- Equity Espresso

- Posts

- Gold Mines, Martial Law & Empty Shelves: Your Wild Week in Review

Gold Mines, Martial Law & Empty Shelves: Your Wild Week in Review

Hello!

We hope everyone is enjoying their weekend so far!

We’re back with six of this week's biggest local and global stories that shaped markets.

Plus, we're spotlighting the week's biggest movers on the ASX.

We'd love to hear your thoughts on this new format. Enjoy!

#1 Northern Star Expands WA Gold Portfolio

We started the week with a bang as Northern Star Resources revealed plans to acquire De Grey Mining in a $5 billion deal, marking one of the largest acquisitions for an undeveloped mine. The transaction will be executed through a share-exchange scheme where De Grey shareholders will receive 0.119 new Northern Star shares for each De Grey share, equivalent to AU$2.08 per share.

The centrepiece of this acquisition is De Grey's Hemi gold project, located in Kariyarra lands in Western Australia. The project boasts an impressive resource estimate of 10.5 million ounces of gold and remains open for further exploration in multiple directions. De Grey has already secured a $150 million loan from the Northern Australia Infrastructure Facility and completed a definitive feasibility study for the project in September 2023.

Northern Star views Hemi as a strategic addition to its portfolio, citing its potential to become a low-cost, long-life, and large-scale gold mine in Western Australia's Tier-1 jurisdiction. The company plans to focus on finalising project approvals and optimising development and mine planning, with the acquisition scheme expected to be implemented in late April or May 2025.

#2 Political Crises Rock Asia and Europe

A mind-boggling week in government

First, President Yoon Suk Yeol is facing mounting pressure to resign in South Korea following his failed attempt to impose martial law on Tuesday, which sparked a constitutional crisis and nationwide protests. The declaration, which lasted only six hours before being reversed, marked the first time military rule had been attempted in the democratic nation since 1980. President Yoon cited threats from "North Korean communist forces" and accused the opposition Democratic Party of Korea (DP) of being "anti-state forces" attempting to "overthrow free democracy."

The move backfired spectacularly, with lawmakers swiftly convening to vote against the measure. The incident has triggered multiple criminal investigations, with prosecutors, police, and anti-corruption officials launching probes into Yoon, as well as several cabinet ministers and military commanders. They face potential charges of insurrection and abuse of power.

France’s government is in turmoil this week after the French National Assembly voted to remove Prime Minister Michel Barnier from office on Wednesday, marking the country's first successful no-confidence vote since 1962.

Barnier's downfall came just three months into his tenure - making him the shortest-serving prime minister in French history - after he attempted to bypass Parliament to pass a controversial 2025 budget containing approximately $63 billion in spending cuts and tax increases.

The political crisis stems from Macron's decision to dissolve Parliament in June following his centrist party's defeat in European elections. The resulting snap elections left Parliament divided into three roughly equal blocs - left, centre, and right/far right - with no clear majority, creating an unstable political environment.

#3 Bitcoin Surges to $100k

Bitcoin hit new heights this week, reaching US$100,000 on Wednesday. The cryptocurrency continues its November surge following former President Donald Trump's victory in the 2024 presidential election and his promises to make the United States a global cryptocurrency leader.

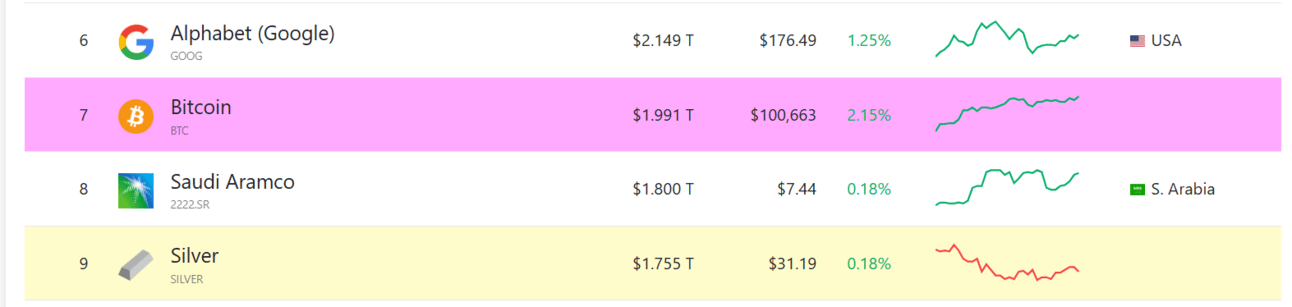

Bitcoin's total market value flew past $2 trillion during parts of this week as the cryptocurrency continued to break records. The digital asset now ranks as the seventh-largest asset by market capitalisation, overtaking silver. However, it still trails far behind gold, which remains the undisputed leader with a market cap of $17.684 trillion.

Trump's announcement of Paul Atkins as his nominee for SEC Chairman has further fueled Bitcoins rally. Atkins, a former SEC commissioner and co-chair of Token Alliance, is expected to implement more accommodating crypto regulations once Chairman Gary Gensler steps down on Inauguration Day.

#4 CBA Backtracks on Controversial $3 Withdrawal Fee

Commonwealth Bank (CBA) has postponed its controversial plan to charge customers $3 for over-the-counter cash withdrawals following public backlash and government criticism. The fee was set to be implemented from January 6, 2025, as part of the bank's transition from 'Complete Access' to 'Smart Access' accounts.

Finance Minister Katy Gallagher publicly opposed the move, calling it "really hard" on customers who prefer branch services.

