- Equity Espresso

- Posts

- Chevron Strikes & BNPL Resurgence

Chevron Strikes & BNPL Resurgence

Zip Co. Tyro Pay and EML Payments all rose today in something of a FinTech resurgence. Meanwhile, Chevron workers are set to strike next week

Good Evening,

Welcome to Equity Espresso.

We’ve had a revamp, and whilst the name has changed, the content will be better than ever.

Here’s a sample of what you may have missed today:

💳 BNPL Resurgence?

🪨 Mineral Resources Rises

⛽ Chevrons Strike Saga Esclates

⛩️ Economists Lower China Outlook

🍚 India Continues Rice Restrictions

The Recap

Chevron Strikes &

The BNPL Resurgence

Following Wall Street’s strong lead overnight, the ASX200 index rose by 50.7 points to 7210.5, with nine of the 11 sectors finishing higher.

The Materials (+1.60%) sector was the biggest gainer on the day as BHP (+1.2%), Fortescue (+3.2%) and Rio Tinto (1.1%) all finished higher. Mineral Resources was the other big mover, rising by 7.9% after reporting full-year earnings overnight. Discretionary also rose (+1.42%), whilst the Tech sector fell by 0.31%.

Fintech and BNPL stocks had a positive day. Zip Co. saw a 4.6% increase after reporting record transaction volumes and revenue for FY23. Despite the economy's decline in spending, consumers are still utilising buy now, pay later services. EML Payments and Tyro Payments also saw increases of 31.5% and 14.7%, respectively, due to better-than-anticipated full-year results.

European gas prices rallied sharply overnight after unions notified energy giant Chevron that strikes would occur at the two essential LNG plants in Western Australia, threatening the global gas supply. Both facilities supply an estimated 7% of global LNG.

ASX200 Stock Snapshot

Wall Street

U.S. stocks finished higher for the second consecutive trading day despite Federal Reserve Chairman Powell's indication of maintaining "higher for longer rates". The S&P500 and Nasdaq gained on the day, with 10 of the 11 sectors finishing higher. Notably, the Communication Services and Technology sectors led the pack, registering increases of 1.05% and 0.81% respectively.

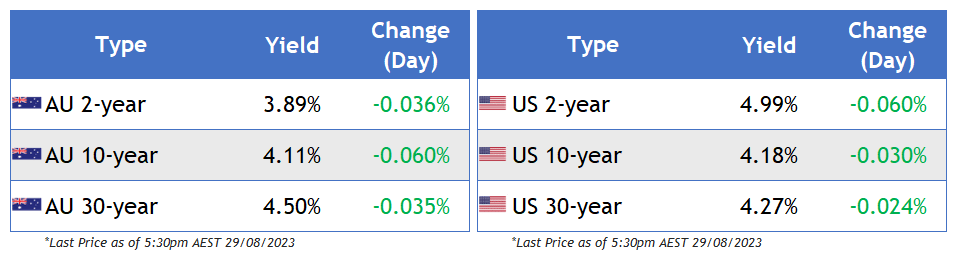

Bond markets seem to have already factored in this hawkish perspective. The yields on the 2-year and 10-year treasuries declined by three basis points, settling at 5.04% and 4.21%, respectively.

Investors could experience volatility this week in anticipation of significant key economic data, including JOLT job openings, advanced Q2 GDP figures, and the non-farm payroll data.

Economic News

The ANZ-Roy Morgan Australian Consumer Confidence survey showed that consumer confidence in Australia rose by 2.3 points over the past week. Among the mainland states, confidence increased in NSW, Victoria, and Queensland, while it declined in South Australia and Western Australia. Additionally, weekly inflation expectations dropped by 0.3% to 5.2%, and the four-week moving average decreased from 5.4% to 5.3%.

China's economic growth projections are being lowered, with GDP expected to rise by 5.1% in 2023, down from a previous 5.2% estimate. This aligns closer to the government's 5% target set in March. The revision is partly due to lowered third-quarter growth forecasts, now at 4.4% compared to the initial 4.6%. Growth for 2024 is anticipated at 4.5%, a decrease from the earlier 4.8% prediction.

Sponsor

Become A Better Investor

In 5 Minutes a Day

Bite-sized investing ideas, wisdom, news, and trends you need to grow your dough!

Join legendary traders, investors, and entrepreneurs at the Daily Dough!

Markets

Index & Commodity Prices

Bond Prices

ASX By Sector

ETF Watch

Quick Singles

🪃 Local News

Starting a Passive Income Stream has never been easier. Learn how to use minimal capital to build your Passive Income streams with your very own vending route.*

EML shares surged by almost 31.5% as the payments company took a large impairment loss of $260 million, driving its statutory loss of $284.8 million. The company’s revenue rose 4% to $245 million.

John Lyns Group reported a revenue increase of 43.2% to $1.28 billion and an EBITDA jump of 42.9% to $119.4 million while telling investors it is tipping another strong year in financial year 2024.

