- Equity Espresso

- Posts

- Bapcor Soars on Buyout Bid Amid Savage ASX Selloff

Bapcor Soars on Buyout Bid Amid Savage ASX Selloff

Good Evening,

Welcome to Equity Espresso’s Daily Market Recap.

The Aussie market suffered a savage sell-off on Tuesday after the Kings birthday holiday, with the ASX 200 index losing 104.6 pts. or 1.33%, the largest one-day fall in six weeks despite Wall Street's gains on Monday.

The Materials (-2.58%) sector saw the biggest falls, with a sell-off in gold, silver, copper and uranium commodity prices sending stocks lower. Fortescue (-3.16%), South32 (-5.17%) and Northern Star Resources (-5.08%) were some of the stocks hit hardest in the sector.

Real Estate (-2.35%) and Utilities (-2.03%) were a couple of the other sectors to see sharp falls, while Consumer Discretionary (+0.11%) rose, largely thanks to a 13.9% rise in Bapcors’ share price on reports of a takeover offer. More on that later.

Gold miners saw the most significant drop after the price of the precious metal suffered the biggest fall in three years on Friday to trade at around US$2,300 today after a strong U.S. jobs report lowered hopes of an impending interest rate cut. West African Resources (-9.12%), St.Barbara (-8.00%), Ramelius Resources (-7.25%) and Bellevue Gold (-5.53%) all saw significant sell-offs.

In company news:

Bapcor (+13.99%) was the big mover today, closing at $4.97 after it confirmed media speculation that it had received a non-binding takeover offer from Bain Capital to acquire the company at $5.40 per share.

Strike Energy (+12.2%) shares jumped after The Australian reported that Gina Rinehart's Hancock Prospecting is considering a possible buyout.

AGL (-1.72%) shares rose after the company announced plans to acquire a 20% stake in technology platform Kaluza for $150 million.

Peninsula Energy (-9.09%) shares fell after completing a $39.8 million capital raise from retail shareholders at $0.10 per share.

ASX Indices | ASX Sector Performance |

Wall Street

The S&P 500 (+0.3%) and NASDAQ (+0.4%) closed at record highs on Monday ahead of this week’s consumer price report and Federal Reserve Policy announcement set to drop on Wednesday. The Dow Jones trailed behind, rising by 0.2%

The central bank is expected to maintain interest rates as it releases updated economic and policy projections. Investors will be seeking hints on when the U.S. central bank might start reducing interest rates.

Southwest Airlines (+7.03%) rose after activist hedge fund Elliott Management bought a $1.9 billion stake in the company. The firm is pushing for leadership changes at the airliner. Gamestop (-12.01%) shares sunk in a roller-caster week after the company reported a fall in first-quarter earnings on Friday,

U.S. Indices | Fear & Greed Index |

S&P500 Sector Performance

Economic Data

Australia's NAB business confidence index fell to -3 in May 2024, the lowest level in six months from an April reading of 2.

U.K. wages went up 6% year-on-year in the quarter ending April 2024, the same as the last two periods, which was in line with forecasts.

Sponsor

Oh Sh*t You’re a Grown Up

Life comes at you fast. Suddenly you’re being quizzed on things like 529 plans and backdoor Roth IRAs. It’s time to step up and be responsible with your money and financial goals. But unlike 2 AM feeds - you don’t have to be in this alone.

Advisor.com lets you compare expert financial advisors and select a vetted fiduciary to handle your investing. They evaluate credentials, client reviews, and an advisor’s overall experience to make sure you are in good hands.

Quick Singles

🌎️ Around The Globe

Kia is recalling nearly 463,000 Telluride SUVs in the U.S. over front seats that could start burning.

TJX will start using body cameras for some employees in its retail stores to prevent theft.

Apple announced a series of generative artificial intelligence products and services during its annual developer conference. Apple also announced a partnership with OpenAI that will integrate ChatGPT into iPhones

Norway's $1.7 trillion sovereign wealth fund said it will vote against ratifying Tesla CEO Elon Musk's $56 billion pay package, which is up for a shareholder vote next week.

OpenAI's C-Suite will expand with the hires of Sarah Friar as its first chief financial officer and Kevin Weil as chief product officer, the company said Monday.

Markets

ASX Company Movers

Commodity Prices

Bonds

Forex

Global Health Check

ETF Prices

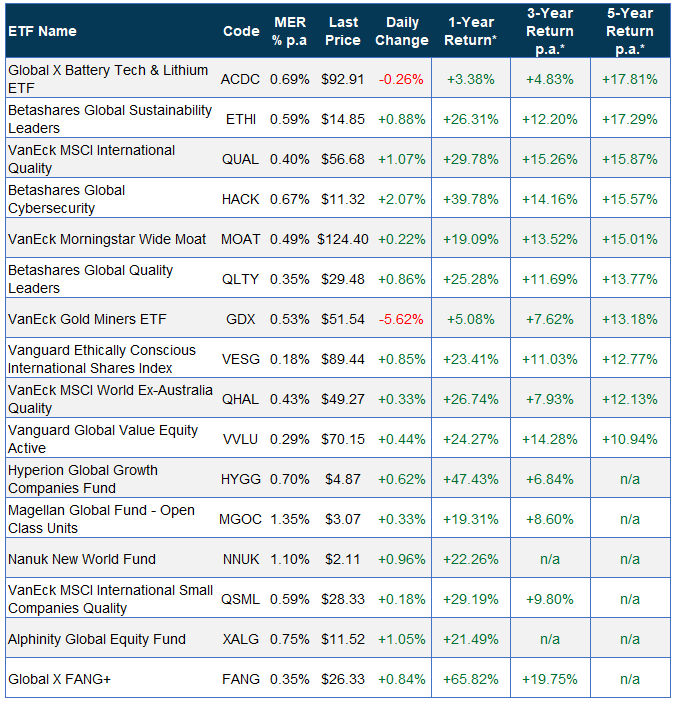

🔍️ ETF Watch

The new and improved ETF Watch section.

Want to see how one of your ETFs compares to the rest? Reply to this e-mail and tell us an ETF or two you want to be included in the tables below.

Australian Index

Australian Sectors

Global Indices & Sectors

Global Strategy

Property & Infrastructure

Fixed Income

Mixed Assets

*1-year, 3-year and 5-year returns are calculated as of the end of April 2024.

Newsletter Recommendation

| All About VentureYour must read from the venture world. Find out about live virtual events. All with occasionally witty commentary. |

The Last Word

How are we doing?

We always love hearing from our readers and are constantly seeking feedback.

How are we doing with Equity Espresso?

Is there anything you’d like to see more of or less of?

Which aspects of the newsletter do you enjoy the most?

Hit reply and say hello - or leave us feedback in the poll below:

If you enjoyed this newsletter, forward this e-mail to a friend.

If you’re that friend, subscribe here.

DISCLAIMER: Please note that the information provided in this newsletter is for educational purposes only and should not be considered financial advice. It is not intended to encourage you to buy/sell assets or make economic decisions. We strongly recommend conducting your research before making any investment decisions.