- Equity Espresso

- Posts

- BHP's Copper Chase Can't Save ASX

BHP's Copper Chase Can't Save ASX

Good Evening,

Welcome to Equity Espresso’s Market Recap.

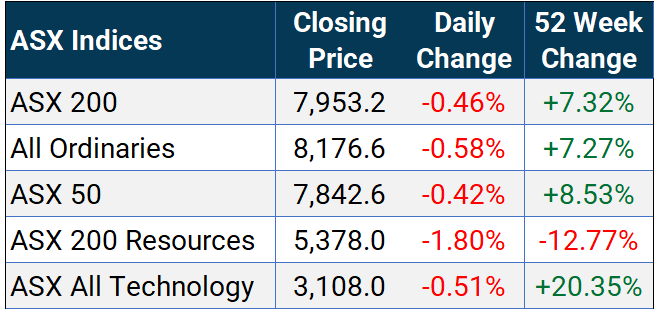

The Aussie market fell on Tuesday due to a sharp sell-off in the Materials sector, which lost 1.93% after losses from BHP Group and Fortescue Metals who were both in the headlines. The major ASX 200 index lost 36.4 pts. or 0.5% to 7,953.20, with nine sectors finishing the day lower.

Following the materials sector lower were Technology (-0.90%) and Energy (-0.70%) stocks. Wistech Global (-2.10%) gave back Monday’s gain, while Audinate (-5.79%) saw a sharp fall again today after losing almost 4% on Monday.

Discretionary (+0.23%) and Financials (+0.19%) were the only sectors to finish the session in green. Some of the bigger movers in these sectors included Idp Education (+3.47%), Breville Group (+2.98%) and Medibank Private (+1.31%).

In company news:

BHP Group (-1.26%) dropped on news it will partner with Lundin Mining to jointly acquire Toronto-listed copper miner Filo Corp. BHP’s total cash payment for the deal is expected to be $US2.1 billion.

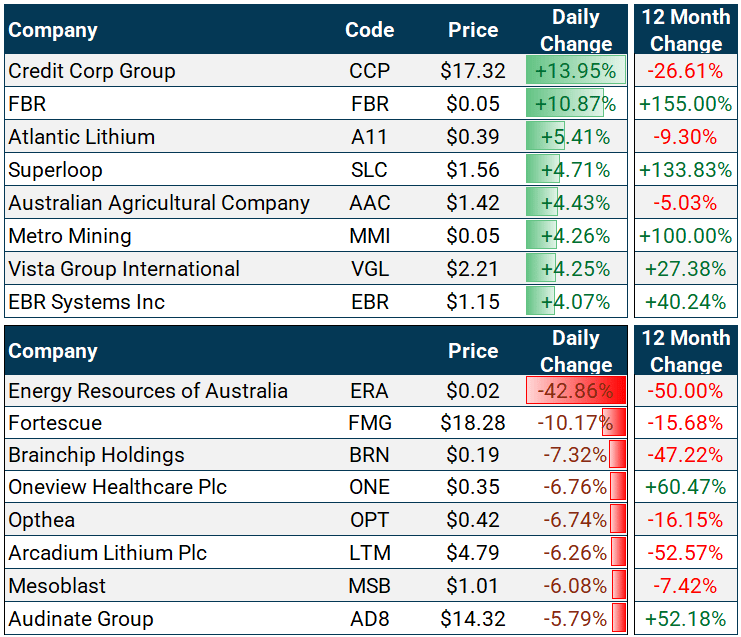

Fortescue (-10.17%) shares plunged after media reports that JP Morgan was looking for buyers for $1.9 billion worth of shares after the close of the market yesterday.

Regional Express shares remain in a trading halt after the company asked for trading to be paused yesterday after Ernst & Young was bought in to advise the board on a restructure.

Credit Corp (+13.95%) climbed despite reporting an 11% drop in its underlying net profit after tax to $81.2 million for FY24.

