- Equity Espresso

- Posts

- Best Week in Five: Gold Glitters & Tech Lifts

Best Week in Five: Gold Glitters & Tech Lifts

Good Evening,

Welcome to Equity Espresso’s Market Recap.

The Australian sharemarket finished higher on Friday, with the S&P/ASX200 index edged up 0.5%, closing at 8,532.3 points, marking its largest weekly gain in five weeks, driven by strength across Technology (+1.15%), Materials (+1.09%) and Real Estate (+1.08%) sectors. Goodman Group (+1.42%) advanced 1.4%, while tech stocks rallied on positive Nasdaq futures, with Xero (+2.50%) gaining 2.5% and Technology One up 1.61%.

Gold miners benefited from bullion reaching a record high of $US2,796 per ounce, with Newmont rising 3.83%, De Grey Mining up 3.43%, and Bellevue Gold climbing 3.73%.

The Utilities (-4.15%) sector was the only laggard, as Origin Energy (-6.70%) fell after reducing its FY25 LNG production outlook.

The ASX achieved its strongest monthly performance since July, boosted by optimistic sentiment and lower December inflation data, leading major banks to predict a rate cut by the RBA when it meets on February 17-18.

Company News

Capricorn Metals (+1.18%) has purchased Top Iron's Mummaloo mining project for $3.5 million, adding 219 square km of exploration territory near its Mt Gibson Gold Project in W.A. The company paid an initial $100,000 deposit, with the balance due in February.

Lendlease (+2.04%) has agreed to sell its Capella Capital infrastructure business to Sojitz Corporation for $235 million, expecting to generate $70 million in after-tax operating profit in FY25 as part of its ongoing strategy to streamline operations.

Magellan Financial Group (-7.65%) shares fell following the announcement of veteran infrastructure head Gerald Stack's departure after 18 years, during which he managed $16.6 billion in infrastructure assets and maintained client funds.

Origin Energy (-6.70%) reduced its FY25 production forecast for Australia Pacific LNG to 670-690 petajoules (PJ), down from 685-710 PJ, due to underperforming well optimisation and operational issues.

ResMed (-0.79%) exceeded Q2 expectations with revenue rising 10% to $US1.3 billion and net income soaring 65% to $US344.6 million, driven by strong sleep device and mask sales despite concerns about weight-loss drugs potentially reducing demand.

ASX Indices | ASX Sector Performance |

Wall Street

U.S. markets finished higher in a volatile session Thursday, with the Dow gaining 0.38%, the S&P 500 rising 0.53% and the Nasdaq added 0.25%. The gains came despite President Trump announcing 25% tariffs on Mexican and Canadian imports and Microsoft's 6.2% drop following disappointing cloud growth forecasts.

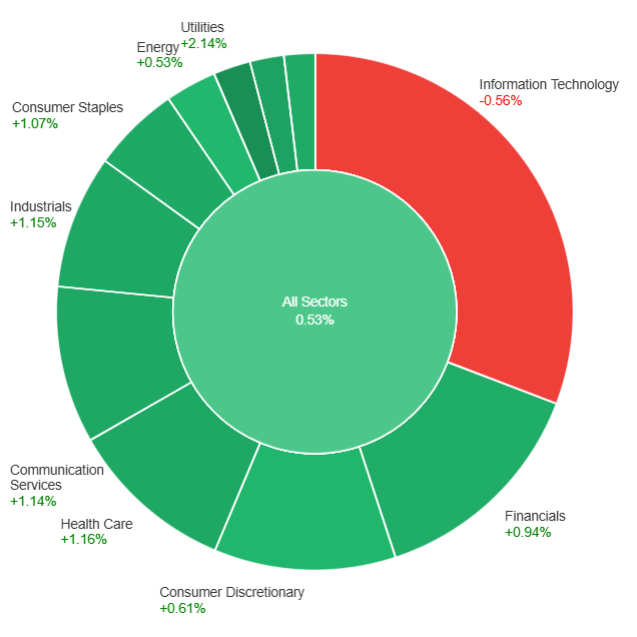

All S&P 500 sectors advanced except Technology (-0.56%), with Communication Services (+1.14%) and Financials (+0.94%) reaching record highs. Utilities (+2.14%) led the gains, highlighted by Vistra's (+13.59%) double-digit rebound following Monday's DeepSeek-related selloff.

