- Equity Espresso

- Posts

- Australian Shoppers Tighten Purse Strings Amid Rate Rises

Australian Shoppers Tighten Purse Strings Amid Rate Rises

Good Evening,

Welcome to Equity Espresso’s Daily Recap. Markets fell away this afternoon despite a positive start, while retail sales came in lower than expected for October. Were consumers holding back for those Black Friday sales? Let’s jump in.

Didn’t get this email directly? Join for Free

The Recap

In a similar trading session to yesterday, markets started the day strong, but the positive momentum petered out, with the ASX200 index still managing to etch out a 0.40% gain to 7,015.20.

Real Estate (-1.48%) stocks were the biggest mover of the seven sectors that ended the day higher, with Goodman Group (+1.3%), Scentre Group (+1.9%) and Stockland (+1.7%) all finishing in the green. Energy (-1.01%) stocks ended the day lower, despite the steady oil price on Tuesday, while Tech (-0.42%) gave back some of yesterday’s gains.

RBA Governor Michelle Bullock told a central banking conference in Hong Kong today that businesses are passing through higher costs and wages to customers because demand remains strong. She also said that borrowers are “very unhappy” with the central bank after 13 rate hikes, but households are resilient enough to cope with higher repayments.

Australian Retail Sales took an unexpected fall during October, a possible sign that the Reserve Banks interest rate increases are starting to take effect. Retail sales fell by 0.2% in October from a month earlier. Estimates were for a 0.1% rise, with the result the weakest since June. Some analysts believe the weaker-than-expected result is a sign that consumers saved their spending for Black Friday and Cyber Monday in November, which have reportedly increased from last year. Clothing, footwear and personal accessory retailing (-1.0%) saw the largest fall, followed by Department stores (-0.6%) and Household goods retailing (-0.6%). ⬇️

|  |

Economic Data

Australian Retail Sales for October were down by a seasonally adjusted 0.2%, below estimates of a 0.1% gain.

U.S. new single-family house sales fell 5.6% to a seasonally adjusted annualised rate of 679,000 in October, well below forecasts of 723,000.

U.S. Building Permits rose by 1.8% to a seasonally adjusted annual rate of 1.498 million in October, compared to the preliminary estimate of 1.487 million.

Wall Street

Markets fell on Monday in the first full trading session post-Thanksgiving, with all three main indices trading in the red. According to Adobe Analytics, online shopping deals as part of Cyber Monday are expected to entice shoppers to spend a record $12 billion.

Zscaler reported quarterly revenue above analysts’ estimates, but shares fell by over 6% in after-hours trading as the company’s cloud security expenses jumped by 24%. The rush into artificial intelligence, which has led to industries employing vast and vulnerable data, has sharply increased costs.

| Fear and Greed Index |

Outlook

Tomorrow, we get completed construction data for Q3, which is expected to rise by 0.3% QoQ. The CPI for October also drops. In the U.S., consumer confidence and weekly crude oil stock levels are reported for November.

Half-year reports from Fisher & Paykel Healthcare, EROAD, Metro Performance Glass, and Straker Translations are expected tomorrow. In the U.S., Intuit, Workday, and CrowdStrike are some of the companies reporting quarterly earnings.

Futures markets are flat this afternoon, with the S&P 500 (+0.05%) only marginally higher, while the NASDAQ (+0.00%) hasn’t budged.

Quick Singles

🪃 Local News

A National Australia Bank survey found that low-income households continue to bear the brunt of the higher cost of living, with the total number of Australians experiencing financial hardship increasing to 44%.

The Australian gender pay gap dropped to a new low of 21.7% - shrinking by 1.1% in the past year, with the average annual pay gap now $26.393.

Optus is attempting to prevent law firm Slater & Gordon from accessing a report that the telecommunications company had commissioned from Deloitte. The report pertains to the 2022 cyberattack that resulted in the online posting of the personal information of around 10,200 Optus customers.

🌏 Around The Globe

According to a Bloomberg report, Reddit is testing the waters with potential investors about the possibility of an Initial Public Offering, which said that Reddit could list as early as Q1 next year.

On Monday, the U.S. Securities and Exchange Commission adopted a financial crisis-inspired rule barring traders in asset-backed securities from betting against the same assets they sell to investors. The rule blocks "securitisation participants" from entering deals that involve shorting or buying credit-default swaps against those same securities.

Rumours are circulating that Chinese fast-fashion giant Shein has filed for an Initial Public Offering to go public. The retailer was last valued at $66 billion and could be ready to start trading on the public markets as soon as 2024.

Binance founder Changpeng Zhao, who pleaded guilty last week to criminal charges tied to his cryptocurrency exchange, has to remain in the U.S. at least temporarily, according to a ruling Monday by a federal judge.

