- Equity Espresso

- Posts

- ☕️ ASX Dips as Earnings Reports Paint Mixed Picture

☕️ ASX Dips as Earnings Reports Paint Mixed Picture

Good Evening,

Welcome to Equity Espresso’s Market Recap.

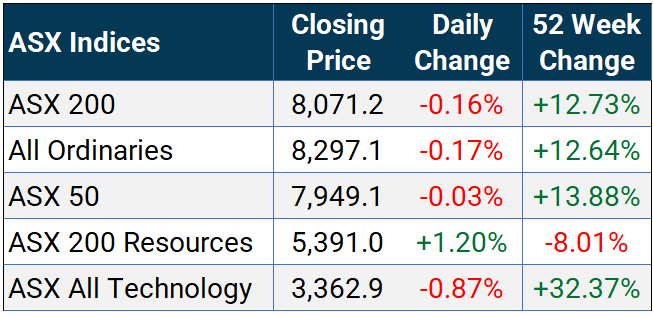

The Australian share market closed lower on Tuesday, with the S&P/ASX 200 index dropping 0.2% to 8,071.2 points, as Middle East tensions and corporate earnings reports influenced investor sentiment.

The Technology (-1.33%) and Financials (-0.86%) sectors led the decline, while Woodside (+3.94%) and Worley (+2.77%) gained following their results announcements making the Energy (+2.34%) sector the best performer. Despite the dip, the market remains close to its all-time high.

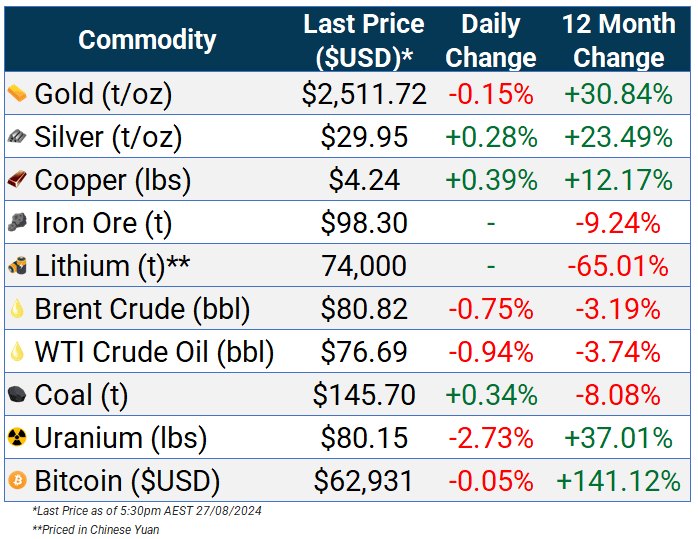

Iron ore prices continued to rise in Asian markets, with the benchmark September futures contract in Singapore increasing 1.6% to $US102 per tonne. Gold prices declined in Asian trading on Tuesday, influenced by a strengthening dollar. However, expectations of lower interest rates and increased safe-haven demand kept gold prices near recent highs.

Corporate Earnings

BHP Group (+1.25%) announced a 14% dividend reduction, with shareholders receiving a US74¢ final dividend. The company reported a $US13.7 billion underlying profit, slightly exceeding expectations. Total dividends for 2023-24 will be $US1.46 per share, down from $US1.70 last year, indicating BHP's shift towards reserving more earnings for growth investments.

Coles (+1.68%) reported strong financial results, with revenue up 4.4% to $43.7 billion and earnings rising 8.2% to $3.7 billion. Managing Director Leah Weckert emphasised the company's focus on customer value amid intensifying political scrutiny of supermarket profits. Supermarket earnings increased 10.5% to $3.5 billion, with profits up 8.3% to $1.1 billion. Recent sales trends show consumers adapting to cost-of-living pressures by opting for bulk and frozen items over fresh produce.

Guzman y Gomez (+3.21%) reported a strong start to FY2025, with 7.4% same-store sales growth in Australia. The company marginally exceeded FY2024 prospectus forecasts, with network sales of $959.7 million. For FY2025, GYG plans to open 31 new outlets in Australia and three in the U.S.

Integral Diagnostics (+1.17%) reported a statutory loss of $60.7 million for FY2024, compared to a $25 million profit the previous year. This loss was primarily due to a $71.6 million impairment in its New Zealand division. Despite this, revenue grew 6.6% to $469.7 million, and EBITDA margin improved slightly.

Lovisa (-12.98%) reported strong financial results for FY24, with revenue rising 17.1% to $699 million and net profit increasing 20.9% to $82.4 million. The jewellery retailer declared an unfranked final dividend of 37¢ per share. CEO Victor Herrero highlighted the company's successful balance of growth and global expansion investments.

SG Fleet (-8.18%) reported a 6.7% increase in net profit to $89.7 million for FY24, with total net revenue up 11.4% to $390.1 million. The company declared a special dividend of 15¢ and a final dividend of 9.33¢, totalling 33.93¢ for the year.

Woodside (+3.94%) reported a 14% decrease in core net profit to $US1.632 billion for the first half due to softening LNG prices. Despite this, bottom-line profit rose 11% to $US1.937 billion.

Worley (+2.77%) reported a mixed financial picture. Net profit jumped sevenfold to $303 million despite a 2% decrease in work backlog. CEO Chris Ashton warned of project delays due to various global factors. Underlying earnings rose 24% to $751 million, excluding a $58 million writedown.