Start Entertainment reported a $2.4 billion loss after the casino operator wrote down more than $2 billion in value from its Sydney, Gold Coast and Brisbane casinos.

Current board member Reg Weine has been appointed as the new chief executive and managing director of Bubs Australia.

🌏 Around The Globe

Tesla has received approval for its Diner and Drive-In Movie Supercharger in Los Angeles. The location will feature 32 Supercharger stations, a restaurant, rooftop seating, and two movie screens.

X has rolled out its new hiring feature in beta, where job postings will appear on company accounts.

The Indian government has imposed new restrictions on rice exports, including setting a minimum price of $1,200 per ton for basmati exports and a 20% tax on parboiled rice sales abroad.

Apple plans to upgrade its iPad Pro. The upgrade aims to boost iPad sales through the new features, including a new Magic Keyboard, adoption of the M3 chip, and better displays.

ChatGPT has launched ChatGPT Enterprise, an A.I. chatbot business tier that improves user utilisation by adding enterprise-grade privacy and data analysis capabilities while performing the same tasks.

₿ Crypto Corner

Impact Theory has paid a $6 million settlement after the Securities and Exchange Commission (SEC) alleged its NFTs were unregistered securities.

The U.S. government is considering new tax regulations for cryptocurrency. It would require crypto brokers, including trading platforms (both centralised and decentralised), payment processors, and specific wallets, to collect and disclose customer information to the IRS. These brokers must also report their customers' tax positions, detailing any gains or losses using a new form called 1099.

*Sponsor

Movers and Shakers

✅ Biggest Gainers

Mineral Resources rose 7.9% today, reporting their full-year earnings after yesterday's market closed. Here are the financial highlights:

Revenue increase of 40%, reaching $4.8 billion.

Underlying EBITDA surged by 71% to $1.8 billion, EBITDA margin of 37%.

Fully Franked final dividend of $0.70, making the total FY23 dividend $1.90 per share, a significant rise from FY22's $1.00.

Non-cash impairment charges of the Yilgarn and Utah Point iron ore assets impacted statutory NPAT of $244 million.

Net debt at $1.9 billion and available liquidity as of June 30 2023 at $1.8 billion, including $1.4 billion cash on hand.

The company reported record earnings in the lithium sector, continued ramp-up at Wodgina, and completed the Mt Marion plant expansion.

The iron ore division saw a final investment decision for the Onslow Iron project and a non-cash impairment of $552 million related to the Utah Point Hub and Yilgarn Hub assets.

The energy division reported two onshore natural gas discoveries in the Perth Basin and completed the acquisition of Norwest Energy NL.

Resimac shares climbed 20.1% today despite reporting a decline in after-tax profits by over 30% to $66.5 million due to tripling interest expenses from rising interest rates. Despite this, the company maintained its dividend at 4¢ per share.

CEO Scott McWilliam cited fierce competition and declining demand for credit as reasons for the decline in earnings. However, he stressed the company's determination to improve operational efficiency and customer experience through technology. McWilliam remains hopeful for the future, anticipating a more stable pricing environment for home loans as interest rates approach their peak and banks adjust their offerings.

🔻Biggest Fallers

Internal Diagnostics fell 6.1% after reporting full-year earnings yesterday, revealing a mix of weak performance in the year's first half and a significantly stronger second half. The Group's EBITDA margins improved by 1.7% to 20.2% for the second half of FY23, showcasing the operational leverage of the business.

Operating NPAT decreased by 17.6% to $17.8 million, and Operating diluted EPS dropped by 26.0% to 7.6 cents.

The Group faced challenges in 1H FY23 due to a slow recovery in patient volumes, inflation-driven labour costs, and higher interest funding costs. The second half of FY23 saw better results due to stronger organic revenue growth in Australia and New Zealand. Despite these improvements, the company's dividend for FY23 decreased.

Adbri saw its share price fall 14.6% despite a 14% revenue rise, reaching $926.4 million. Underlying EBITDA increased by 20.9% from last year to $149.1 million. There were some negatives from the report which may have contributed to the falling share price:

Dividend Decision: The Board opted not to announce an interim dividend. The capital necessities for the Kwinana Upgrade influenced this decision.

Capital Expenditure: Adbri's capital expenditure significantly increased from $115.1 million in 1H22 to $173.0 million in 1H23. A substantial portion of this, $83.4 million, was allocated for the Kwinana Upgrade project.

Net Debt: The company's net debt escalated by $96.5 million during the reporting period to $672.9 million.