Foxconn Technology has announced that it will invest over $1.5 billion in a construction project in India to meet the operational needs of one of its major clients, Apple. Foxconn is a critical supplier to Apple and runs significant operations in mainland China, with its factories playing a crucial role in manufacturing iPhones.

Markets

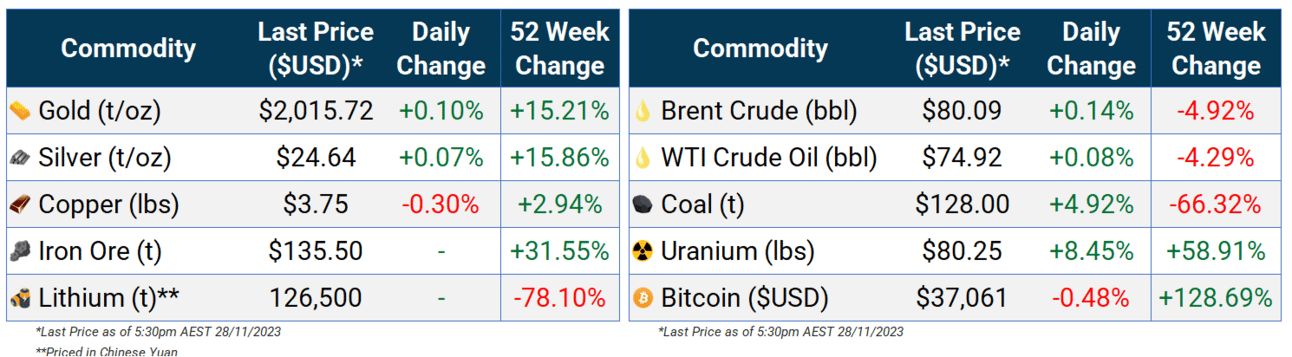

Commodity Prices

Bond Prices

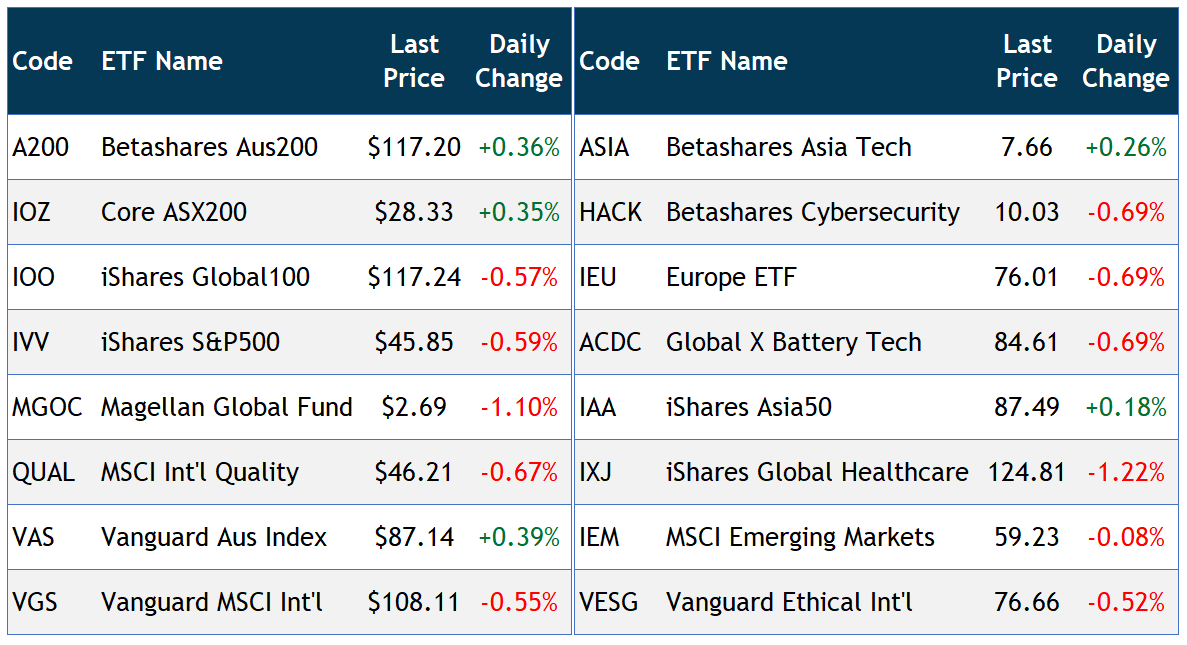

ETF Watch

ASX News

🗞️ Company Announcements

Aroa Biosurgery (ARX) reported an 8% increase in H1FY24 sales to NZ$31.2 million, guiding for a further 30-40% increase during the year's second half.

Collins Food Group (CKF) reported an increase of 14.3% in revenue from continuing operations to $696.5 million, with growth across all its business units. The company’s Statutory NPAT tripled to $50.5 million in a “challenging operating environment”. Collins Foods owns several food chains, including KFC Australia, which grew its revenue by 9% to $522.9 million.

