- Equity Espresso

- Posts

- ASX Gives Back Early Gains As Oil & Gold Surge

ASX Gives Back Early Gains As Oil & Gold Surge

The ASX200 index started the day positively but fell as the afternoon wore on as U.S. futures opened lower this afternoon.

Good Evening,

Welcome to Equity Espresso. We’re here to catch you up on the day’s important stock market news in Australia and abroad. Here’s a sample of today’s top stories:

🛢️ Oil Price Rise Amidst Middle Eastern Conflict

👷 U.S. Jobs September Surge

🛒 Supermarket Standoff

🪙 A Golden Rebound

🖥️ Cyber Shadows Over Liège

The Recap

Oil & Gold Price Spike

Drives ASX Higher

The Australian market rose slightly on Monday as oil prices increased by over 4% after Hama's incursion into Israel over the weekend and looming geopolitical risks should neighbouring countries get involved.

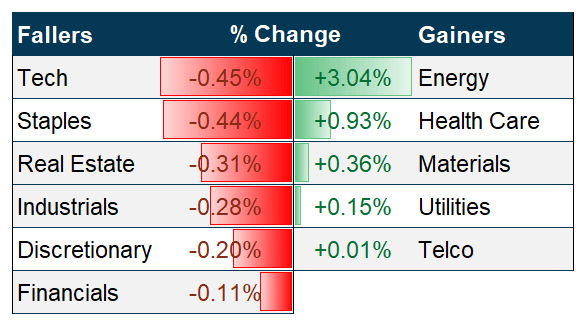

The ASX200 index started the day positively but fell as the afternoon wore on as U.S. futures opened lower this afternoon. The index still managed to eke out a 16-point gain to 6,970.2, with Energy (+3.04%) and Health Care (0.93%) leading the way. Some of the big movers were Woodside (+3.07%), Santos (+4.22%) and Ampol (+1.93%), while CSL finished 1.30% higher.

Gold stocks rose as the commodity jumped by almost 1% to US$1,860 t/oz. Newcrest Mining (+4.7%), Northern Star (+3.9%), Evolution Mining (+6.2%), and Perseus Mining (+5.23%) all finished higher.

Magallen continues to be in the dog house, losing another 7.2% today after falling 18% on Friday to close at $6.66.

Outlook

U.S. futures markets are indicating a weak start to the trading week as they reopen for the first time following the conflict in the Middle East. The S&P500 is down by 0.78%, while the NASDAQ is 0.80% lower. Bond markets will be closed on Monday for Columbus Day, but equity markets are open.

Key events to keep an eye on this week include:

Pepsi Co. Qtr. Earnings (Tue)

Bank of Queensland Earnings (Wed)

Infosys. Qtr. Earnings (Thr)

U.S. CPI Sep (Thu)

U.S. Banks Qtr. Earnings (Fri) - Black Rock, JP Morgan, Citi Group, Wells Fargo

Economic Data

The average 30-year fixed-rate mortgage in the U.S. reached 7.8% last week, its highest level since 2000.

In September 2023, the number of nonfarm payrolls in the U.S. increased by 336,000, exceeding the previous month's upwardly revised figure of 227,000 and surpassing market expectations of 170,000. This represents the highest job growth rate in eight months and exceeds the 70,000-100,000 new jobs needed each month to accommodate population growth in the working-age demographic.

Wall Street

Friday's better-than-expected U.S. jobs report sparked a delayed rally on Wall Street. The data revealed a strong economy with moderating inflation that helped set aside fears of higher interest rates that caused bond yields to soar. The S&P500 (+1.18%) and NASDAQ (+1.60%) finished higher.

Quick Singles

🪃 Local News

Approximately 1,000 Coles and Woolworths workers walked off the job over the weekend, demanding better wages. Employees represented by the Retail and Fast Food Workers Union stopped work from 10 am Saturday for two hours at stores nationwide. Retail and Fast Food Workers Union (RAFFWU) federal secretary Josh Cullinan says members also want more safety at work, with supermarket staff copping daily abuse and harassment from customers.

🌏 Around The Globe

Belgian’s security service is investigating possible espionage by Chinese entities at Alibaba's logistics hub in Liège. The focus is on Alibaba's software that can access merchants' data and share insights into potential vulnerabilities with China.