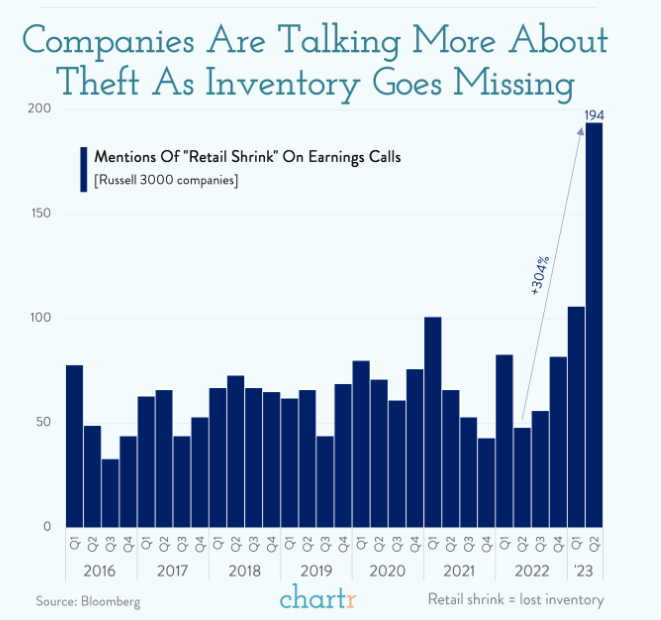

Chart of The Day

Companies Are Talking

More About Theft

We’ve heard from several companies in Australia and overseas about the rise in “Retail Shrink” driven by more store theft.

In fact, a lot more companies are talking about it than normal 👇

Usually, a rise like this is reserved for topics like A.I. and Web3, not inventory going missing!

Like seeing these type of charts?

Subscribe to Chartr to get insights like these delivered daily.

Deep Dive

Zip's Strong FY23 Performance Paves the Way for Continued Growth

Zip Co Limited announced its full-year results for FY23, ending June 30 2023. Here are the key highlights:

Record Group Revenue of $693.2m, marking a 16.1% increase YoY.

Transaction volume (TTV) reached $8.9b, up by 7.0% YoY, with transaction numbers at 72.7m, an 8.3% YoY growth.

Net bad debts were 2.0% of TTV, a decrease from 2.7% in FY22.

Cash gross profit was reported at $250.6m, a 20.4% YoY increase.

Merchant numbers grew to 72.3k, marking an 11.2% YoY increase.

The core business had 6.2m Active Customers.

Core Cash EBTDA of ($48.2m) showed a 54.8% improvement in 2H23 compared to 1H23, surpassing the guidance.

Zip underwent a strategic review of its global operations, leading to the divestment of several non-core businesses.

The companies’ U.S. and N.Z. operations exited FY23 with positive cash EBTDA on a monthly basis. The Australian business has maintained this positive trend for five years.

Zip's CEO, Cynthia Scott, highlighted the company's strong performance over the past year, driven by record transaction volumes, revenue growth, and improved credit losses.

Zip introduced new merchant partnerships in Australia with major brands like eBay AU, Webjet, and Uber. The company reset its business strategy in the U.S., resulting in positive cash EBTDA and improved bad debt performance.

Strategically, Zip said it focused on growth in core markets, improved unit economics, cost base optimisation, and strengthening its balance sheet. The company remains committed to responsible lending, sustainability, and delivering value to its stakeholders.

A Little Extra

📉 Going Down?

Top 10 shorted stocks on the ASX - as of August 23

Flight Centre (FLT) - 10.39%

Syrah Resources (SYR) - 9.20%

Elders Limited (ELD) - 8.82%

Pilbara Resources (PLS) - 8.79%

Lake Resources (LKE) - 8.62%

IDP Education (IEL) - 8.60%

JB Hi-Fi (JBH) - 8.47%

Brainchip (BRN) - 8.00%

Imugene (IMU) - 7.72%

Core Lithium (CXO) - 7.46%

📊Broker Ratings

What do the brokers have to say?

Australian Vintage (AVG) - Upgrade to Add from Hold (Morgans)

Codan (CDA) - Upgraded to Outperform from Neutral (Macquarie)

Imdex (IMD) - Downgrade to Hold from Buy (Bell Potter)

Liberty Financial (LFG) Downgraded to Neutral from Buy (Citi)

Liberty Financial (LFG) Downgraded to Neutral from Outperform (Macquarie)

💲Dividends

Companies trading ex-dividend today

HMC Capital (HMC) - $0.06

Mitchell Services (MSV) -$0.36

Worley (WOR) - $0.25

Bega Cheese (BGA) - $3.01

The Lottery Corporation (TLC) - $0.06

Regal Partners (RPL) - $0.05

Pengana Capital Group (PCG) - $0.01

Ma Financial Group (MCF) - $0.06

Insurance Australia Group (IAG) - $0.09

Sunland Group (SDG) - $0.11 1

📅 Economic Calendar

Data to keep an eye on this week

DISCLAIMER: None of the information provided in this newsletter should be constituted as financial advice. This newsletter is strictly for educational purposes only. It should not be taken as investment advice or a solicitation to buy or sell assets or make financial decisions. Please do your research.