- Equity Espresso

- Posts

- ASX Caps Stellar Week: PWR Plunges, Energy Surges

ASX Caps Stellar Week: PWR Plunges, Energy Surges

Good Evening,

Welcome to Equity Espresso’s Market Recap.

The Australian share market capped off a stellar week with its sixth consecutive rise on Friday, marking the best single-day performance of the period. The ASX 200 index climbed 105.6 points, or 1.34%, to close at 7,971.10, completing a perfect streak for the week. The market's upswing mirrored Wall Street's robust performance, particularly the NASDAQ's 2.0% climb, fueled by robust retail sales data.

All sectors closed positively, with Energy (+2.18%) and Materials (+2.14%) leading the charge - a rare top-two finish. Woodside Energy (+2.35%), Whitehaven Coal (+2.05%) and Santos (+1.83%) lead the Energy sector higher. Uranium stocks got some welcome relief, with Paladin Energy (+3.75%), Boss Energy (+5.52%) and Deep Yellow (+5.50%) seeing much-needed gains.

Iron Ore miners also gained ground despite the commodity trading at levels not seen since 2022, fueled by worries about the strength of China’s economy. Fortescue (+3.09%), BHP Group (+2.04%) and Rio Tinto (+1.56%) all rose, as did James Hardie (+6.19%) after reporting Q1 earnings on Tuesday.

In company news:

Amcor (-2.79%) announced a fall in profits from US$1.05 billion a year ago to US$730 million for the past financial year, although the company had seen a return to year-on-year volume growth for the past quarter.

ASX Ltd. (+0.09%) reported a 3.4% fall in underlying profit to $474.2 million, with higher operating expenses only partially offset by a record revenue figure of $1.03 billion.

Domain (-2.59%) shares fell despite the company reporting a net profit increase of 62.5% to $42.4 million for the full year, as sales rose by 13.1% to $391.1 million.

GQG Partners (-2.81%) lifted its Funds Under Management to US$155.6 billion - up 49.5% from June 30 2023. Net inflows for the year were US$11.1 billion.

PWR Holdings (-15.75%) shares plunged after the company stated that it expected profit growth to be flat in FY25, as it plans to invest $25 million in a new headquarters. Net Profit in FY24 grew by 14.0% to $24.8 million.

ASX Indices | ASX Sector Performance |

Wall Street

Wall Street's main indexes closed higher on Thursday, with the Nasdaq (+2.34%) seeing the largest rise after July U.S. retail sales data signalled resilient consumer spending, easing fears of a recession.

The S&P 500 (+1.61%) and Dow Jones (+1.39%) also saw significant gains, with nine of the 11 major S&P500 sectors making ground, led by Discretionary (+3.38%) and Technology (+2.54%) stocks.

Walmart (+6.58%) shares jumped after the company reported better-than-expected quarterly earnings and lifted its full-year outlook. The company expects sales to rise between 3.75% and 4.75% and adjusted earnings to come in between $2.35 and $2.43 per share. Nike (+5.07%) shares jumped after Perishing Square Capital Management revealed a stage in the company, buying more than 3 million shares of the retail giant.

U.S. Indices | Fear & Greed Index |

S&P500 Sector Performance

Economic Data

U.S. Retail sales rose by 1.0% month-over-month in July 2024 after falling by 0.2% in June - well ahead of forecasts of a 0.3% increase. The reading was the largest increase since January 2023, with sales at motor vehicle and part dealers (+3.6%) rising the most.

U.K. Retail sales rose by 0.5% month-over-month in July 2024, which was in line with expectations and well ahead of a 0.9% decline in June.

Sponsor

Take a demo, get a Blackstone Griddle

Automate expense reports so you can focus on strategy

Uncapped virtual corporate cards

Access scalable credit lines from $500 to $15M

Quick Singles

🌎️ Around The Globe

General Motors is being sued by the Texas Attorney General, who alleges that the company illegally collected and sold driver data to insurance companies without their knowledge.

Intel has divested its stake in British chip firm Arm Holdings, selling 1.18 million shares. Based on Arm's average stock price from April to June, the sale is estimated to have generated nearly $147 million for Intel.

Mars is set to acquire snack maker Kellanova, which owns popular brands like Pringles and Cheez-Its, in a $36 billion all-cash deal at $83.50 per share.

Southwest Airlines is facing a proxy fight with activist hedge fund Elliott Investment Management, who wants to replace 10 of 15 board directors.

Twitter / X has been ordered to pay €550,000 to an employee from Ireland who was dismissed for not responding to Elon Musk’s ‘extremely hardcore’ email. The employee thought the email might have been malware and was wary of opening it.

Victoria's Secret stock surged on Wednesday following the announcement of Hillary Super as its new Chief Executive. The lingerie retailer made a strategic move by recruiting Super from its competitor, Savage X Fenty, the famous brand owned by popstar Rihanna.

Markets

ASX Company Movers

Commodity Prices

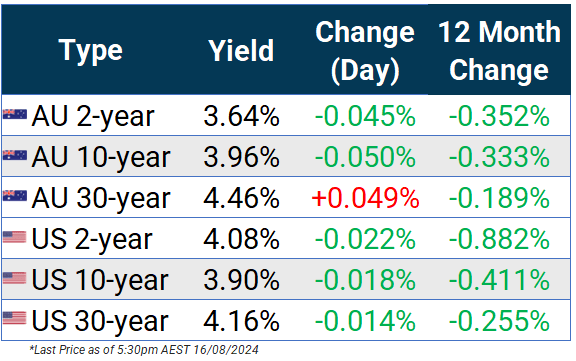

Bonds

Forex

Global Health Check

ETF Prices

🔍️ ETF Watch

Want to see how one of your ETFs compares to the rest?

Reply to this e-mail and tell us an ETF or two you want included in the tables below.

Australian Index

Australian Sectors

Global Indices & Sectors

Global Strategy

Property & Infrastructure

Fixed Income

Mixed Assets

*1-year, 3-year and 5-year returns are calculated as of 30 June 2024.

The Last Word

How are we doing?

We always love hearing from our readers and are constantly seeking feedback.

How are we doing with Equity Espresso?

Is there anything you’d like to see more of or less of?

Which aspects of the newsletter do you enjoy the most?

Hit reply and say hello - or leave us feedback in the poll below:

If you enjoyed this newsletter, forward this e-mail to a friend.

If you’re that friend, subscribe here.

DISCLAIMER: Please note that the information provided in this newsletter is for educational purposes only and should not be considered financial advice. It is not intended to encourage you to buy/sell assets or make economic decisions. We strongly recommend conducting your research before making any investment.