- Equity Espresso

- Posts

- ASX Bounces Back as US Inflation Cools, Jobs Data Impress

ASX Bounces Back as US Inflation Cools, Jobs Data Impress

Good Evening,

Welcome to Equity Espresso’s Daily Market Recap.

The market rebounded on Thursday, reversing two days of losses, with the main ASX 200 index gaining 34.2 pts. or 0.4% to 7,749.70 following another bumper session on Wall Street which saw the Nasdaq and S&P 500 hit all-time highs for the third day running.

The biggest news overnight was the May U.S. CPI data, which showed that inflation continues to cool, coming in at 3.3%, marginally below expectations of 3.4%.

Locally, employment data surprised to the upside, with workers losing or leaving their job falling to a near-record low. The jobless rate fell to 4.0% in May, down from 4.1% in April, as 39,700 people found work, according to data from the Australian Bureau of Statistics.

Nine of the 11 major sectors closed higher, with interest-rate sensitive stocks gaining the most, with Technology (+2.14%), Health Care (+1.60%) and Real Estate (+1.22%) leading the way.

NextDC (+3.56%) was the big mover in the tech. sector, hitting an all-time high share price of $18.34, while Wisetech Global (+2.04%) and Xero (+2.30%) continued their steady rise. In the healthcare sector, CSL (+2.03%) was a big mover, as was ProMedicus (+2.40%), which closed at an all-time high price for the fourth day running.

In company news:

Sigma Healthcare (-3.73%) fell on concerns raised by the ACCC surrounding the proposed acquisition of Chemist Warehouse. “This is a major structural change for the pharmacy sector, involving the largest pharmacy chain by revenue merging with a key wholesaler to thousands of independent pharmacies that in turn compete against Chemist Warehouse,” ACCC Commissioner Stephen Ridgeway.

said.

ASX Ltd. (-8.01%) plunged to a six-month low after the stock market exchange flagged rising technology costs, forecasting total expense growth of 15% - which was at the top end of guidance.

ASX Indices | ASX Sector Performance |

Wall Street

The S&P 500 (+0.9%) and NASDAQ (+1.5%) posted record closing highs for a third straight day on Wednesday after May’s inflation rate came in softer than expected at 3.3%. The Dow Jones (-0.1%) fell for the second straight day.

Seven sectors finished the session higher, with Technology (+2.46%) the big mover thanks to a jump from Oracle (+13.32%) after it announced cloud deals with Google and OpenAI. Oracle is also partnering with Microsoft and OpenAI to deliver supplemental computing capacity.

Energy (-1.09%) and Consumer Staples (-1.00%) were the worst performers on the day. Apple (+2.86%) shares gained further ground on Wednesday, briefly overtaking Microsoft as the world’s most valuable company. Rentokil Initial

U.S. Indices | Fear & Greed Index |

S&P500 Sector Performance

Economic Data

Australia’s Unemployment rate fell to 4.0% in May, following April’s three-month high of 4.1%, in line with market forecasts. The number of unemployed individuals fell by 9,200 to 598,800.

Australia’s Employment increased by 39,700, the most in three months, to 14,355.600 in May 2024, easily beating market forecasts of a 30,000 gain.

U.S. Annual Inflation rate came in at 3.3% during May, below forecasts of and last month’s figure of 3.4%. Inflation eased from last month for food, shelter, transportation and apparel. Energy costs, however, rose more (3.7% vs 2.6%).

Sponsor

Probably the Most Important report on the US Stockmarket you will read This Year

Topdown Charts has just released a Major Report on the US Stockmarket covering long-term perspectives on price, fundamental trends, opportunities in sectors + styles, global stocks, and issues in asset allocation.

Quick Singles

🌎️ Around The Globe

Elon Musk has officially withdrawn his lawsuit against OpenAI, one day before a key court hearing. In the previous filing, Musk accused OpenAI of abandoning its mission of ‘developing AI for the benefit of humanity’.

Google is launching a new advertising network that serves targeted ads to Google TV-powered streaming boxes and smart TVs.

Raspberry Pi, maker of tiny single-board computers, saw its shares pop 38% in its debut on the London Stock Exchange.

South Korea has decided to extend a market-wide ban on stock short-selling through the first quarter of 2025. Before resuming the trading strategy, the government will focus on developing a system to control illicit trading practices.

Warner Bros. Discovery will be the new exclusive U.S. broadcaster of the French Open tennis tournament beginning in 2025, signing a 10-year contract valued at around $65 million per year.

Walmart is adding electronic shelf labels to over 2,000 stores by 2026, cutting the time it takes for workers to change prices from two days to a few minutes.

Markets

ASX Company Movers

Commodity Prices

Bonds

Forex

Global Health Check

Newsletter Recommendation

|

ETF Prices

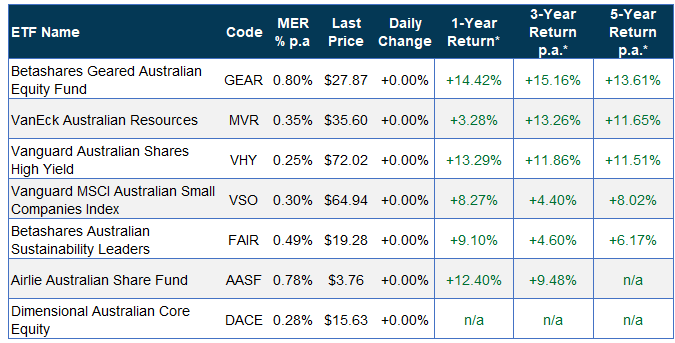

🔍️ ETF Watch

Want to see how one of your ETFs compares to the rest?

Reply to this e-mail and tell us an ETF or two you want to be included in the tables below.

Australian Index

Australian Sectors

Global Indices & Sectors

Global Strategy

Property & Infrastructure

Fixed Income

Mixed Assets

*1-year, 3-year and 5-year returns are calculated as of the end of April 2024.

The Last Word

How are we doing?

We always love hearing from our readers and are constantly seeking feedback.

How are we doing with Equity Espresso?

Is there anything you’d like to see more of or less of?

Which aspects of the newsletter do you enjoy the most?

Hit reply and say hello - or leave us feedback in the poll below:

If you enjoyed this newsletter, forward this e-mail to a friend.

If you’re that friend, subscribe here.

DISCLAIMER: Please note that the information provided in this newsletter is for educational purposes only and should not be considered financial advice. It is not intended to encourage you to buy/sell assets or make economic decisions. We strongly recommend conducting your research before making any investment d