- Equity Espresso

- Posts

- Helloworld Takes Flight, Ubers Profitable Path

Helloworld Takes Flight, Ubers Profitable Path

The ASX falls with all sectors in the red. Uber reports first ever profitable qtr. Trump indicated on four charges!

Good Evening,

Welcome to the ASX News Daily Recap.

Lost track of what happened on the market today?

Don’t stress. We’re here to catch you up.

Here’s a sample of what you may have missed:

✈️ Helloworld rises on increased travel demand

🏛 Trump indicted on four charges

✂ Litecoin halving approaches

🐻 Your vote - Human or Bear?

🚗 Uber finally profitable

The Recap

ASX Takes a Dip:

Here's What Went Down

A challenging session as the ASX dropped right from the start and continued to decline throughout the day as markets digested the RBA's decision yesterday to maintain the current cash rate.

A weak lead from Wall Street didn’t help, with the ASX weighed down by the Real Estate and Utilities sectors. They weren’t the only culprits though, with all 11 sectors finishing lower, a reversal from Tuesday. The ASX200 finished the day -1.29% lower to close at 7,354.6.

Utilities fell by -2.18%, with Origin Energy (-1.18%) and APA Group (-1.80%) dragging the sector lower. REITs dropped by -1.96%, with Goodman Group (-2.42%), Dexus (-1.69%) and Charter Hall Group (-3.78%) all lower.

Iron Ore futures traded lower this afternoon, dragging down material sector heavyweights BHP (-1.12%), Rio Tinto (-0.9%) and Fortescue Metals (-1.96%).

In M&A news, two homegrown Australian brands have been sold in multi-million dollar deals - more on that later.

Wall Street

The U.S. market took a small breather overnight just a few days ahead of a jobs report read and earnings from tech giants Apple and Amazon. The Energy index traded higher, with Crude Oil up almost 1% to $81.80

The S&P500 finished the day -0.27% lower to 4,589.02, whilst the Nasdaq (-0.43%) also fell.

Uber reported its first-ever operating profit on Tuesday, but the milestone was overshadowed by the slowing pace of top-line growth - which has decelerated from pandemic highs sending the share price down by over 5%.

Global Earnings Recap:

AMD reported a Q2 revenue decline of 18% due to weaker sales in the PC market. EPS was $0.58 - which was in line with estimates.

Caterpillar’s share price rose by 8% on Tuesday's trade despite a slowdown in China that the CEO described as “worse than forecasted.” Adj. EPS of $5.55 beat analysts’ expectations, with sales rising 21.6% to $17.3 billion.

Merck Co. beat expectations by posting $15.04 billion in Q2 revenue vs. estimates of $14.45 billion; this came on the back of the company’s cancer drug Keytruda and HPV vaccine Gardasil.

Starbucks beat analysts’ expectations, posting revenue of $9.17 billion - a 12% increase from the PCP at an EPS of $1.00 - up 19%.

Pfizer's Q2 sales underperformed estimates with slowing sales of its covid pill. Total Q2 revenue of $12.7 billion was down 54% from the PCP.

Uber shares fell on Tuesday despite posting its first-ever operating profit of $326 million. Slowing revenue growth rate of 14% in the quarter, well down from the Covid highs, appeared to cause investors concern.

Another busy day of earnings reports with Albermale, CVS, Equinix, Kraft Heinz, Qualcomm, MercadoLibre, PayPal, Shopify and Sony, just some of the companies reporting overnight.

Economic News

The June U.S. Job Opening & Labour Turnover Survey (JOLTS) report dropped on Tuesday, with job openings falling by 34,000 to a 2-year low of 9.58 million. Despite the fall, this figure is still elevated from pre-pandemic levels of sub-8 million before March 2020.

The U.S. ISM Manufacturing PMI for July came in at 46.40, up from 46.00 last month and down from 52.80 one year ago. The PMI index is an indicator of economic activity in the manufacturing sector in the U.S.

Sponsorship

Powerful ideas in 15 minutes

Join now and start up-levelling your small talk game. Get access to over 5,000 book titles alongside 20 million other readers.