The proposed changes would have affected customers withdrawing at bank branches, post offices, or over the phone, though the monthly account fee would have decreased from $6 to $4. CBA claimed 90% of affected customers would have been better off or unaffected by the changes.

CBA paused the account migration and plans to contact potentially affected customers over the next six months to discuss more appropriate banking options.

#5 Australian Economy Shows Signs of Slowdown

Australia's economy grew by a modest 0.3% in the September quarter of 2024, marking its twelfth consecutive quarter of growth but falling short of market expectations of 0.4%. The annual growth rate slowed to 0.8%, its lowest since late 2020.

Public sector spending continues to be the main growth driver, with government investment reaching record levels, rising 6.3% during the quarter. This was primarily fueled by increased defence equipment imports and investments in hospitals, roads, and renewable energy projects. Government spending rose by 1.4% during the quarter.

GDP per capita declined for the seventh straight quarter, dropping 0.3%. Household spending remained flat following a 0.3% decline in the previous quarter, though the household savings ratio improved to 3.2% from 2.4%.

#6 Woolworths Workers Strike Over Pay and Safety

Woolworths faces nationwide product shortages as 1,500 warehouse workers enter their second week of industrial action at four distribution centres across Victoria and NSW. The strike centres on workers' demands for improved safety conditions and significant wage increases, including an immediate 25% pay rise followed by 15% increases in their agreement's second and third years.

The industrial action has already cost Woolworths $50 million in lost sales during the crucial pre-Christmas trading period. With distribution centres paralysed, supermarket shelves across multiple states remain empty. CEO Amanda Bardwell apologised to frustrated customers this week but maintained that the company had "a really good offer on the table."

The situation escalated further when the Fair Work Commission ruled that the United Workers Union had engaged in "unlawful picketing" at distribution centres, particularly at the key Dandenong facility in Melbourne. Deputy President Gerard Boyce ordered the removal of picket lines, finding that the union's actions had improperly hindered warehouse access and affected third parties, including employees wanting to return to work and transport operators.

Sponsor

Why This Gold Stock is Our Top Trade of the Month

Tiny Float: Just 19 million shares outstanding with strong insider ownership.

Stock Performance: Up 200% in recent years and primed for the next breakout.

Ideal Timing: Upcoming catalysts + gold pullback = prime opportunity.

This is a sponsored advertisement on behalf of Four Nines Gold. Past performance does not guarantee future results. Investing involves risk. View the full disclaimer here: https://shorturl.at/73AF8

💰️ Weekly Movers & Shakers 👇️

Some of the ASX companies that saw sharp moves this week ⬇️

The Winners

Company | Share Price | Weekly Mvmt. |

|---|---|---|

1. De Grey Mining (DEG) | $1.91 | +25.66% |

2. Temple & Webster Group (TPW) | $13.36 | +13.12% |

3. Gold Road Resources (GOR) | $2.09 | +12.06% |

4. Spartan Resources (SPR) | $1.58 | +12.05% |

5. Ramelius Resources (RMS) | $2.27 | +8.09% |

De Grey Mining received a takeover offer from Northern Star Resources. The company plans to buy De Grey for $5 billion or $2.08 per share.

Temple & Webster Group's share price sharply rose this week despite no price-sensitive news. The online retailer has recorded ten consecutive days of gains, starting on November 25. Discretionary stocks were some of the best performers on the week, with the sector rising 1.74%

Gold Road Resources saw a lift in its share price curiosity of the Northern Star/De Grey Mining Deal. Gold Road is a major shareholder of De Grey, with an approximate 17.85% ownership as of August.

Spartan Resources secured $220 million through an institutional placement on Wednesday, with major shareholder Ramelius Resources increasing its stake to 19.9%. The funds will support the restart of operations at Dalgaranga Gold Project, including underground development, infrastructure improvements, and expanded drilling programs.

Ramelius Resources gained ground after it confirmed it would participate in Spartans capital, increasing its holding from 18.3% to 19.9%.

The Losers

Company | Share Price | Weekly Mvmt. |

|---|---|---|

1. Vulcan Energy Resources (VUL) | $5.97 | -15.91% |

2. Liontown Resources (LTR) | $0.62 | -14.38% |

3. Clarity Pharmaceuticals (CU6) | $5.52 | -13.88% |

4. PYC Therapeutics (PYC) | $1.60 | -13.51% |

5. Coronado Global (CRN) | $0.83 | -10.27% |

Vulcan Energy Resources saw a sharp drop this week, recording eight consecutive days of losses after its stock price reached $8.14 on November 26. There was no price-sensitive news; however, the stock’s short interest saw a slight tick up to 4.84% as of December 2.

Liontown Resources continues to drop, with no key price-sensitive price announcements driving the stock. The company has been down over 50% in the last 12 months.

Clarity Pharmaceuticals fell on no key news this week. The stock has been on a steady downtrend after reaching all-time highs of $8.79 in September. The company will enter the ASX200 as part of the ASX quarterly rebalance, which will take effect on December 23.

PYC Therapeutics dropped despite no key news events this week. The stock has been tearing up recently, up 45% in the last six months.

Coronado Global continues to be affected by Coal prices, which were down 4.9% last week.

The Last Word

If you enjoyed this newsletter, forward this e-mail to a friend.

If you’re that friend, subscribe here.

DISCLAIMER: Please note that the information provided in this newsletter is for educational purposes only and should not be considered financial advice. It is not intended to encourage you to buy/sell assets or make economic decisions. We strongly recommend conducting your research before making any investment.