An epidemiological study released last week revealed that weight loss drugs like Wegovy and Ozempic may be associated with an increased risk of three rare but severe stomach conditions in non-diabetic patients.

Exxon Mobil is reportedly in talks to take over Pioneer Natural Resources, which would make the oil giant the largest shale gas producer in the Permian Basin of West Texas and New Mexico. Pioneer, which has a market cap of ~$55 billion, would mark the largest acquisition for Exxon since it merged with Mobil in 1999.

Tesla has reduced the cost of select Model 3 and Model Y versions in the U.S. to increase demand, which began with a global price reduction at the end of last year.

Late on Sunday, United Auto Workers announced that employees at Mack Trucks, which is owned by the Volvo Group, have rejected a proposed five-year contract deal. Workers will go on strike starting on Monday. This marks the most recent instance of a potential labour agreement being turned down by its members.

₿ Crypto Corner

During court proceedings last week, FTX co-founder Gary Weng accused Sam Bankman-Fried of fraud and giving Alameda "backdoor" access to customer funds, resulting in a $65B line of credit and unlimited withdrawals.

Yuga Labs, the team behind the prominent Bored Ape Yacht Club NFT collection, has undergone a restructuring and laid off some U.S. employees.

Enjoying The Recap?

Forward this email to a friend, family member, or work colleague who would benefit from getting caught up on the day’s news.

They can sign up with the link below. ⬇️

Markets

ASX200 Company Movers

Index & Commodity Prices

Sector

Bond Prices

ETF Watch

ASX News

🗞️ Company Announcements

Fonterra (FSF) has raised the 2023/24 season forecast Farmgate Milk Price range to $6.50 - $8.00 per kgMS, with a midpoint of $7.25 per kgMS, up $0.50. The increase has been attributed to recent increases in buying at Global Dairy Trade events however, Fonterra still forecasts collections to be slightly below last season.

Fortescue (FMG) and Genex (GNG) have announced a 25-year solar energy agreement for Genex's Bulli Creek Solar and Battery Project. The solar energy will be utilised by Fortescue for the operation of a green hydrogen and green ammonia facility in connection with its Gibson Island project.

Myer (MYR) chairwoman JoAnne Stephenson will retire at the upcoming AGM, with current non-executive director Ari Mervis stepping into the position.

Chris Baddock, the chief executive of Metcash’s (MTS) liquor division, has resigned due to health reasons. John Barakat will take over the role temporarily while the company seeks a permanent replacement.

Strandline Resources (STA) has released assay results from their second Ore Reserve definition drilling program. These results will be used to update the Mineral Resource and Ore Reserve definitions in the March 2024 quarter. The drilling program was conducted in the southern region of its’ active mining area.

Deep Dive

Why Do Bond Prices Matter?

We had feedback from some readers last week regarding the ongoing commentary on bond yields and their relevance to markets. We’ve attempted to do a bit of an explainer below. We hope this helps!

Government Bonds

Government bonds, or Treasury bonds, are long-term debt securities governments issue.

Corporations can also issue bonds, but we will focus on government-issued bonds.

Government-backed bonds are perceived as a low-risk investment since the risk of the bond lender is connected to the borrower's capacity to repay the debt, which in this situation is the government.

The Government bond that investors tend to watch closely is the U.S. 10-year bond.

Bond Example

A simple example of how bond payouts work: John invests $10,000 in 2-year AU bonds at a 4.00% interest rate.

In year 1, John will receive $400 in a coupon/bond yield.

In year 2, John will receive another $400 in a coupon/bond yield, plus the initial $10,000 principal.

Generally speaking, the longer the yield term, the more the returns are compared with shorter-term yields like the 2-year.

Bonds vs. Equities

Historically, the average returns of the equity market are around 7-9%. However, this can include significant volatility between years. In the last five years, including 2023 to date, the ASX200 Total Returns (incl. dividends) has returned an average of 8.4%. Included in that were bumper returns in 2019 (23%) and 2021 (17%)

However, it is important to remember that investing in the equity market comes with an added layer of risk. With over 2,000 companies listed on the ASX, the variability of returns can be significant.

