- Equity Espresso

- Posts

- Green Across the Board

Green Across the Board

Good Evening,

Welcome to Equity Espresso’s Market Recap.

Risk on sentiment helped lift the Aussie market today, sending the ASX 200 index 68.3 pts. or 0.86% higher to 7,989.60, with a clean sweep on the sector boards. This followed a positive session on Wall Street last Friday, which rebounded after a sluggish start to the week.

Technology (+1.53%) was the best-performing sector, with Wisetech Global (+2.22%), NextDC (+2.02%), and Life360 (+2.74%) just some of the big movers. Telecommunication (+1.40%) and Real Estate (+1.38%) were the next best performers, REA Group (+2.99%) re-crossed the $200 share price milestone, while TPG Telecom (+3.29%) was another excellent performer.

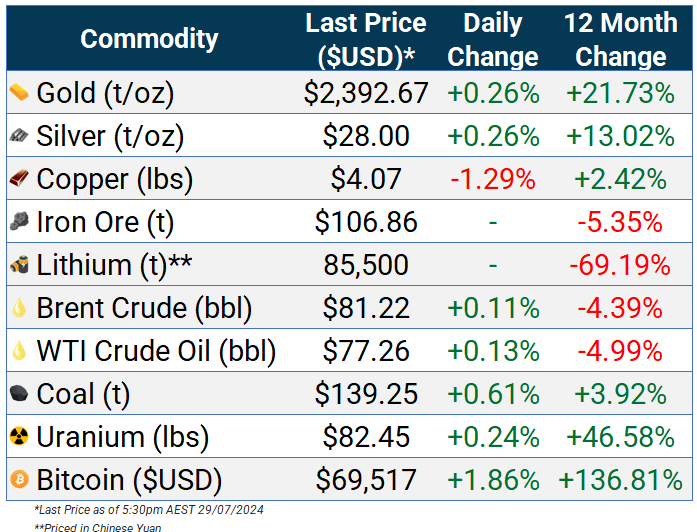

Commodity prices were mixed on Friday. Base metals and gold rallied modestly, but oil continued to weaken. The price of Bitcoin rose on Monday to trade a smidge under US$70,000.

In company news:

Adore Beauty (+3.23%) rose after it announced Sacha Laing, the ex-CEO of General Pants, as CEO.

Fletcher Building (-5.98%) dropped after it warned of operational issues within its cement business, which is expected to impact FY25 earnings by between $10 million and $30 million.

Kogan (-0.92%) shares fell marginally after it reported a 1.5% decline in its Q4 sales to $184.1 million vs. the pcp. Revenue, however, did grow by 0.2%, while its Kogan FIRST subscribers jumped by 25% YoY to 502,000

Pacific Smiles Group (+1.90%) received a revised takeover proposal from Genesis Capital Manager to acquire all its shares at $1.90 per share. Pacific Smiles Group shares closed the day at $1.88.

ASX Indices | ASX Sector Performance |

Wall Street

Investors rushed back into Technology stocks on Friday, as all three of Wall Street's major indices finished the day higher after broad sell-offs at the start of the week. The Dow Jones (+1.64%) was the best performer on the day and ended the week higher (+0.8%). The S&P 500 (+1.11%) and NASDAQ (+1.03%) finished Friday higher but still ended the week lower.

3M stock surged 23%, hitting a one-year high after the maker of office supplies and adhesives reported stronger-than-expected quarterly results. The company reported second-quarter adjusted earnings of $1.93 p/s, above estimates of $1.68 p/s.

U.S. Indices | Fear & Greed Index |

S&P500 Sector Performance

Economic Data

U.S. Personal Consumption Expenditure (PCE) edged up 0.1% month-over-month during June, in line with forecasts following a flat reading in May.

The Bank of Russia raised its benchmark interest rate by 200bps to 18% in its July 2024 decision, consistent with expectations.