ASX Indices | ASX Sector Performance |

Wall Street

A lacklustre session on Wall Street saw the S&P 500 (+0.08%) and NASDAQ (+0.07%) move only marginally higher as investors await company earnings from some big technology companies. Microsoft, Meta Platforms, Apple and Amazon are just some of the major companies to report June quarterly earnings this week.

The Federal Reserve meets on Wednesday, where investors will be hoping to get clear signs that it is preparing for a September rate cut. Some of the other key economic data on the agenda this week include Nonfarm Employment (Wednesday), Manufacturing PMI (Thursday) and Unemployment data (Friday.)

McDonald's (+3.74%) shares climbed despite missing quarterly earnings and revenue expectations. The fast-food giant revealed it plans to continue using its $5 value meals to attract low-income customers. Revvity (+9.07%) shares jumped after posting a second-quarter earnings beat. The life sciences company reported adjusted earnings of $1.22 per share, above estimates of $1.12.

U.S. Indices | Fear & Greed Index |

S&P500 Sector Performance

Economic Data

Frances’s GDP expanded by 0.3% QoQ during Q2, the same as Q1 and above market estimates of a 0.2% rise.

Australian Dwelling Approvals fell 6.5% month over month to 13,237 units in June, after climbing 5.7% the previous month.

Chinese foreign direct investment plunged by 29.1% year over year during the January-June period, a record decline for the first six months of the year.

Sponsor

Get value stock insights free.

PayPal, Disney, and Nike recently dropped 50-80%. Are they undervalued? Can they recover? Read Value Investor Daily to find out. We read hundreds of value stock ideas daily and send you the best.

Quick Singles

🌎️ Around The Globe

Six of the world's largest banks have agreed to pay $80 million to settle antitrust litigation in New York after being accused of conspiring to rig the prices of European government bonds.

Abbott Laboratories will pay an Illinois family $495 million in damages after its infant formula caused a girl to develop a dangerous disease.

Apple has reached a tentative collective bargaining agreement with workers at one of its stores in Maryland, the tech giant's first of this kind.

Ola Electric, an Indian electric scooter company, is targeting a $4.3 billion valuation in its IPO this week as it plans to list on the country’s National Stock Exchange.

The Justice Department claims TikTok collects information about users based on their opinions on topics like gun control, abortion, and religion.

Qatar Airways is reportedly in talks to buy a stake in South Africa’s Airlink as the airline seeks to expand its presence on the continent.

Markets

ASX Company Movers

Commodity Prices

Bonds

Forex

Global Health Check

ETF Prices

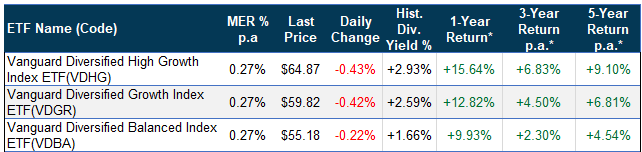

🔍️ ETF Watch

Want to see how one of your ETFs compares to the rest?

Reply to this e-mail and tell us an ETF or two you want to be included in the tables below.

Australian Index

Australian Sectors

Global Indices & Sectors

Global Strategy

Property & Infrastructure

Fixed Income

Mixed Assets

*1-year, 3-year and 5-year returns are calculated as of 30 June 2024.

The Last Word

How are we doing?

We always love hearing from our readers and are constantly seeking feedback.

How are we doing with Equity Espresso?

Is there anything you’d like to see more of or less of?

Which aspects of the newsletter do you enjoy the most?

Hit reply and say hello - or leave us feedback in the poll below:

If you enjoyed this newsletter, forward this e-mail to a friend.

If you’re that friend, subscribe here.

DISCLAIMER: Please note that the information provided in this newsletter is for educational purposes only and should not be considered financial advice. It is not intended to encourage you to buy/sell assets or make economic decisions. We strongly recommend conducting your research before making any investment.