- Equity Espresso

- Posts

- ASX Tiptoes Higher: CSL Stumbles While Gold Glitters

ASX Tiptoes Higher: CSL Stumbles While Gold Glitters

Good Evening,

Welcome to Equity Espresso’s Market Recap.

The Australian share market kept its head above water for most of the day, with the ASX 200 index edging out a 13.1 pt. or 0.2% gain in another busy day of corporate earnings. The gain came despite the country's third-largest listed company, CSL, sharply falling back under $300. More on that later.

The Financials (+0.94%) sector was the best performer on the day, thanks to a lift in Challengers' (+6.54%) share price after it reported a 24% rise in its Net Profit After Tax.

Healthcare (-2.87%) saw the most significant fall of the four sectors to finish in the red, thanks mainly to a drop in CSL’s (-4.58%) share price, while Fisher & Paykel Healthcare (-1.34%) and Sonic Healthcare (-0.91%) also fell.

Gold stocks were some of the best performers today, as the gold price continues to climb higher, currenlty trading at US$2,460. Northern Star Resources (+1.71%), Sandfire Resources (+2.49%) and Perseus Mining (+2.49%) all saw gains.

In company news:

CSL (-4.58%) shares fell despite reporting a 20% increase in full-year net profit to $US2.64 billion, boosted by growth in its immunoglobulins business. CSL warned that the recently acquired Vifor Pharma business had underperformed, likely driving the fall in share price today. CSL said it expects double-digit earnings growth for the next five years as its core blood products business grows.

Orora (+19.16%) shares rose after it rejected a takeover offer from Lone Star, a Texas-based private equity company (not the steakhouse), in a deal valued at $2.50 per share. Orora shares finished the session at $2.27.

Temple & Webster (+23.26%) was the biggest mover of the companies reporting earnings today, climbing after reporting revenue of $498 million for FY24, a 26% rise on the pcp.

James Hardie (-2.87%) reported a net profit increase of 2% to $US178 million during the quarter, primarily due to its North American business. However, the company continues to face challenges locally, with weak demand in the Australian housing market due to higher costs deterring potential renovators.

Seek (-6.64%) shares dipped after it reported a 13% drop in earnings to $483 million during FY24 from the pcp., with job ads falling across the Asia-Pacific region as the major contributor.

ASX Indices | ASX Sector Performance |

Wall Street

A mixed session on Wall Street kicked off the new week, which will be crucial for economic data. The big one is consumer prices, which will likely direct the Federal Reserve on monetary policy. The NASDAQ (+0.21%) was the only major index to rise, while the S&P 500 (+0.00%) ended flat, and the Dow Jones (-0.36%) fell.

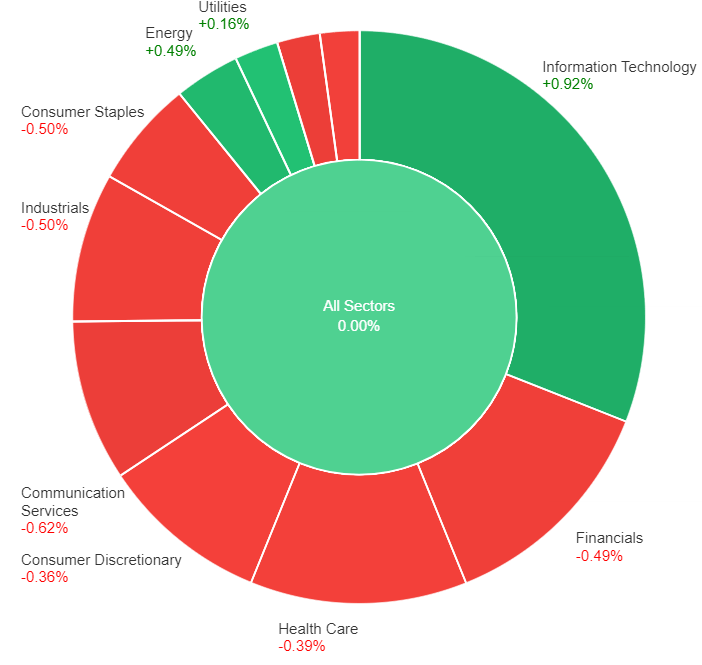

Small-cap companies continue to be sold off, with the Russell 2000 (-0.91%) index seeing steeper falls than its more prominent contemporaries. Real Estate (-0.64%) and Communication Services (-0.62%) saw the largest falls of the eight sectors to finish lower, while Technology (+0.92%) and Energy (+0.49%) were the big winners.

