- Equity Espresso

- Posts

- August Kicks Off with ASX in the Green; RBA's Rate Decision Surprises Market

August Kicks Off with ASX in the Green; RBA's Rate Decision Surprises Market

The RBA makes an unexpected move. Credit Corp falls on weaker outlook. A new streaming service awaits

Good Evening,

Welcome to the ASX News Daily Recap.

Lost track of what happened on the market today? Don’t stress. We’re here to catch you up.

Here’s a sample of what you may have missed:

🏛️ RBA's unexpected move

💳 Credit Corp falls on weak outlook

🪱 46,000-year-old discovery!

🚀 Streaming Stars: ‘NASA+’ Arrives

⚖️ TerraLuna court ruling continues crypto rollercoaster

The Recap

ASX Closes Higher

Amidst RBA's Rate Hold

The market started the day positively, then took a surge upward in the afternoon after the RBA announced it was keeping the cash rate on hold at 4.1%, with pockets of the market pricing in a rate increase. Overall, it was a pleasant surprise for markets - more on the RBA decision (or non-decision) in today’s deep dive.

The ASX200 ended the day 0.54% higher to close at 7,450.7, with all 11 sectors finishing the day in the green.

The Tech (+1.14%) sector led the way, with WiseTech (+0.87%) and Xero (+1.37%) continuing their upward momentum. Materials (+0.82%) also finished higher, whilst Staples reversed some of yesterday’s losses, climbing by (+0.88%)

Companies that report tomorrow include BWP Trust, Genworth, Janus Henderson, Jupiter Mines and SSR.

Wall Street

The U.S. started the week off positively as markets looked past concerns about an earnings recession. The S&P500 finished the day +0.15% higher to 4,589.02, whilst the Nasdaq (+0.21%) and Dow Jones (+0.28%) also finished in the green.

Oil prices continue to climb, with Brent Crude up 1.38% to $85.57, which helped the Energy sector overnight.

Apple and Amazon are the two big players to report earnings this Thursday.

In company news:

Exxon Mobile ended the day 2.9% higher after Bloomberg reported that it’s talking with car makers Tesla, Ford and Volkswagen about supplying lithium by expanding their current production.

SoFi Technologies rose by over 20% as the online bank raised revenue guidance from $1.96 billion to $1.97 billion - $2.03 billion, citing benefits from deposit growth and lower funding costs on loans.

Adobe rose by 3% after Morgan Stanley upgraded its price target, fueled by optimism over its A.I. strategy - setting a price target of $660. Adobe ended Monday’s trade at $546.17

Palantir is back at 52-week highs after analysts at Wedbush initiated coverage of the software developer with a ‘Buy’ rating and a price target of $25. The analyst believes the company"has built an AI fortress that is unmatched and poised to be a major player in this AI Revolution over the next decade," Palantir closed Monday trade at $19.84.

The earnings calendar gets busier on Tuesday, with Merck & Company, Pfizer, AMD, Caterpillar, Starbucks, and Uber just some of the companies to report.

Economic News

US Chicago PMI for July came in at 42.8 vs. a consensus of 43.0 but was above June’s figure of 41.5.’This index measures the economic health of the manufacturing sector in the Chicago region. A reading below 50 indicates a contraction in the sector.

Corelogic’s National Home Value index rose 0.7% in July, making it run five months of increases. The most significant increases came from Brisbane (+1.4%), Adelaide (+1.4%) and Perth (+1.0%).

Eurozone consumer prices grew by 5.3% YoY in July - down from 5.5% in June, extending a continued downtrend. Excluding unprocessed food, prices increased by 6.6% after a 6.8% rise last month. Markets reacted positively to the news, with the STOXX600 ending Monday 0.12% higher.

Sponsorship

Unlimited Free Grocery Delivery on Orders $35+

Get groceries delivered in as fast as one hour with Instacart

Charts and Prices

Index & Commodity Prices

ASX By Sector

ETF Watch

Quick Singles

🪃 Local News

Adairs finished the day 5.1% higher after announcing it will take over the operational control of its National Distribution Centre (NDC) from 6th September. The NDC is currently managed by DHL Supply Chain. Adairs will invest approximately $20 million in capital and transition costs but is expected to realise cost savings of approx. $4.0 million from the first year of the change.

