- Equity Espresso

- Posts

- ☕️ ASX Flirts with Record High: Uranium Stocks Glow

☕️ ASX Flirts with Record High: Uranium Stocks Glow

Good Evening,

Welcome to Equity Espresso’s Market Recap.

The Australian share market rose again on Monday, with the S&P/ASX 200 index closing 0.8% higher at 8,084.5 points, just 30 points shy of its record high. This rally, marking the 11th gain in 12 sessions, was fueled by optimism following U.S. Federal Reserve chairman Jerome Powell's comments at the Jackson Hole meeting, hinting at imminent interest rate cuts.

Eight sectors finished the session higher, evenly spread among the Telcos. (+1.25%), Financials (+1.23%), Energy (+1.16%) and Discretionary (+1.11%) sectors.

Consumer Staples (-0.85%) was the biggest faller, dragged down by disappointing earnings from Endeavour Group (-6.87%). More on that later.

Uranium stocks were among the best-performing stocks on the session, rallying after the world’s largest producer, Kazatomprom, released guidance that fell short of market expectations. Paladin Energy (+11.82%) and Boss Energy (+7.56%) were some of the best performers on the day.

Corporate Earnings

Adore Beauty (+4.55%) posted a net profit of $2.2 million during the 2024 financial year, up from a loss of $559,000 a year ago. The retailer said sales in the first seven weeks of the new year are up 7%, warning that conditions will remain challenging. Adore posted full-year revenue of $195.7 million, up 7.4% in the 12 months to June 30, supported by a record 519K returning customers, who accounted for about 80% of sales. The group has also signed two Adore retailer concept stores that are expected to open later this year.

Aussie Broadband (+12.02%) reported strong financial results for FY2024, with revenue increasing 26% to $999.7 million and profits rising 21% to $26.4 million. The company declared a 4¢ dividend for investors.

Bendigo & Adelaide Bank (-0.48%) reported a 2.6% decrease in cash profits to $562 million, primarily due to increased competition in the mortgage market. Net interest margins fell four basis points to 1.9% for the year but stabilised at 1.94% in the second half. Despite a slight increase in 90-day arrears, overall asset quality remained stable. The bank declared a final dividend of 33¢ per share, bringing the full-year dividend to 63¢ per share.

Dalrymple Bay Infrastructure (+1.31%), the Queensland coal export terminal, reported flat coal exports for the six months ending June 30. However, the company's interim net profits increased by 8.3% to $36.8 million, primarily due to higher handling fees implemented during the period.

Endeavour (-6.51%) reported record sales of $12.3 billion, up 3.6%, driven by growth in its liquor stores and improved hotel performance. Retail sales increased 3.4% to $10.2 billion, while hotel revenue rose 4.2% to $2.1 billion. Despite these gains, net profit fell 3.2% to $512 million due to increased finance costs.

Infomedia (+1.70%) reported strong financial results for FY24, with revenue increasing 8% to $140 million and profits surging 32% to $12.7 million. The company projected continued growth, forecasting FY25 revenue between $144 million and $154 million.

Kogan (+12.90%) reported a return to profitability in FY2023-24, with a net profit of $83,000 compared to a $25.9 million loss the previous year. Despite a 6.1% drop in revenue to $459.7 million, the online retailer announced a final dividend of 7.5¢ per share, resuming dividend payments after a three-year pause.

Nib Holdings (-16.92%) shares fell on a cautious outlook despite reporting a 67.4% increase in full-year net profit, reaching $181.6 million. Group revenue rose 9.3% to $3.3 billion.

Pilbara Minerals (+1.34%) reported a significant profit decline due to falling lithium prices. The company's revenue dropped 69% to $1.2 billion, while profits plummeted 89% to $257 million in FY24.

Tyro Payments (+12.25%) reported a significant increase in after-tax profits, quadrupling to $25.7 million. CEO Jon Davey announced plans to expand into two new verticals within the next 12 months, including unattended payments and a sector adjacent to Health. Transaction values grew by 1% to $42.9 billion, and the company projected a gross profit between $218 million and $226 million for FY2025.

