- Equity Espresso

- Posts

- ☕️ ASX Climbs: CBA and Macquarie Hit Record Highs

☕️ ASX Climbs: CBA and Macquarie Hit Record Highs

Good Evening,

Welcome to Equity Espresso’s Market Recap.

The Australian sharemarket rebounded on Tuesday, with the S&P/ASX 200 index advancing 0.3% to 8,011.9 points, driven by a strong performance in the Banking and Tech sectors. Commonwealth Bank (+0.57%) and Macquarie Group (+1.63%) reached all-time highs, contributing to the overall market gains. Ten of the eleven sectors climbed, marking a broad-based recovery following Monday's slight decline. The benchmark index is back over 8,000 and 137 points away from its record high set in August.

Energy (+0.93%) stocks led the gains despite Brent oil prices falling below $US72/bbll due to weak Chinese demand and global oversupply concerns. Woodside (+0.84%) and Santos (+0.58%) saw notable increases, demonstrating resilience in challenging market conditions.

Despite Iron Ore futures climbing on Tuesday on hopes of improved Chinese demand, the Materials (-0.27%) sector closes in negative territory. This came as China reported mixed commodity import data, with August iron ore imports falling 4.73% year-on-year while year-to-date figures rose 5.2%. Similarly, copper imports showed a 12.3% decline in August but a 3% increase for the first eight months of 2024, highlighting the fluctuating nature of China's commodity demand.

Company News

Duratec (+12.00%) and its associate business DDR Australia announced significant contract wins in the Energy and Defence sectors. Duratec won a $21.8 million project with Woodside for the King Bay Supply Base Wharf Refurbishment, while DDR secured a $54.7 million contract with the Department of Defence for Project Phoenix in the Northern Territory.

Paladin Energy (+5.85%) gained after it announced that Fission Uranium Corp. shareholders had approved Paladin's proposed acquisition of Fission, with 67.9% of votes in favour, exceeding the required 66.67% threshold.

Steadfast Group's (-10.74%) shares dropped following media reports alleging misleading client practices. The company refuted these claims, citing selective reporting by ABC and highlighting their commissioning of an independent review to improve industry transparency and practices.

ASX Indices | ASX Sector Performance |

Wall Street

Wall Street staged a strong rebound on Monday, with the Dow Jones rising 1.2%, while the S&P 500 and Nasdaq gained 1.16%. This rally came as investors sought bargains following last week's significant sell-off, which saw the Nasdaq experienced its largest weekly loss since January 2022 and the S&P 500 its biggest weekly decline since March 2023. A shift in sentiment fueled the market's recovery despite recent weak economic data, including disappointing August jobs figures and poor manufacturing numbers.

Investors are now turning their attention to upcoming inflation reports and the Federal Reserve's next policy decision, scheduled for September 18. Despite ongoing concerns about the U.S. economy's health and uncertainty surrounding the Fed's interest rate decision, Monday's trading session reflected a more optimistic sentiment among market participants.

Palantir (+14.04%) & Dell (+3.83%) jumped following the announcement after the bell last Friday that both stocks would join the S&P 500 on September 23. American Airlines (+3.89%) and Etsy (-1.58%) will fall out of the index.

U.S. Indices | Fear & Greed Index |

S&P500 Sector Performance

Economic Data

Australia's NAB business confidence index plunged to -4 in August from July's figure of +1. It was the first negative reading in three months and the lowest reading year to date.

Australia's Consumer Sentiment index dropped by 0.5% Month over Month to 84.6 in September 2024, shifting from August's six-month high of 2.8% rise.

Chinese Exports increased by 8.7% YoY in August, the most since March 2023, reaching US$308.65 billion - beating forecasts of 6.5% after a 7.0% rise in July.

Germany's Annual Inflation rate was 1.9% in August 2024, down from a 2.3% increase in July and in line with estimates.

Sponsor

Ease into investing

“Ease” being the key word. With automated tools like portfolio rebalancing and dividend reinvestment, Betterment makes investing easy for you, and a total grind for your money.

Quick Singles

🌎️ Around The Globe

Apple introduced its AI-focused iPhone 16 lineup, featuring new A18 chips with enhanced AI capabilities. The standard iPhone 16 costs $799, while Pro models offer advanced features like improved video capture and audio mixing. All models include a customisable action button for various functions. Apple also unveiled updates to its Apple Watch and AirPods, promising new AI features across devices next month.

