- Equity Espresso

- Posts

- Farewell to a Financial Legend: Charlie Munger's Legacy and Lessons in Investments

Farewell to a Financial Legend: Charlie Munger's Legacy and Lessons in Investments

Good Evening,

Welcome to Equity Espresso’s Daily Recap. A sad day for the investing world, with Berkshire Hathaway Vice-Chairman Charlie Munger passing away on Tuesday at age 99. A sharp drop in inflation for October sent markets higher. Let’s jump in.

Didn’t get this email directly? Join for Free

The Recap

Markets finished the day higher on Tuesday but gave back some early gains, with the ASX 200 index closing the day +0.29% higher to finish at 7,035.30. Interest rate-sensitive stocks rose after today’s better-than-expected CPI read for October, with investors betting that the RBA will keep rates on hold when it meets on December 5. Technology (+2.08%), Healthcare (+1.82%) and Discretionary (+1.62%) led the way among the six sectors that rose. While Energy (-0.76%) and Utilities (-0.60%) finished lower

The world of investing has lost a legendary figure, Charlie Munger. The Vice-chairman of Berkshire Hathaway passed away at the age of 99 on Tuesday. Charlie joined Berkshire Hathaway in 1978 as its new Vice President, forming one of the most iconic investing duos the world has ever seen with Warren Buffett, also known as the Oracle of Omaha. Charlie went from earning 20 cents an hour working for Warren Buffett's grandfather during the Great Depression to spending over four decades as Buffett's second-in-command and foil atop Berkshire Hathaway. Munger played a crucial role in helping Buffett develop a philosophy of investing in companies for the long term.

We collated some of Charlie’s most famous quotes and human psychology philosophies, which you’ll find later in the newsletter.

Australia’s October CPI came in at 4.9%, below estimates of 5.2% and below September’s mark of 5.6%, as inflation growth continues to fall. Falling clothes prices and easing supermarket costs were the catalysts for the sharper-than-expected fall. The most significant contributors to the October annual increase were Housing (+6.1%), Food and non-alcoholic beverages (+5.3%) and Transport (+5.9%). ⬇️

|  |

Economic Data

Australia’s CPI for October fell to an annualised growth of 4.9%, from 5.6% in September and below estimates of 5.2%.

Total Construction Work in Australia during Q3 rose 1.3% in the September quarter, a large jump from the 0.4% gain in the previous quarter, which was also the consensus estimate.

The Reserve Bank of New Zealand (RBNZ) left rates on hold at 5.50% for the fourth month running during today's November meeting but said that inflation remains too high.

The National Home Price Index in the U.S. increased 0.7% month-over-month to reach a record high of 311.18 points in September.

U.S. Consumer Confidence rose to 102.0 for November, up from 99.1 in the previous month and above expectations of 101.0

U.S. Consumer Sentiment was revised to 61.3 in November from a preliminary figure of 60.4 but has remained at its lowest point since May.

Wall Street

U.S. stocks ended with modest gains on Tuesday, despite losing momentum as the day wore on, with the NASDAQ (+0.29%) leading the key indices after upbeat consumer data provided markets some imputes.

Workday stock added more than 6% after third-quarter results that beat Wall Street estimates. Workday reported adjusted earnings of $1.53 per share on $1.87 billion in revenue, beating analysts expectations of $1.41 in earnings per share and $1.85 billion in revenue. NetApp stock climbed by 10% after a beat on revenue and earnings in its Q2 report, reporting adjusted earnings of $1.58 per share on $1.56 billion in revenue vs. estimates of $1.39 per share and $1.53 billion in revenue.