Airliner Jetblue (-20.66%) shares saw a savage sell-off after the company announced plans to sell $400 million of five-year convertible senior notes. The funds will be used to repurchase a portion of their existing 0.50% senior convertible notes due 2026. Monday.Com Ltd. (+14.78%) rose after reporting better-than-expected second-quarter results, with revenue of $236.1 million, beating analysts’ expectations of $229 million.

U.S. Indices | Fear & Greed Index |

S&P500 Sector Performance

Economic Data

Australia’s Consumer Sentiment index rose by 2.8% MoM to a six-month higher of 85.0 in August, above estimates of a 0.5% increase after falling by 1.1% in July.

Australia’s NAB Business Confidence index fell to +1 pts in July, down from a +3 in the previous month.

U.K. Regular Pay rose by 5.4% YoY to £645 per week in the quarter ending June, the lowest since August 2022 after a 5.8% rise the previous quarter,

Sponsor

We put your money to work

Betterment’s financial experts and automated investing technology are working behind the scenes to make your money hustle while you do whatever you want.

Quick Singles

🌎️ Around The Globe

Cisco is reportedly planning another round of layoffs, potentially affecting over 4,000 employees. This follows a previous cut of 4,000 jobs in February.

Disney has announced a $60 billion investment in its Experiences division following a disappointing Q3 earnings report. The plan includes a significant expansion of its parks and the addition of four new cruise ships by 2031.

Google is rolling out a new "Take notes for me" feature powered by its Gemini AI for its Google Meet feature. The tool will automatically take notes during Google Meet calls.

Notorious short-seller Hindenburg Research has alleged that the head of India's market regulator, Madhabi Puri Buch, previously held investments in offshore funds also used by the Adani Group.

Playboy plans to relaunch its magazine with an annual edition to be released in February 2025, four years after the company said it would shut down the magazine.

Starbucks may become the focus of an active investor. New York-based hedge fund Starboard Value purchased a stake in Starbucks with plans to improve the coffee giant's stock price.

Markets

ASX Company Movers

Commodity Prices

Bonds

Forex

Global Health Check

ETF Prices

🔍️ ETF Watch

Want to see how one of your ETFs compares to the rest?

Reply to this e-mail and tell us an ETF or two you want to be included in the tables below.

Australian Index

Australian Sectors

Global Indices & Sectors

Global Strategy

Property & Infrastructure

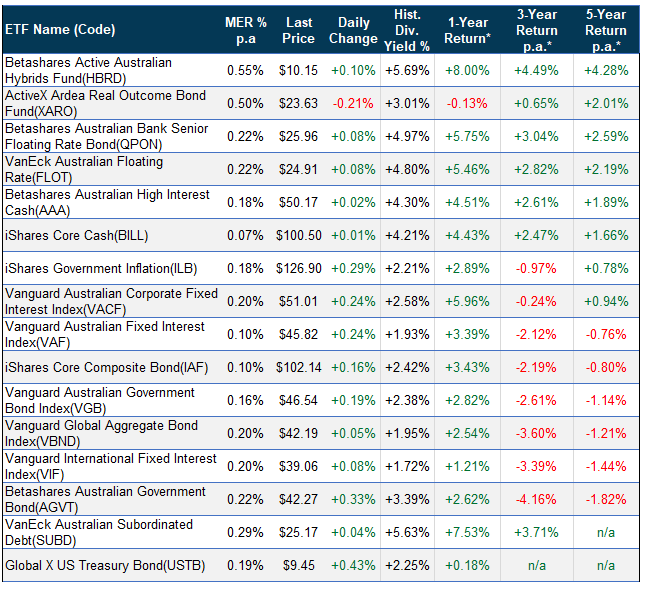

Fixed Income

Mixed Assets

*1-year, 3-year and 5-year returns are calculated as of 30 June 2024.

The Last Word

How are we doing?

We always love hearing from our readers and are constantly seeking feedback.

How are we doing with Equity Espresso?

Is there anything you’d like to see more of or less of?

Which aspects of the newsletter do you enjoy the most?

Hit reply and say hello - or leave us feedback in the poll below:

If you enjoyed this newsletter, forward this e-mail to a friend.

If you’re that friend, subscribe here.

DISCLAIMER: Please note that the information provided in this newsletter is for educational purposes only and should not be considered financial advice. It is not intended to encourage you to buy/sell assets or make economic decisions. We strongly recommend conducting your research before making any investment.