Viva Energy Group (+0.66%) reported a 10.3% increase in core net profit to $192.1 million for the half-year ending June 30, despite facing cost-of-living pressures on its expanded convenience store chain. Sales rose 13% to $14.38 billion, but same-store sales declined 5%, with tobacco sales down 17%. The company declared a 6.7¢ interim dividend, lower than last year's 8.5¢.

ASX Indices | ASX Sector Performance |

Wall Street

U.S. stocks rallied on Friday following dovish remarks from Federal Reserve Chair Jerome Powell at the Jackson Hole Symposium. Powell indicated that "the time has come" to lower the Fed funds target rate, citing diminished upside inflation risks and a desire to avoid further labour market weakening. These comments strongly suggest a potential rate cut at next month's policy meeting, which would be the first in over four years.

All three major indices rose in response, with the NASDAQ leading at 1.47%, followed by the S&P 500 and Dow Jones at 1.15% and 1.14%, respectively. Small-cap stocks outperformed, with the Russell 2000 jumping 3.19%. Among mega-cap stocks, Nvidia (+4.55%), Tesla (+4.58%), and Broadcom (+2.48%) were notable gainers.

Cava Group's (+19.63%) shares surged after reporting strong Q2 results, with earnings of 17 cents per share on $233 million revenue, surpassing expectations. The Mediterranean restaurant chain saw a 35% increase in net sales and a 14.4% rise in same-store sales. Cava raised its full-year outlook, driving its market cap to $11.6 billion. Intuit's (-6.83%) shares dropped despite beating Q4 earnings expectations. The financial software company's stock decline was attributed to its disappointing Q1 forecast, projecting adjusted earnings of $2.33 to $2.38 per share, significantly below analysts' expectations of $2.78 per share. Bill.com's (-6.70%) stock fell despite beating Q4 expectations with adjusted earnings of 57 cents per share on $344 million revenue. Goldman Sachs downgraded the stock to neutral, citing concerns over the company's revenue guidance and internal investment plans.

U.S. Indices | Fear & Greed Index |

S&P500 Sector Performance

Economic Data

U.S. Building Permits fell by 3.3% to an annual rate of 1.406 million in July 2024, revised higher from a preliminary estimate of 1.396 million.

U.S. Sales of new single-family houses soared by 10.6% MoM in July 2024 to 739,000, well above market expectations of a 1% increase. It was the sharpest increase in sales since August of 2022.

Canada’s Retail Sales grew by 0.6% MoM in July, according to preliminary estimates, a significant turnaround from the 0.3% decline in June.

Sponsor

Stop Guessing, Start Managing: PocketSmith Helps You

Track Your Finances

Can’t keep track of multiple bank and investment accounts?

Curious about your spending patterns and habits?

Managing currencies across borders?

Then you need PocketSmith - Australia’s leading personal finance management tool. Managing household finances is complex, and PocketSmith provides tailored tools to streamline budgeting, expense tracking, and future planning. Keep an eye on all income streams and assets in one place.

PocketSmith’s comprehensive insights and forecasts help users see their true net worth and make informed decisions. If you’d like to manage your money like a pro, PocketSmith has a special deal for Equity Espresso readers.

Get 50% off your first two months of PocketSmith’s Foundation plan by clicking the link below.

Quick Singles

🌎️ Around The Globe

Canada's two major railroads have locked out over 9,000 workers due to failed contract negotiations with the Teamsters union. This unprecedented stoppage will cost $750 million daily, disrupt US-Canada trade, and severely impact the shipment of grain, potash, coal, and other goods.

Cruise, GM's self-driving subsidiary, is partnering with Uber to integrate its robotaxis into the ride-hailing platform by 2025. The partnership aligns with Uber CEO's vision of the company as a critical commercialisation partner for autonomous vehicle firms, signalling Cruise's plans to relaunch its driverless service. Cruise temporarily suspended services after a pedestrian accident last October.