U.S. Consumer Sentiment was revised higher to 66.4 in July from an initial reading of 66, its lowest mark in eight months.

Sponsor

Earnings Hub - Your Earnings Calendar Go-To

Earnings Expectations & Actuals

Listen to Earnings Calls Live (or replay)

Earnings Alerts delivered via Text or Email

Quick Singles

🌎️ Around The Globe

GE HealthCare is partnering with Amazon Web Services to develop new generative artificial intelligence models and tools for efficiently analysing complex medical data.

Kroger and Albertsons merger has been temporarily blocked by a Colorado judge until after the state court rules on a lawsuit brought by the state's attorney general.

Meta Platforms is set to be hit in a few weeks with its first EU antitrust fine for tying classified advertisements service Marketplace with its Facebook social network.

OpenAI is testing a new search engine that uses generative artificial intelligence to produce results. SearchGPT will launch with a small group of users and publishers before a potential wider rollout.

Walmart plans to spend $200 million on self-driving forklifts to help automate its warehouses. These forklifts would move goods around in Walmart's distribution centres, which supply its stores.

Warner Bros Discovery and its sports division, Turner Broadcasting System, sued the National Basketball Association (NBA) in New York on Friday. They claim the NBA broke their agreement by not accepting their matching bid for media rights.

Markets

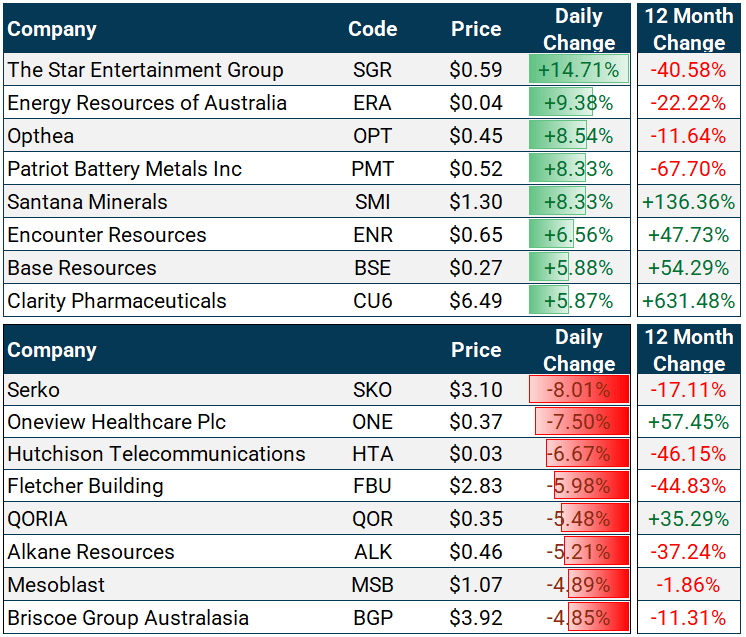

ASX Company Movers

Commodity Prices

Bonds

Forex

Global Health Check

ETF Prices

🔍️ ETF Watch

Want to see how one of your ETFs compares to the rest?

Reply to this e-mail and tell us an ETF or two you want to be included in the tables below.

Australian Index

Australian Sectors

Global Indices & Sectors

Global Strategy

Property & Infrastructure

Fixed Income

Mixed Assets

*1-year, 3-year and 5-year returns are calculated as of 31 May 2024.

The Last Word

How are we doing?

We always love hearing from our readers and are constantly seeking feedback.

How are we doing with Equity Espresso?

Is there anything you’d like to see more of or less of?

Which aspects of the newsletter do you enjoy the most?

Hit reply and say hello - or leave us feedback in the poll below:

If you enjoyed this newsletter, forward this e-mail to a friend.

If you’re that friend, subscribe here.

DISCLAIMER: Please note that the information provided in this newsletter is for educational purposes only and should not be considered financial advice. It is not intended to encourage you to buy/sell assets or make economic decisions. We strongly recommend conducting your research before making any investment.