- Equity Espresso

- Posts

- ASX Falls, Iron Ore Woes and a CEO's Misconduct Allegations

ASX Falls, Iron Ore Woes and a CEO's Misconduct Allegations

Good Evening,

Welcome to Equity Espresso’s Daily Recap.

Last week's record high feels like a distant memory, with the Aussie market losing ground again today. The ASX 200 index started the day over 120 pts. lower, before ending the session down 0.6% or 43.3 pts. to 7,670.30. The drop followed Wall Street’s negative night as worries over slowing growth in China weighed on global markets.

Eight sectors finished the day lower, with Materials (-1.91%) continuing their wretched run as Iron Ore futures continue to tumble, trading at 7-month lows of around US$105.50. BHP Group (-1.51%), Fortescue (-2.32%) and Rio Tinto (-1.88%) all fell, with Lithium miners Pilbara Minerals (-6.24%), Mineral Resources (-2.69%) and IGO (-5.14%) also trading in the red. Discretionary (-1.03%) and Technology (-0.86%) stocks were the other big movers down.

On the positive, Energy (+2.01%) stocks rose, with Woodside Energy (+2.47%) and Santos (+2.37%) leading the charge, followed by the Utilities (+1.03%) and Real Estate (+0.76%) sectors.

EML Payments (+11.50%) had the largest positive move on the ASX All Ordinaries after announcing the sales of its Sentenial business for €32.75m (A$54.1m). Syrah Resources (-21.43%) was another big mover, just in the wrong direction, however, closing at $0.55 after completing a capital raise of $80 million at $0.55

The big story that dropped after hours yesterday was Tabcorp Managing Director and Chief Executive Officer Adam Rytenskild's resignation. According to the company, the now-former chief executive used inappropriate and offensive language in the workplace, leading to his resignation. The AFR reported that Mr Rytenskild allegedly suggested that he could provide sexual favours to a female Victorian regulator last year if she handed the wagering group a lucrative licence. Tabcorp shares finished the day 5.23% lower.

ASX Indices | ASX Sector Performance |

U.S. Indices | Fear & Greed Index |

Wall Street

U.S. stocks fell during Thursday’s session, with the Semiconductor (-3.2%) sector extending losses for a second consecutive day. A rise in producer prices left investors cautious about whether the Federal Reserve might wait longer than expected to cut interest rates. Nvidia (-3.2%) shares finished the day lower. The S&P 500 lost 14.83 points, or 0.29%, while the Nasdaq dropped 49.24 points, or 0.3%.

Dick’s Sporting Goods (+15.5%) shares jumped after the sporting goods retailer posted fourth-quarter results that exceeded expectations. Dick’s Sporting Goods reported earnings of $3.85 per share on revenue of $3.88 billion. Earnings expectations were $3.35 per share on revenue of $3.80 billion. Robinhood Markets (+5.2%) rose after the trading app operator said its assets under custody rose 16% in February.

Economic Data

U.S. Producer Prices rose by 0.6% month-over-month in February, the largest increase since last August and surpassing market expectations of a 0.3% rise.

China's New Home Prices declined by 1.4% year-on-year in February 2024, more than a 0.7% fall last month, the eighth straight month of declines.

Sponsor

Get Your Crypto News Made Simple

Get Actionable Crypto Alpha in 5 minutes, three times a week with the Crypto Pragmatist.

Join 47,000+ investors and insiders who get daily insights for FREE

Get Your Business Featured Here

Take a look at our sponsorship packages to feature your business in Equity Espresso’s newsletter.

Quick Singles

🌎️ Around The Globe

Dollar Tree will close nearly 1,000 of its 8,000 store network while also recording a $950 million impairment charge against its Family Dollar stores, which it acquired in an $8 billion deal in 2015.

Adidas recorded its first annual loss in almost 30 years. Lower demand and overstocked stores in the U.S. drove its North American sales 17% lower during Q4. The sports retailer expects North American sales to fall by around 5.0% this year.

Under Armour is bringing back founder and former CEO Kevin Plank, with current CEO Stephanie Linnartz to step down on April 1 after one year in the role.

Spotify is rolling out full-length music videos in a limited beta launch for premium subscribers beginning this week.

Waymo will begin offering free driverless Robotaxi services to select members of the public in Los Angeles this week. The services will be available across 63 square miles from Santa Monica to downtown Los Angeles.

