- Equity Espresso

- Posts

- Colonel's Crunch & Bell's Bounce: Collins Serves Up Spicy Earnings

Colonel's Crunch & Bell's Bounce: Collins Serves Up Spicy Earnings

Good Evening,

Welcome to Equity Espresso’s Daily Market Recap.

There was green across the boards today, with the ASX200 index recording its one-day session since mid-May, rising by 105.1 pts. or 1.4% to 7,838.80. The major Aussie index is now only 72 points away from its record high of 7,910.50.

All major sectors finished the day higher, led by gains in Energy (+2.23%), Materials (+1.83%) and Real Estate (+1.66%). Brent Crude prices hit a two-month high, trading above US$85.50/bbl on expectations of solid demand from the U.S. Woodside Energy (+3.67%) was the big mover in the Energy sector, followed by Ampol (+1.93%) and Santos (+1.73%).

Iron Ore futures dipped on Tuesday, but that didn’t stop BHP Group (+2.10%), Fortescue (+1.93%) and Rio Tinto (+2.07%) from gaining ground. In the REIT sector, GPT Group (+4.54%), Dexus (+3.61%) and Stockland (+2.96%) were some of the best performers.

In company news:

Paladin Energy (-5.14%) shares fell after it announced a planned takeover of Candaion company Fission Uranium in a $1.3 billion deal

Healius (+0.33%) provided a trading update to the market today, lowering its FY24 underlying EBIT forecast to between $60 million and $65 million. The company had previously provided EBIT guidance of $70 million—$80 million.

Synlait Milk (-10.17%) says it will be insolvent if shareholders reject a $NZ130 million loan.

Collins Foods (+7.30%) saw a lift today after reporting a 10.4% lift in full-year revenue to $1,488.9 million, while NPAT was $76.7 million—up from $12.7 million in FY23. The growth came despite slowing sales from its KFC Australia business (+6.6%), with the company saying customers have been cutting back spending during May and June.

ASX Indices | ASX Sector Performance |

Wall Street

The Dow Jones (+0.66%) was the big mover on Monday, reaching a one-month high, while the NASDAQ (-1.09%) took a sharp fall after Nvidia (-6.68%) fell for the third straight session. Shares in the chipmaker have their biggest one-day fall since April, with the share price down from the lofty heights of $135.64 to $118.11.

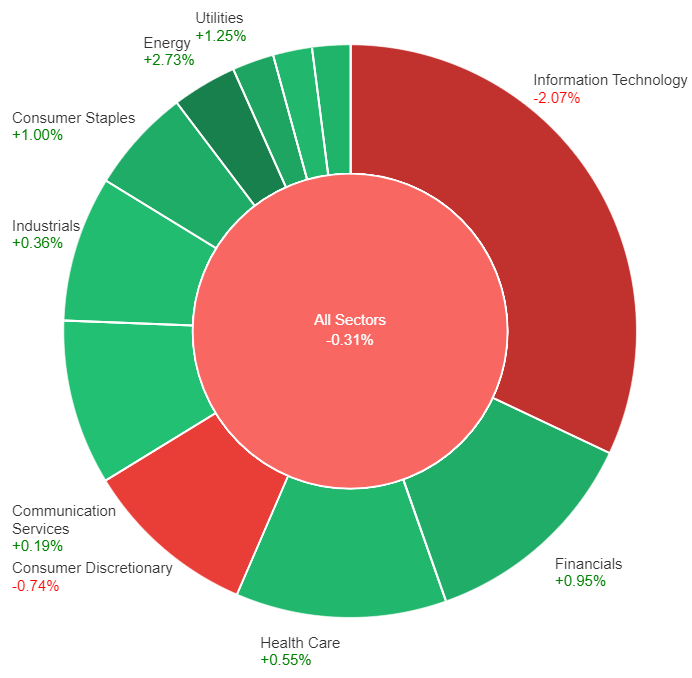

Nine of the 11 major sectors rose despite the S&P 500 (-0.31%) falling, with Technology (-2.07%) stocks driving the index lower. Energy (+2.73%) was the best performer thanks to rising oil prices, followed by the Utilities (+1.25%) and Consumer Staples (+1.00%) sectors.