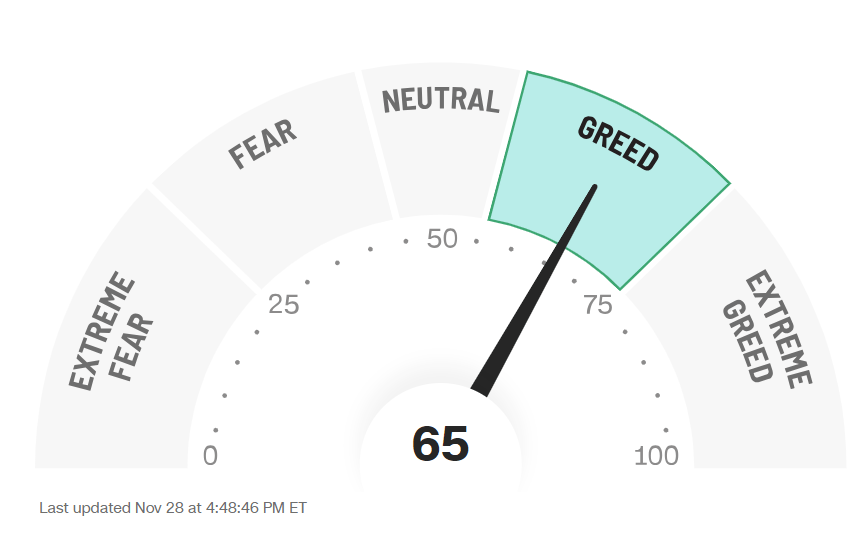

| Fear and Greed Index |

Outlook

October Building Approval data and Private Capital Expenditure for Q3 will be reported in Australia, with Chinese PMI data another key item to watch for tomorrow. A busy night in the U.S., with Q3 GDP, Trade Data and Crude Oil inventories all being reported.

Earnings from Thorn Group are expected to be released tomorrow in Australia, while in the U.S., Snowflake, Synopsys, Salesforce, Dollar Tree and Okta are all reporting earnings overnight.

Futures markets are higher this afternoon, with the S&P 500 (+0.13%) and NASDAQ (+0.13%) in the green.

Sponsor

Discover Koyfin:

The Investor's Ultimate Toolbox

The only Financial Software Tool you will ever need - get 20% off as an Equity Espresso Subscriber!

From precise charts to comprehensive transcripts, we've got it all covered on Koyfin. Why settle for the ordinary when you can access data beyond your wildest dreams?

Empower your investment strategies, stay ahead of the curve, and easily make informed decisions.

Whether you're a seasoned investor or just starting,

Koyfin is your go-to platform for everything related to finance.

Quick Singles

🪃 Local News

Arcturus Therapeutics and CSL announced that Japan's Ministry of Health has approved their ARCT-154 COVID-19 vaccine, marking the world's first regulatory clearance of a self-amplifying mRNA.

Brookfield has reportedly informed its co-investors that it may consider relisting Origin Energy on the stock exchange within five years. The shorter timeframe has raised concerns among shareholders, who worry that it may not provide enough time to invest the $20 billion to $30 billion that Brookfield has publicly stated it plans to invest.

The Federal Government will ban single-use, disposable vapes from entering Australia from January 1. The new measures won’t prevent medically-prescribed vapes from being accessed. Reusable vapes imported for non-medical use won't be allowed from March 2024.

After a landmark high court ruling, Victorians who paid the state's electric vehicle tax will receive a refund plus interest in the upcoming months. The Labor government introduced a road-user charge for zero- and low-emission vehicles to collect road funds from electric vehicle drivers, who are not subjected to petrol excise. This charge raised $3.9 million in the last financial year.

🌏 Around The Globe

The price of cocoa futures has increased significantly, reaching the $4,300 per tonne mark, last seen in September 1977. So far this year, the price has risen by about 65% due to ongoing concerns about the tight supply from the top producers, the Ivory Coast and Ghana.

According to Reuters sources, OPEC+ talks are reportedly challenging, raising the possibility of a rollover of previous agreements rather than further production cuts. OPEC+ is set to meet this Thursday to decide oil output levels for 2024.

Tesla filed a lawsuit against Sweden’s transportation agency and its postal service after workers refused to deliver their license plates in solidarity with striking Tesla mechanics.

Eli Lilly’s diabetes drug Mounjaro performed better for weight loss than Novo Nordisk’s Ozempic in a real-world study of overweight or obese adults.

Bumble and Match are suspending ads from Instagram after a WSJ investigation found they appeared beside explicit content, some featuring children.

Starting this week, Google will be permanently deleting inactive accounts and all their data and contents.

Markets

ASX Company Movers

Commodity Prices

Bond Prices

ETF Watch

ASX News

🗞️ Company Announcements

4DMedical (4DX) has signed a MoU with healthcare giant Philips to commercialise its’ XV Technology. The initial focus of the partnership will be to offer 4D lung imaging as a critical screening solution for Veterans exposed to burn pits.

Codan (CDA) is set to buy U.S. Tech company Wave Central in a deal valued at $21.3 million through Codan’s subsidiary Domo Broadcast, with the agreement made up of $9.1 million in cash with the remainder paid if specific earn-out targets are achieved. Wave Central integrates wireless broadcast equipment with Domo Broadcast’s sports, cinema and broadcast technology.

EML Payments (EML) provided an update on its strategic review, saying it will focus on business lines demonstrating profitability and positive cash flow. These businesses include Gifting, Australia General Purpose Reloadable (GPR) and UK GPR. EML said it had received expressions of interest for its Sentenial business.