Markets

ASX Company Movers

Commodity Prices

Bonds

Forex

Global Health Check

Partners

Your Investing Essentials

Become a more informed and better investor with the best research tools from our trusted partners.

Help support the Equity Espresso newsletter by signing up using the links below:

Trading View: The best charting platform money can buy. Used by over 50 million traders and investors around the world. Signup here

Koyfin: Our platform provides comprehensive investment research on various asset classes, such as equities, fixed income, funds, ETFs, and foreign exchange. Signup here

Tikr: A software analytics platform used to track stocks. Tikr aggregates the best investment resources into one comprehensive platform for a fraction of the price. Signup here

FinTip: An education and content-based app. that includes a competition-based game designed to engage, help and educate to make better investment decisions. Download here

Moomoo: Get a kick start on your trading journey with ten free stocks and a generous interest rate on uninvested cash. Signup here

A Little Extra

📉 Going Down?

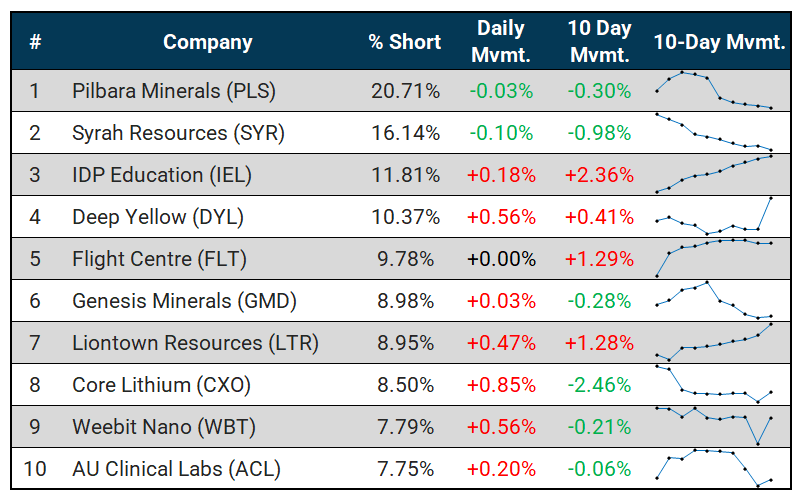

Top-10 shorted stocks on the ASX - as of March 11

📂 Broker Ratings

Aussie Broadband (ABB) - Upgrade to Buy from Accumulate (Ord Minnett)

Aristocrat Leisure (ALL) - Downgrade to Hold from Add (Morgans)

BHP Group (BHP) - Upgrade to Buy from Neutral (Citi)

Clinuvel Pharmaceuticals (CUV) - Upgrade to Add from Hold (Morgans)

Fortescue (FMG) - Upgrade to Neutral from Sell (Citi)

Hartshead Resources (HHR) - Downgrade to Hold from Buy (Bell Potter)

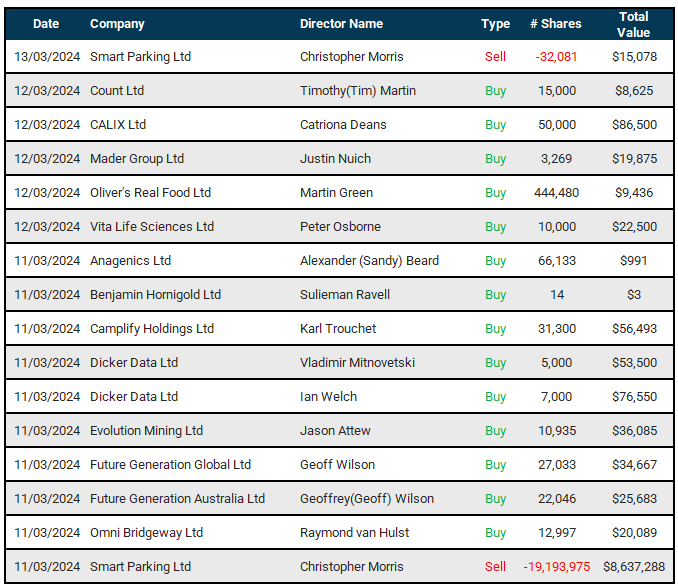

👨💼 Director Transactions

What are the insiders doing? (On-market trade only)

DISCLAIMER: Please note that the information provided in this newsletter is for educational purposes only and should not be considered financial advice. It is not intended to encourage you to buy/sell assets or make financial decisions. We strongly recommend conducting your own research before making any investment decisions.