Inspire Medical Systems (-16.07%) saw its share price crunched, with the sleep apnea device manufacturer falling victim to the news Eli Lilly’s weight loss drug tirzepatide reduced the severity of the condition. RXO (+22.96%) shares jumped 22.96% after the freight company said it struck a deal to buy Coyote Logistics from UPS for more than $1 billion. UPS was up 1.5%.

U.S. Indices | Fear & Greed Index |

S&P500 Sector Performance

Economic Data

Australia’s Consumer Sentiment increased by 1.7% to a 3-month high of 83.6 pts. during June after a 0.3% fall in May. The mark remains well down from the neutral level of 100.

Malaysia’s Annual inflation rose to 2.0% in May, an increase from the previous month's 1.8% and also above the forecast of 1.9%.

Sponsor

Copper is up 70%

Discover the Zonia Advantage

World Copper’s (OTC: WCUFF | TSX.V: WCU) Zonia project is leading the industry in next-generation copper production, and is poised to meet surging global copper demand. By leveraging simple metallurgy and proven SX-EW processing in a prime location, Zonia stands to achieve cash flow up to 4x faster than typical projects.

World Copper is one of the very few projects that can start producing before the end of this decade, just in time to capture the upcoming copper price surge.

Quick Singles

🌎️ Around The Globe

CDK Global, a software company powering over 15,000 automotive retailers, experienced two cyberattacks last week affecting dealerships across North America. Hackers demanded tens of millions in payment, and it’s unknown if CDK Global plans to pay the ransom.

Meta has discussed integrating its generative AI model into Apple's iPhone AI system, according to the Wall Street Journal. The iPhone maker is also expected to discuss partnerships with other AI companies in different regions.

The U.S. FDA has authorised four menthol e-cigarettes from vaping brand Njoy, acknowledging that vaping flavours can reduce the harms of traditional tobacco smoking.

Nvidia has signed a deal with Qatari telecoms group Ooredoo to deploy its AI technology in data centres across five Middle Eastern countries.

TikTok says it proposed to the U.S. government the ability to shut down the platform to address lawmakers' concerns about data protection and national security. The company disclosed the offer of a "kill switch," made in 2022, as it launched its legal battle against legislation that would ban the app in the United States unless parent company ByteDance sells it.

Markets

ASX Company Movers

Commodity Prices

Bonds

Forex

Global Health Check

What The?

| An unnamed man in England is suing Apple for £5 million because his wife found messages he was sending to sex workers via the family iMac. His lawsuit claims that iMessage doesn't clearly state that deleting a message on the iPhone doesn't delete the message everywhere else. |

Newsletter Recommendation

|

ETF Prices

🔍️ ETF Watch

Want to see how one of your ETFs compares to the rest?

Reply to this e-mail and tell us an ETF or two you want to be included in the tables below.

Australian Index

Australian Sectors

Global Indices & Sectors

Global Strategy

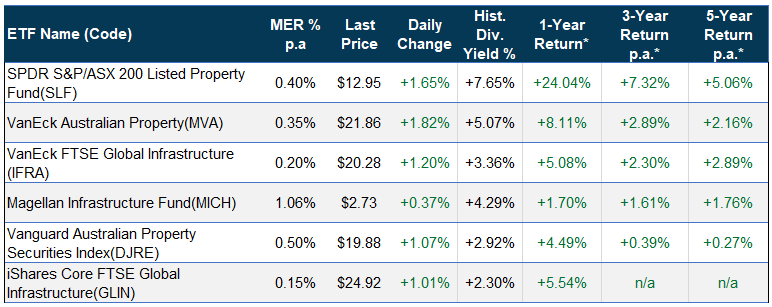

Property & Infrastructure

Fixed Income

Mixed Assets

*1-year, 3-year and 5-year returns are calculated as of 31 May 2024.

The Last Word

How are we doing?

We always love hearing from our readers and are constantly seeking feedback.

How are we doing with Equity Espresso?

Is there anything you’d like to see more of or less of?

Which aspects of the newsletter do you enjoy the most?

Hit reply and say hello - or leave us feedback in the poll below:

If you enjoyed this newsletter, forward this e-mail to a friend.

If you’re that friend, subscribe here.

DISCLAIMER: Please note that the information provided in this newsletter is for educational purposes only and should not be considered financial advice. It is not intended to encourage you to buy/sell assets or make economic decisions. We strongly recommend conducting your research before making any investment.