Zip (-7.93%) reported a 14% increase in transaction value to over $10 billion for the year ending June 30, driven by solid growth in the US market. The company achieved cash earnings of $69 million, reversing last year's $48 million loss. With four consecutive profitable quarters, revenue rose 28% to $868 million.

ASX Indices | ASX Sector Performance |

Wall Street

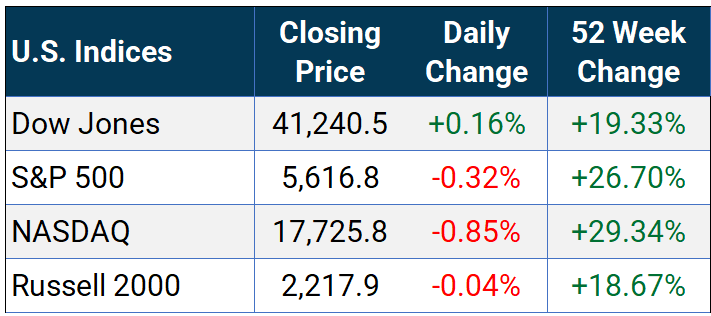

U.S. stocks ended mixed on Monday, with the S&P 500 (-0.32%) and Nasdaq (-0.85%) declining while the Dow Jones (+0.16%) eked out a small gain. Nvidia, a key player in the A.I. sector, dipped 2.25% ahead of its anticipated earnings report due Wednesday. Investors remain cautious, focusing on upcoming inflation data for insights into potential Federal Reserve interest rate cuts.

Boeing (-0.85%) shares dropped following NASA's decision to use SpaceX to retrieve two astronauts from the International Space Station. This choice came despite Boeing's assurances that its Starliner was safe for emergency returns, highlighting a discrepancy between NASA's risk assessment and Boeing's evaluation. PDD Holdings (-28.51%), the parent company of Temu, saw its shares plummet after reporting underwhelming second-quarter results. The China-based online retailer's revenue of 97.06 billion yuan fell short of the estimated 100.17 billion yuan.

U.S. Indices | Fear & Greed Index |

S&P500 Sector Performance

Economic Data

U.S. New orders for manufactured durable goods surged by 9.9% from the previous month in July 2024, making up for the 6.9% decline in the earlier period.

China Industrial profits grew by 3.6% year over year to CNY 4,099.17 billion in the first seven months of 2024, after a 3.5% gain in the prior period.

Sponsor

Stop Guessing, Start Managing: PocketSmith Helps You

Track Your Finances

Can’t keep track of multiple bank and investment accounts?

Curious about your spending patterns and habits?

Managing currencies across borders?

Then you need PocketSmith - Australia’s leading personal finance management tool. Managing household finances is complex, and PocketSmith provides tailored tools to streamline budgeting, expense tracking, and future planning. Keep an eye on all income streams and assets in one place.

PocketSmith’s comprehensive insights and forecasts help users see their true net worth and make informed decisions. If you’d like to manage your money like a pro, PocketSmith has a special deal for Equity Espresso readers.

Get 50% off your first two months of PocketSmith’s Foundation plan by clicking the link below.

Quick Singles

🌎️ Around The Globe

NASA has announced that two astronauts, Suni Williams and Butch Wilmore, stranded at the International Space Station since June, will return to Earth in February aboard a SpaceX vehicle.

Kroger and Albertsons proposed merger is facing a legal challenge. A federal judge in Portland, Oregon, will begin hearing arguments Monday to determine whether to grant the Federal Trade Commission's request for a preliminary injunction. The FTC argues that the merger would reduce competition and increase grocery prices, while the supermarket chains claim it would help them compete with larger rivals like Costco.

The Canada Industrial Relations Board (CIRB) ordered thousands of rail employees to return to work Monday morning, ending a significant contract dispute that had halted operations at Canadian National Railway and Canadian Pacific Kansas City.

Apple has announced its highly anticipated product launch event for Monday, September 9. The event will be held at the Steve Jobs Theatre in Apple's Cupertino headquarters and will unveil the iPhone 16 series, new Apple Watch models, and updated AirPods.

Meta has reportedly cancelled its plans for a high-end mixed-reality headset, codenamed "La Jolla," which was intended to compete with Apple's Vision Pro. The decision came after a product review meeting, during which employees at the Reality Labs division were instructed to halt work on the device.

At the 2024 World Robot Conference in Beijing, Chinese companies showcased 27 humanoid robots alongside Tesla's Optimus, demonstrating China's ambition to lead the industry. Notable entries included AGIBOT's LLM-powered industrial robots, Astribot's multifunctional S1 assistant, and Galbot's wheeled service robots.

Markets

ASX Company Movers

Commodity Prices

Bonds

Forex

Global Health Check

The Last Word

How are we doing?

We always love hearing from our readers and are constantly seeking feedback.

How are we doing with Equity Espresso?

Is there anything you’d like to see more of or less of?

Which aspects of the newsletter do you enjoy the most?

Hit reply and say hello - or leave us feedback in the poll below:

If you enjoyed this newsletter, forward this e-mail to a friend.

If you’re that friend, subscribe here.

DISCLAIMER: Please note that the information provided in this newsletter is for educational purposes only and should not be considered financial advice. It is not intended to encourage you to buy/sell assets or make economic decisions. We strongly recommend conducting your research before making any investment.