Energy (+0.42%) were the best performers.

Nike (-19.98%) shares had their biggest one-day fall in over two decades after it lowered its full-year sales forecasts, stating that it expects sales to be down mid-single digits after previously saying it expected sales to grow. Trump Media & Technology (-10.84%) shares fell after starting the day positively post the first presential debate between Donald Trump and President Joe Biden.

U.S. Indices | Fear & Greed Index |

S&P500 Sector Performance

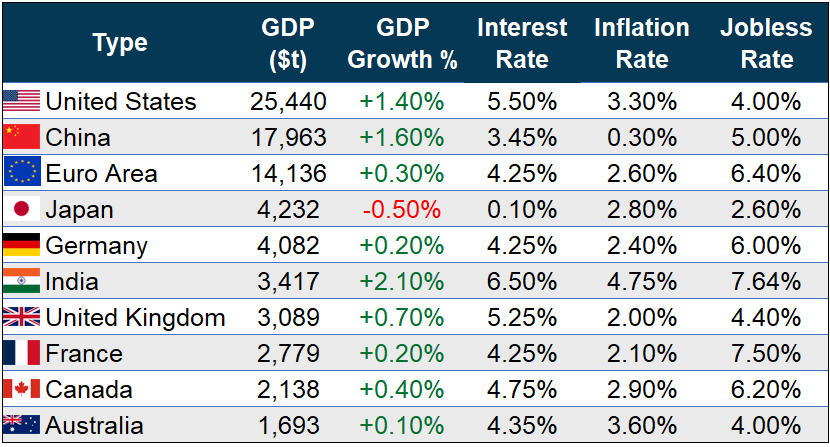

Economic Data

China’s General Manufacturing PMI ticked up to 51.8 in June from 51.7 in May, beating market forecasts of 51.2 and marking the highest figure since May 2021.

Japan’s Business Confidence rose to +13 during Q2 of 2024, up from the +11 reading in the previous quarter, reaching the highest mark in two years amid an improving economic outlook.

Sponsor

The only AI Crash Course you need to master 20+ AI tools, multiple hacks & prompting techniques to work faster & more efficiently.

Just 3 hours - and you become a pro at automating your workflow and save upto 16 hours a week.

This course on AI has been taken by 1 Million people across the globe, who have been able to:

Stay ahead of Markets with your AI Personal Assistant

Build No-code apps using UI-ZARD in minutes

Write & launch ads for your business (no experience needed + you save on cost)

Create solid content for 7 platforms with voice command & level up your social media

And 10 more insane hacks & tools that you’re going to LOVE!

Quick Singles

🌎️ Around The Globe

BlackRock has agreed to buy U.K. data firm Preqin for £2.55 billion in an all-cash deal.

Boeing will buy Spirit AeroSystems in a $4.7 billion all-stock deal valuing the company at $37.25 per share.

Google has added 110 languages to Google Translate after training the platform on its PaLM 2 AI language model.

OpenAI has agreed to a multiyear licensing deal with Time magazine. The agreement gives OpenAI access to 101 years of Time content to train its models. Time will be able to develop new products using OpenAI’s technology.

SpaceX plans to sell insider shares at $112 each in a tender offer, valuing the company at close to $210 billion, up from a $180 billion valuation in December. The new valuation is a record for an American private company.

Markets

ASX Company Movers

Commodity Prices

Bonds

Forex

Global Health Check

ETF Prices

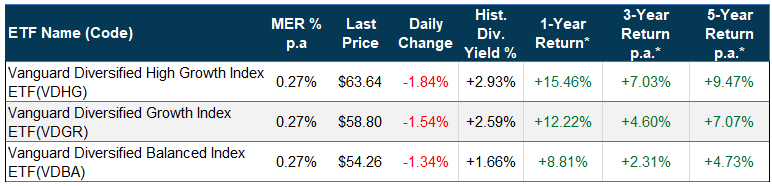

🔍️ ETF Watch

Want to see how one of your ETFs compares to the rest?

Reply to this e-mail and tell us an ETF or two you want to be included in the tables below.

Australian Index

Australian Sectors

Global Indices & Sectors

Global Strategy

Property & Infrastructure

Fixed Income

Mixed Assets

*1-year, 3-year and 5-year returns are calculated as of 31 May 2024.

The Last Word

How are we doing?

We always love hearing from our readers and are constantly seeking feedback.

How are we doing with Equity Espresso?

Is there anything you’d like to see more of or less of?

Which aspects of the newsletter do you enjoy the most?

Hit reply and say hello - or leave us feedback in the poll below:

If you enjoyed this newsletter, forward this e-mail to a friend.

If you’re that friend, subscribe here.

DISCLAIMER: Please note that the information provided in this newsletter is for educational purposes only and should not be considered financial advice. It is not intended to encourage you to buy/sell assets or make economic decisions. We strongly recommend conducting your research before making any investment.