EcoFibre (EOF) Managing Director and CEO Eric Wang has tendered his resignation after seven years with the company, with current chairwoman Vanessa Wallace appointed acting interim MD and CEO.

Imugene (IMU) announced that its MAST (Metastatic Advanced Solid Tumours) clinical program, which evaluates the safety and efficacy of novel cancer-killing virus, has been granted Fast Track designation from the U.S. FDA. “The Fast Track process of drug development is designed to facilitate the development and the review of drugs to treat serious conditions and fill an unmet medical need, with Fast Track status often leading to earlier drug approval and access by patients”, Imugene CEO and MD Ms Leslie Chong said.

MedAdvisor Solutions (MDR) announced it has made a strategic investment in the U.K. pharmacy market, with a £1 million investment in Charac Limited, securing a 7.4% stake in the company. MedAdvisor will discontinue its current operations in the U.K. as part of the deal.

Plenti Group (PLT) released its half-year results. It announced a strategic partnership with National Australia Bank (NAB), launching a “NAB powered by Plenti” car and electric vehicle (EV) loan, making Plenty renewable energy finance available to NAB customers. The companies also entered an agreement where NAB can acquire up to 15% of Plenti’s share capital.

Synlait Milk (SM1) increased its milk price forecast for the 2023-2024 season to $NZ7.25 per kilogramme milk solids (kgMS) from $NZ7.00. This increase is attributed to a recovery in dairy commodity prices.

South 32 (S32) has appointed Sharon Warburton as an independent non-executive on its board, who currently serves on the board of Northern Star Resources, Wesfarmers and Worley.

Pointsbet (PBH) held its AGM today, where it said it’s on track to deliver revenue growth of between 10-20% for FY23, with group EBITDA to be at or close to breakeven.

Westgold Resources (WGX) will expand its Big Bell gold mine project, expanding its mine life to 16 years. The site is expected to produce 15.7 million tonnes of ore or 1.5 million ounces of gold.

Social Media

📱 Post of The Day

Cyber Monday online sales notched up another record this year, following Black Friday’s record day.

Broker Research

Comms Group

Code: CCG | Market Cap: $22.3m | Current Price: $0.059

Price Target: $0.16 | Sector: Information Technology | Broker: Research as a Service

Overview

Comms Group provides Telecommunications and IT services in Australia and globally. The company offers IT managed, cloud hosting, cloud communications, and unified communications services. The company provided updated trading commentary at is AGM presentation. CCG operates three largely independent divisions in the broad communications space.

AGM Update

Unaudited Q1 FY24 revenue was $13.6m, and unaudited EBITDA was $1.5m - achieving half of the broker’s full-year estimates.

Large opportunities are expected to close in the Global division over the coming quarters, and additional Vodafone revenue is expected to boost the H2 FY24 result.

The strategic review continues with third-party interest expressed in several CCG business units.

The Global division is CCG’s growth vehicle, providing voice solutions to Microsoft Teams users and other wholesale carriers across several regions.

Recommendation

Using FY23 estimates, CCG trades at a 30% discount to the average listed profitable peer. Using FY24 EBITDA guidance and FY23 peer multiples, the discount is closer to 58%, with a peer average implying a share price of $0.15/share.

Newsletter Recommendation

One-click subscribe

The Naked Newsletter A friend that's looking out for your health & wellness. We know you're the kind of person who wants to stay ahead of the curve on optimising your fitness. |

Daily Quiz

❓️ Test Your Knowledge

Last Week’s Question. Which of these countries is not in the Organization of the Petroleum Exporting Countries (OPEC)?

Answer: India (29%). The Organization of the Petroleum Exporting Countries (OPEC) is a permanent, intergovernmental Organisation created at the Baghdad Conference in the 1960s. OPEC aims to coordinate and unify petroleum policies among Member Countries to secure fair and stable prices for petroleum producers. The current OPEC members are Algeria, Angola, Equatorial Guinea, Gabon, Iran, Iraq, Kuwait, Libya, Nigeria, the Republic of the Congo, Saudi Arabia, the United Arab Emirates and Venezuela.

A Little Extra

📉 Going Down?

Top-10 shorted stocks on the ASX - as of November 22

Weekly Movers ⬆️

| Weekly Movers ⬇️

|

📊 Broker Ratings

What do the brokers have to say?

Aeris Resources (AIS) - Downgrade to Neutral from Outperform (Macquarie)

Orora (ORA) - Upgrade to Overweight from Equal-weight (Morgan Stanley)

👨💼 Director Transactions

What are the insiders doing? (On-market trade only)

DISCLAIMER: None of the information provided in this newsletter should be constituted as financial advice. This newsletter is strictly for educational purposes only. It should not be taken as investment advice or a solicitation to buy or sell assets or make financial decisions. Please do your research.