Donald Trump is promoting "The DeFiant Ones," a new Trump Organisation crypto platform, to his 7.5 million Truth Social followers. Trump claims the platform will challenge big banks and financial elites. This marks his first personal endorsement of the yet-to-launch digital bank, which was also shared by Donald Trump Jr. on X.

Edgar Bronfman has increased his bid to acquire Paramount Global, offering $6 billion for its controlling shareholder, National Amusements and a minority stake in Paramount. This new offer, up from $4.3 billion previously, includes $3.2 billion to address Paramount's debt or purchase non-voting shares at $16 each. The bid competes with Skydance's $8.4 billion complex deal proposal.

Neuralink is reporting the successful implementation of its brain-computer interface in a second patient, Alex, who has a spinal cord injury. The patient can now play video games like Counter-Strike 2 and use CAD applications. Neuralink aims to provide greater autonomy through robot arm and wheelchair controls.

French police arrested Telegram CEO Pavel Durov at an airport near Paris. The 39-year-old's arrest reportedly relates to offences associated with the messaging app. Authorities are focusing on Telegram's lack of moderators, which they believe allows criminal activity to proceed unchecked on the platform.

Markets

ASX Company Movers

Commodity Prices

Bonds

Forex

Global Health Check

ETF Prices

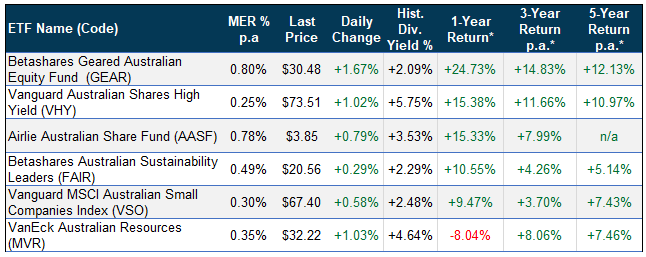

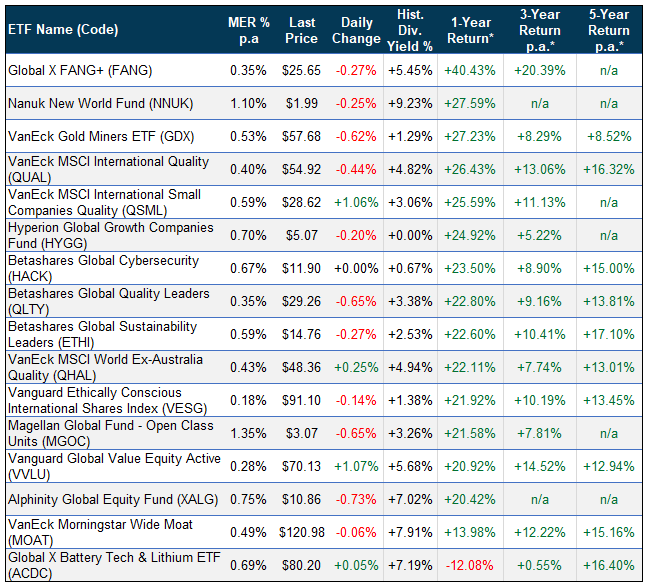

🔍️ ETF Watch

Want to see how one of your ETFs compares to the rest?

Reply to this e-mail and tell us an ETF or two you want to be included in the tables below.

Australian Index

Australian Sectors

Global Indices & Sectors

Global Strategy

Property & Infrastructure

Fixed Income

Mixed Assets

*1-year, 3-year and 5-year returns are calculated as of July 31 2024.

The Last Word

How are we doing?

We always love hearing from our readers and are constantly seeking feedback.

How are we doing with Equity Espresso?

Is there anything you’d like to see more of or less of?

Which aspects of the newsletter do you enjoy the most?

Hit reply and say hello - or leave us feedback in the poll below:

If you enjoyed this newsletter, forward this e-mail to a friend.

If you’re that friend, subscribe here.

DISCLAIMER: Please note that the information provided in this newsletter is for educational purposes only and should not be considered financial advice. It is not intended to encourage you to buy/sell assets or make economic decisions. We strongly recommend conducting your research before making any investment.