Microsoft (-6.18%) shares fell after providing lower-than-expected revenue guidance of $67.7-68.7 billion for Q3, despite beating Q2 earnings expectations. The decline was primarily driven by slowing growth in its Azure cloud services. Caterpillar (-4.64%) shares fell despite beating earnings estimates at $5.14 per share, as fourth-quarter revenue of $16.22 billion fell short of analysts' expected $16.39 billion. IBM (+12.96%) shares surged after reporting Q4 earnings of $3.92 per share, beating analysts' expectations of $3.78, while revenue met forecasts at $17.55 billion. The company projects 5% currency-adjusted growth and $13.5 billion in free cash flow for 2025.

U.S. Indices | Fear & Greed Index |

S&P500 Sector Performance

Economic Data

Australia's Producer Price index rose 0.8% quarter-on-quarter in Q4 2024, missing market expectations and Q3’s figure of 1.0%.

U.S. GDP expanded by an annualised 2.3% in Q4 2024, the slowest growth in three quarters, down from 3.1% in Q3 and below forecasts of 2.6% (advanced estimates).

Japan’s Unemployment rate was 2.4% in December 2024, below the market consensus and November’s figure of 2.5%

Sponsor

Here’s Why Over 4 Million Professionals Read Morning Brew

Business news explained in plain English

Straight facts, zero fluff, & plenty of puns

100% free

Quick Singles

🌎️ Around The Globe

Alibaba Cloud says its new AI model, Qwen2.5-Max, outperforms DeepSeek's V3 and Meta's Llama 3.1 on various benchmarks while matching the capabilities of GPT-4 and Claude 3.5 Sonnet.

President Trump has reportedly signed a settlement agreement with Meta resolving his lawsuit over his account suspension following the January 6 attack on the Capital, with the company agreeing to pay approximately $25 million, including $22 million toward Trump's presidential library.

OpenAI has accused Chinese startup DeepSeek of using its models to develop competing chatbots, with Microsoft reportedly investigating potential unauthorised use of OpenAI's data.

Starbucks plans to cut approximately 30% of its food and beverage menu items to streamline operations and reduce wait times. CEO Brian Niccol announced the simplification strategy during Tuesday's earnings call, addressing concerns about menu complexity affecting customer service.

Spirit Airlines has rejected Frontier's $400 million merger proposal despite the potential benefits of creating a stronger low-cost competitor to major carriers. Spirit deemed the offer financially insufficient and poorly timed while navigating its bankruptcy proceedings.

Tesla announced plans to launch a paid robotaxi service in Austin this June, using an upcoming 'unsupervised' version of Full Self-Driving software. While the software will be available to Tesla owners in various U.S. regions this year, private vehicles won't join the ride-hailing fleet until 2025.

Markets

ASX Company Movers

Commodity Prices

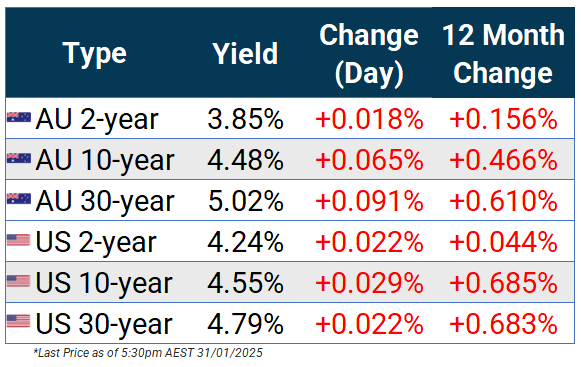

Bonds

Forex

Global Health Check

ETF Prices

🔍️ ETF Watch

Want to see how one of your ETFs compares to the rest?

Please reply to this e-mail and tell us an ETF or two you want included in the tables below.

Australian Index

Australian Sectors

Global Indices & Sectors

Global Strategy

Property & Infrastructure

Fixed Income

Mixed Assets

Geared

*1-year, 3-year and 5-year returns are calculated as of December 31, 2024.

The Last Word

How are we doing?

We always love hearing from our readers and are constantly seeking feedback.

How are we doing with Equity Espresso?

Is there anything you’d like to see more of or less of?

Which aspects of the newsletter do you enjoy the most?

Hit reply and say hello - or leave us feedback in the poll below:

If you enjoyed this newsletter, forward this e-mail to a friend.

If you’re that friend, subscribe here.

DISCLAIMER: Please note that the information provided in this newsletter is for educational purposes only and should not be considered financial advice. It is not intended to encourage you to buy/sell assets or make economic decisions. We strongly recommend conducting your research before making any investment.