Huawei unveiled its new Mate XT, a three-way foldable smartphone, in China, receiving over 3.6 million pre-orders. The launch, timed close to Apple's iPhone event, showcases Huawei's efforts to maintain its lead in the global foldable smartphone market, where it holds a 27.5% share. The Mate XT will go on sale on September 20.

OnlyFans reported impressive financial growth, with revenue reaching $1.3 billion and profits hitting $485.5 million, both up 20% in fiscal year 2023. The platform saw a 29% increase in creators to 4.1 million and a 28% rise in users to 305 million, who spent $6.6 billion. The company’s owner, Leonid Radvinsky, received $472 million in dividends.

Qualcomm has reportedly considered acquiring parts of Intel's design business to enhance its product portfolio. The mobile chipmaker is particularly interested in Intel's client PC design unit but is exploring all design divisions.

Roblox has announced plans to introduce paid video games on its platform and enable developers to sell physical merchandise through the games they create. The company will also allow desktop users to price certain "experiences" in real currency.

Weave has unveiled its $59,000 personal robot, Isaac, which can perform various household tasks autonomously. Set to ship in fall 2025, Isaac responds to voice or text commands and features a foldable camera for privacy. The bot can tidy up, fold clothes, organise spaces, and perform many other household chores.

Markets

ASX Company Movers

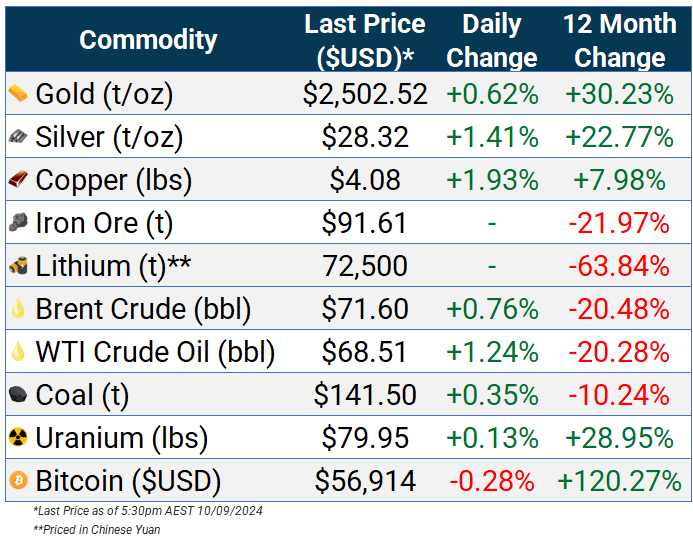

Commodity Prices

Bonds

Forex

Global Health Check

Newsletter Reccomendation

|

ETF Prices

🔍️ ETF Watch

Want to see how one of your ETFs compares to the rest?

Reply to this e-mail and tell us an ETF or two you want to be included in the tables below.

Australian Index

Australian Sectors

Global Indices & Sectors

Global Strategy

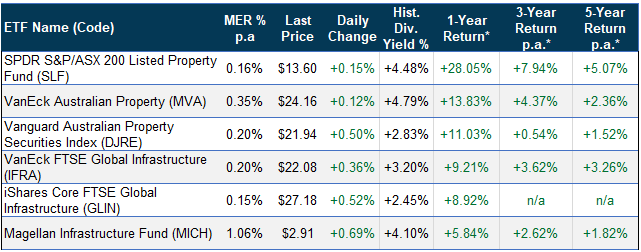

Property & Infrastructure

Fixed Income

Mixed Assets

*1-year, 3-year and 5-year returns are calculated as of July 31 2024.

The Last Word

How are we doing?

We always love hearing from our readers and are constantly seeking feedback.

How are we doing with Equity Espresso?

Is there anything you’d like to see more of or less of?

Which aspects of the newsletter do you enjoy the most?

Hit reply and say hello - or leave us feedback in the poll below:

If you enjoyed this newsletter, forward this e-mail to a friend.

If you’re that friend, subscribe here.

DISCLAIMER: Please note that the information provided in this newsletter is for educational purposes only and should not be considered financial advice. It is not intended to encourage you to buy/sell assets or make economic decisions. We strongly recommend conducting your research before making any investment.