Charts and Prices

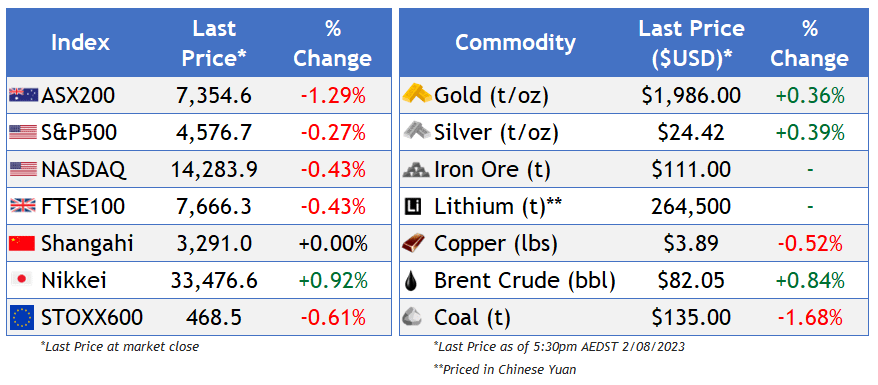

Index & Commodity Prices

ASX By Sector

ETF Watch

Quick Singles

🪃 Local News

Self-tanning and skincare brand Bondi Sands has been sold to Japan’s chemical and beauty giant Kao Corporation in a deal estimated to be $450 million.

The Australian Financial Review reported this afternoon that the swimwear brand Seafolly had been sold to an Asian strategic buyer in a deal worth around $170 million. The AFR said that it understands the entity to be called ‘Bondi Brands Group’, an entity only created in June this year.

The Age reported today that Woolworths has been hit with more than 1,000 criminal charges for allegedly failing to pay long service leave to Victorian workers.

Helloworld upgraded its FY23 guidance, increasing underlying EBITDA to $42m-$45m, with TTV forecasted to be $2.56 billion - a 138% increase from the prior year.

Mesoblast went into a trading halt today pending an announcement relating to the U.S. FDAs review of its’ resubmission application for its’ stem cell drug remestemcel-L.

Sayona Mining announced its first commercial shipment of 20,500 tonnes of spodumene (lithium) concentrate from its’ North American Lithium (NAL) operation in Canada.

PSC Insurance Group expects to report an underlying EBITDA of approximately $111 million for FY23, surpassing initial guidance of $101-105m set in Aug-22 and the upgraded $104-108m estimate from Feb-23.

🌏 Around The Globe

Former U.S. President Donald Trump has been indicted on four separate charges that he conspired to defraud the country and attempted to prevent the peaceful transfer of presidential power to Joe Biden. The indictment outlined how Trump and his allies knowingly spread false allegations of election fraud, convened fraudulent electors and attempted to block the certification of the election on January 6.

X marks the hidden spot - workers took down the giant glowing ‘X’ sign at what was formally known as Twitter’s headquarters after complaints about the brightness.

Amazon wants to speed up its same-day delivery service by doubling the number of centres it owns over the next two years.

Taco Bell has been accused of deceiving consumers by falsely advertising various products as containing “at least double” the content of what was actually in the product.

Coinbase’s CEO Brian Armstrong reportedly told the Financial Times that the U.S. SEC asked him to halt trading in the exchange with all currencies except bitcoin.

IPO Season Incoming?

Bloomberg reported this afternoon that SoftBank Group Corp.’s semiconductor unit Arm Ltd. is targeting an initial public offering this September at a valuation of between $60 billion and $70 billion.

Birkenstock is potentially planning an IPO this year estimated to be worth around $8 billion - $10 billion. The seemingly not-so-fashionable sandals have been making a comeback with celebs like Kendall Jenner wearing Birks, with the sandal even appearing in the new Barbie movie.

Movers and Shakers

✅ Biggest Gainers

Codan Minerals (CDA) continues its steady rebound after a disappointing 2022, today announcing that it has acquired UK-based Eagle New Co. - a software supplier for emergency services and public safety, in a deal worth $22 million. Codan anticipates spending $3 million in setup & integration costs and expects the Eagle business to be EPS accretive in year-2. Codan went into a trading halt on Tuesday before the market opened, re-opening today to close 4.2% higher at $7.83.