EROAD (ERD) reported a marginal uptick in half-year reported revenue of 4% to $88.9 million, while EBIT reduced to $0.4 million from $1.0 million in the pcp. Free Cash Flow improved to an outflow of $0.2 million from $21.7 million. EROAD said it will start yielding positive cash flow on a consistent basis in the latter part of 2024.

Fisher & Paykel Healthcare (FPH) reported half-year revenue of $803.7 million - a 16% increase from the pcp. while Net profit rose by 12% to $107.3 million - or 22% in constant currency. Fisher & Paykel’s Hospital product group, which includes humidification products, increased by 11% from the pcp. with the company saying it continues to see strong demand for hospital consumables across the product portfolio.

Healius (HLS) shares rose today after super funds Australian Retirement Trust (9.51% to 11.49%) and Host Super (6.17% to 7.97%) increased their stake in the company.

Harvey Norman's (HVN) total sales so far in the new financial to November 25 are down 7.8% from the pcp. with comparable store sales decreasing by 8.7%. This is despite an appreciation in the Euro and British pound

Temple & Webster (TPW) said sales in FY24 had started strongly, with a 23% year-on-year growth for the period ending November 27, with Q2 up 42%. Over the four days, the company’s Black Friday and Cyber Monday sales rose 101% from last year to $17.4 million.

Social Media

📱 Post of The Day

👑 Charlie Munger Appreciation

We collated some of Charlie Munger’s most famous quotes:

“I think every time you see the word EBITDA, you should substitute the words ‘bullsh*t earnings.”

“All I want to know is where I'm going to die, so I'll never go there.”

"The best thing a human being can do is to help another human being know more."

"The best armour of old age is a well-spent life preceding it."

"If I can be optimistic when I'm nearly dead, surely the rest of you can handle a little inflation"

"Lifelong learning is paramount to long-term success."

RIP Charlie Munger

I'll always remember him for this talk he gave on the Psychology of Human Misjudgement.

If you have an hour, it's well worth the time:

— Brian Feroldi (@BrianFeroldi)

10:38 PM • Nov 28, 2023

Broker Research

Playside Studios

Code: PLY | Market Cap: $211.3m | Current Price: $0.52

Price Target: $0.80 | Sector: Information Technology | Broker: Shaw & Partners

Overview

PlaySide Studios Limited (ASX: PLY) develops and sells mobile, PC, and console video games in Australia. The company provides titles in various categories, including self-published games based on original intellectual property. The company held its AGM last Wednesday.

Highlights

Playside upgraded its FY24 guidance by ~10% at its AGM, now expected to be in the range of $55.0 million - $60.0 million, from $50 million - $55.0 million prior. This implies revenue growth of ~50% YoY.

Broker sees a favourable risk/reward on the current share price, with a pipeline of new games expected to launch through FY25, which is not yet materially impacting revenue.

Management again reiterated that its “Dumb Ways” franchise is far from mature and “still in the early days of its journey”. Dumb Ways mobile titles have seen well over 20m downloads this calendar year; it is one of the leading gaming accounts on TikTok, and its content has been viewed billions of times.

Recommendation

The broker reiterates its Buy rating with a price target of $0.80; it trades on an EV/Revenue multiple of 2.7x, which the broker believes is cheap. The broker has increased its FY24 revenue expectations by 10%, in line with the company’s revised guidance. The broker forecasts EBITDA to be between $5.7 million and $4.2 million.

Newsletter Recommendation

One-click subscribe

|

Daily Quiz

❓️ Test Your Knowledge

Yesterdays Question. The ASX Tech sector has been the best performer of 2023; which of these companies has the highest 52-week gain?

Answer: Xero. Xero shares have been the best performer of the large tech stocks on the ASX, climbing by 47% in the last year after a big underperformance in 2022, with 24% of respondents answering this question correctly. NextDC was the most popular answer, which has risen by 31%. Life360 (+28%) and Altium (+17%) trail both companies.

A Little Extra

📉 Going Down?

Top-10 shorted stocks on the ASX - as of November 23

Weekly Movers ⬆️

| Weekly Movers ⬇️

|

📊 Broker Ratings

What do the brokers have to say?

IDP Education (IEL) - Upgrade to Buy from Hold (Bell Potter)

👨💼 Director Transactions

What are the insiders doing? (On-market trade only)

DISCLAIMER: None of the information provided in this newsletter should be constituted as financial advice. This newsletter is strictly for educational purposes only. It should not be taken as investment advice or a solicitation to buy or sell assets or make financial decisions. Please do your research.