Baby Bunting shares soared by over 20% today after reporting unaudited results for FY23 at the close of trade on Monday. Baby Bunting reported topline sales of $515.8m - a 1.7% increase, although comparable store sales fell by 3.6%. Proforma NPAT was $14.5m, 51% lower than FY22, but within the upper end of guidance of $13.5m - $15.0m.

CommSec is launching a new online international share trading platform, offering faster account set-up, access to 13 equities markets and brokerage rates from USD$5.

Deterra Royalties reported royalty receipts for the June 2023 qtr. of $73 million, bringing the total for FY23 to $229 million.

Lynas Rare Earths wholly owned subsidiary, Lynas USA LLC, has signed a follow-on contract with the Department of Defence to construct the Heavy Rare Earths component of its processing facility in Texas. Lynas said that the contribution by the U.S. government to the project had increased to US$258 million.

TPG Telecom went into a trading halt today, with the share price up 6.7% before the halt. Later in the day, TPG confirmed in a statement to the ASX that they’d been the target of a takeover offer, stating: “Vocus Group made an indicative, highly conditional, non-binding offer to acquire certain of TPG’s Enterprise, Government and Wholesale assets and associated fixed infrastructure assets, including Vision Network, for approximately $6.3 billion.”. TPG ended the day 11.5% higher.

🌏 Around The Globe

99-year-old trucking company Yellow has gone bust. The company has been teetering on the brink of collapse due to poor acquisitions and labour issues. Yellow employs almost 30,000 people.

Doordash aims to speed up ordering and help customers find better food options with an artificial intelligence-based chatbot called DashAI.

Walmart purchased Tiger Global’s stake in Indian e-commerce company Flipkart for $1.4B, valuing the company at $35B.

Get ready to add another subscription to your viewing suite - NASA has announced its own streaming service, NASA+, which will be available later this year. The ad-free, no-cost service will feature footage of launches, documentaries, and content exclusive to the platform.

Apple supplier Foxconn will invest $500 million to set up manufacturing plants in India, set to create 25,000 jobs.

Deep Dive

RBA Holds Steady:

Cash Rate Remains at 4.1%

The Reserve Bank of Australia (RBA) decided to maintain the cash rate target at 4.10% for the second month in a row, catching markets off-guard, with some expecting a rate hike. However, we may not be out of the woods yet, as the RBA highlighted that further rate rises may still be necessary.

Outgoing governor Phil Lowe said he believes that prolonged heightened interest rates are instrumental in achieving a harmonious balance between supply and demand within the economy.

The RBA said pausing would allow itself more time to gauge the repercussions of previous hikes to better understand the economic forecast. Whilst inflation of 6.0% is on the downturn, it is still too high. Services inflation remains a cause of concern for the RBA, with rent inflation also elevated.

The RBA provided the below economic projections in its statement:

Consumer Price Index to be around 3.25% by the end of 2024

Consumer Price Index to settle between 2.0 - 3.0% in late 2025

Unemployment to rise gradually to about 4.5% in 2024

GDP Growth of 1.75% in 2024 and 2.00% in 2025

The RBA noted that labour market conditions remain tight, although they have eased a little. Wage growth has increased due to the tight labour market and higher inflation.

The RBA said that returning inflation to target within a reasonable timeframe remains the Board’s priority. Further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe. It will rely upon the data and the evolving assessment of risks and continue to pay close attention to the global economy, household spenBoard'snflation outlook and the labour market.

Movers and Shakers

✅ Biggest Gainers

Patriot Battery Metals (PMT) has entered into a $C109 million ($123 million) private placement with US-based chemicals giant Albemarle. Albermale will subscribe to just over 7m common shares for C$15.29 - a 7% premium to the market close price on Monday. PMT finished the day 10% higher, closing at $1.67.

29Metals (29M) rose by 11.8% to $0.80 after announcing that its’ mining operations were restarted today at the Capricorn Copper operations. Work at the mine had been suspended since March due to extreme rainfall.

🔻Biggest Fallers

Credit Corp Group (CCP) reported a decline in full-year net profit of 5% to $91.3 million, despite an increase in revenue of 15% to $473m. The company’s loan book grew 43% to $358 million with a final dividend of 47¢ a share declared. A weaker-than-expected outlook may have been the catalyst for concern after providing FY24 NPAT guidance of $90 - $100m. CCP shares finished the day 12.5% lower to $20.63

Strandline Resources (STA) shares fell by 21% after completing an institutional capital raise of $33.8 million, with 187.9 million new shares issued at $0.18 per share. Strandline closed Tuesday down 22.7% to $0.17 per share.