ProMedicus (PME) - Growth stocks, particularly profitable ones like Wistech and ProMedicus, have been in vogue, eclipsing all-time highs on a seemingly daily basis. PME shares ticked over the $70 mark for the first time today, closing 2.99% higher to $71.08. Whilst no public company news drove the share price higher, broker Wilsons did raise their rating to overweight at a price target of $76.04.

🔻Biggest Fallers

Westgold Resources (WGX) forecasted an FY24 cost reduction of between $1,800-$2,000/oz, with the production of 245-265koz of gold. Westgold also said it would more than double its capital investment to $130 million. The result was below analysts’ estimates, as the WGX stock price fell 8.7% to $1.56. Westgold provided FY23 production guidance of 240-260koz of gold at a cost of $1,900 - $2,100/oz.

BWP Trust (BWP) reported a 1% decline in full-year profits to $36.7 million, including $76.9 million in unrealised property losses. The Bunnings landlord will pay a final dividend of 9.27¢ a share, which is in line with last year. The REITs sector was sold off today, likely contributing to BWPs’ share price fall of 3.2% to $3.55.

Crypto Corner

Litecoin Halving Immeniant: What You Need to Know

What is the Litecoin Halving?

The Litecoin halving splits the block rewards miners receive, which lowers the rate at which Litecoin tokens (LTC) are generated. The block-halving happens roughly every four years on the Litecoin blockchain and will occur for the third time since its inception in 2011. The halving is periodical and is programmed into Litecoin's code. Litecoin's initial block reward was 50 LTC which has since halved twice to 12.5 LTC currently. After this week’s halving, the block reward will be 6.25 LTC. The halving is expected to occur around 16:34 UTC on Wednesday (4:34 am Aussie time Thursday)

How does it Happen?

Litecoin's blockchain was designed with periodic halvings that decrease the pace of new LTC token issuance by half, roughly every four years. This occurs every 840,000 transaction blocks, with the average generation time for each block being approximately 2.5 minutes.

Litecoin employs a "proof-of-work" mechanism similar to Bitcoin. Miners who expend computational resources to validate transactions and fortify the network are rewarded. This reward is a mix of fluctuating transaction fees and a predetermined subsidy.

Price Performance

Litecoin's price has historically been influenced by its’ halving events. Before the 2015 halving, LTC surged by 824%, and in 2019, it grew by 525%, peaking seven weeks before the halving.

The LTC price has risen by 33% this year, reaching its highest point of $113 on July 3, and is currently trading at $91.58 at the time of writing.

Crypto Price Watch

🤨 What The?

From time to time, we share something a bit more light-hearted

Bear or Human? The Internet Debates

This one made us chuckle - A Malayan Sun Bear named Angela from the Chinese Hangzhou Zoo has become the centre of some global attention. Videos and images circulating online show the bear standing upright on its hind legs, prompting a wave of people to question if the animal is actually a human in a well-crafted costume.

After a video of Angela standing on two legs and another of her waving went viral, the internet went into overdrive. People pointed to what appeared to be folds on Angela's back, assuming them to be evidence of a poor-fitting costume.

In response to the uproar, Hangzhou Zoo issued a tongue-in-cheek statement written from Angela's perspective, expressing bewilderment at the accusations.

The story has resulted in a whopping 30% surge in daily visitors to the zoo, eager to determine Angela's authenticity for themselves.

Real Bear or Costume?

📊 Broker Ratings

AGL Energy (AGL) - Downgraded to Neutral from Outperform (Macquarie)

EVT Ltd. (EVT) - Downgraded to Neutral from Buy (Citi)

ProMedicus (PME) - Upgraded to Overweight (Wilsons)

MoneyMe (MME) - Upgraded to Speculative Buy from Hold (Morgans)

Seven West Media (SWM) - Downgraded to Neutral from Buy (UBS)

🗓️ Economic Calendar

DISCLAIMER: None of the information provided in this newsletter should be constituted as financial advice. This newsletter is strictly for educational purposes only. It should not be taken as investment advice or a solicitation to buy or sell assets or make financial decisions. Please do your research.