Bond prices have increased significantly in the current year, causing investors to shift their money from riskier investments to safer, "risk-free" bonds. The 30-year bond in Australia currently offers a yield of over 4.90%, which is considered to have very low (some would say nil) risk.

Although market returns are expected to be higher than this, there are no guarantees. In fact, over the past five years on the ASX, only two years have surpassed this return, albeit by a large margin.

What’s Driving Bond Prices Higher?

Another factor that impacts equity markets besides returns is sentiment. The U.S. 10-year bond yield, considered a gauge of investor sentiment, has significantly increased from 4.10% in late August to 4.80%. Such a rapid increase in a short period is atypical and has likely caused market concerns. Additionally, the 10-year bond has reached its highest point in 16 years.

Generally, when bond prices rise, it indicates that the market expects interest rates to remain high for a more extended period. This is particularly true today because of the persistent global inflation.

In the United States, there is an added risk of the government needing to borrow more funds, which may increase the current debt levels that some believe are already unmanageable. As of 2022, the Debt to GDP ratio stands at 129%. In short, this means the U.S. isn’t producing enough to pay off its debt. This could lead bond investors to demand more compensation due to the increased risk of lending money to the government.

As a comparison, Australia’s debt-to-GDP ratio is 22.3%, down from 28.6% in 2021, which spiked during the pandemic due to government hand-outs.

Key Takeaways

Bonds are competing with equity markets for a finite amount of capital

Stocks become a riskier investment compared to “risk-free” government bonds, which have fixed returns.

Bond prices will likely remain elevated until interest rates decrease.

Daily Quiz

Test Your Knowledge

Last week’s Daily Quiz Question. Who co-founded Magellan Financial Group with Hamish Douglass in 2006?

Answer: Chris Mackay. Well done to the 72% who got that correct. MFG was co-founded in 2006 by Hamish Douglass and Chris Mackay off the back of careers in investment banking.

A Little Extra

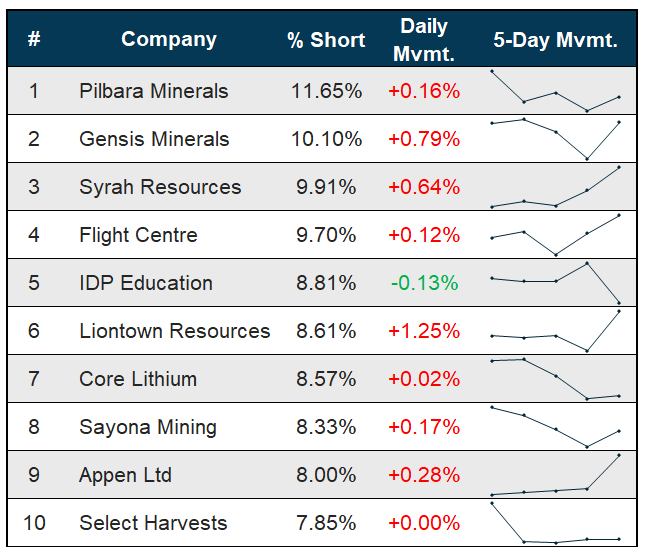

📉 Going Down?

Top-10 shorted stocks on the ASX - as of October 3

Weekly Movers ⬆️

| Weekly Movers ⬇️

|

📊 Broker Ratings

What do the brokers have to say?

Amcor (AMC) - Upgraded to Equal-weight from Underweight (Morgan Stanley). The target price is $14.50.

BHP Group (BHP) - Upgraded to Neutral from Sell (UBS). The target price is $36.00.

Bank of Queensland (BOQ) - Downgrade to Sell from Neutral (Citi). Target price is $5.00.

Deterra Royalties (DRR) - Upgrade to Neutral from Sell (UBS). The target price is $4.80.

Pantoro (PNR) - Upgrade to Buy from Hold (Bell Potter). The target price is $0.05.

👨💼 Director Transactions

What are the insiders doing? (On-market trade only)

💲Dividends

Companies trading ex-dividend today

📅 Economic Calendar

Data to keep an eye on this week

DISCLAIMER: None of the information provided in this newsletter should be constituted as financial advice. This newsletter is strictly for educational purposes only. It should not be taken as investment advice or a solicitation to buy or sell assets or make financial decisions. Please do your research.