Crypto Corner

Regulatory Rollercoaster:

Judge Challenges Previous Ruling on Crypto Classification

Terra Founder Do Kwon

U.S. District Judge Jed Rakoff has denied Terraform Labs' motion to dismiss a lawsuit from the U.S. Securities and Exchange Commission (SEC) on Monday, arguing it has “asserted a plausible claim” that TerraLabs had violated securities law.

This allows the SEC to move forward in its case against Terraform Labs and founder Do Kwon; however, it appears contrary to the ‘Ripple’ case ruling last month - with the judge, in that case, drawing a difference made between public and institutional sales.

U.S. District Judge Analisa Torres had drawn the distinction in the Ripple case based on the method of token sales. Judge Torres ruled that coins sold directly to institutional investors were deemed securities, while those sold to retail investors through secondary markets were not.

However, Judge Rakoff has now rejected this differentiation. He emphasises that the method of sale, whether to institutional or retail investors, should not determine the classification of coins as securities.

While today’s TerraLabs ruling doesn’t directly affect the Ripple case, it does highlight the continued uncertainty on whether digital assets are deemed securities.

Crypto Price Watch

🤨 What The?

From time to time, we share something from left-field

In a groundbreaking discovery, scientists have successfully resurrected nematodes from a 46,000-year-long slumber.

These ancient creatures were found in the Siberian permafrost near the Kolyma River. They hail from a time when Neanderthals and dire wolves were still a part of our world.

What’s a Nematode?

We’ll save you the Google search - Nematodes are thread-like roundworms that live in a wide range of environments, including soil and fresh and salt water. There are species of nematodes that feed on fungi, bacteria, protozoans, other nematodes, and plants.

The Nematodes were successfully woken from a state of suspended animation after researchers found them in the permafrost (frozen soil) that flanks Siberia’s northern Kolyma River. A radiocarbon analysis revealed they belonged to a functionally extinct species called Panagrolaimus kolymaensis, previously unknown to science.

“Their evolution was literally suspended for 40k years,” wrote Philipp Schiffer, an evolutionary biologist at the University of Cologne. "We are now comparing them to species from the same genus, which my team samples around the world. By studying their genomes, we hope to understand a lot about how these populations became different in the last 40k years.”

Nematodes, or roundworms, are a highly adaptable group of squiggly animals that are often microscopic, though some species are visible to the naked eye. Many nematodes have evolved the ability to survive freezing temperatures by entering a state of so-called “cryobiosis”, in which they essentially shut down their metabolic systems and transform into desiccated husks that can be resuscitated once favourable conditions return.

📊 Broker Ratings

Baby Bunting (BBN) upgraded to a neutral (Citi) - P.T. $1.65

Gold Road Resources (GOR) upgraded to outperform (Macquarie) - P.T. $1.90

Challenger (CGF) reduced to a neutral (Credit Suisse) - P.T. $7.20

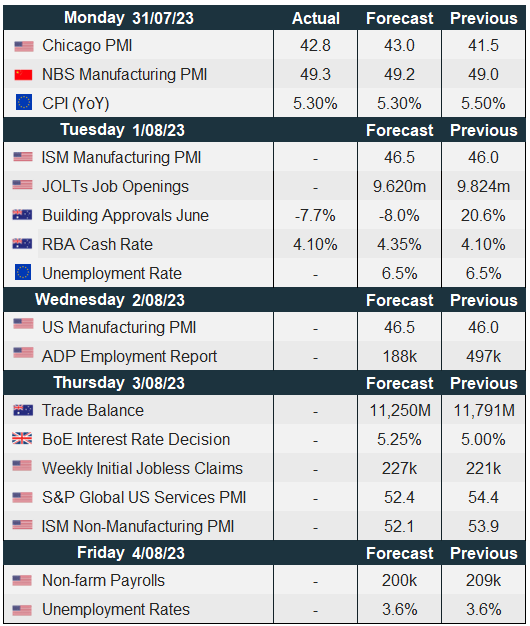

🗓️ Economic Calendar

DISCLAIMER: None of the information provided in this newsletter should be constituted as financial advice. This newsletter is strictly for educational purposes only. It should not be taken as investment advice or a solicitation to buy or sell assets or make financial decisions. Please do your research.