- Equity Espresso

- Posts

- From High Fives to Nosedives

From High Fives to Nosedives

Good Evening,

Welcome to Equity Espresso’s Market Recap.

The Aussie market fell back below the 8,000 mark after setting a new high last week, with the ASX 200 index losing 39.9 pts. or 0.50% to close the new week at 7,931.70.

Energy (-1.62%) was the worst performing following a drop in Brent Crude prices last week, its biggest weekly decline since May, falling by US$83.00/bbl. Woodside Energy (-2.09%) and Whitehaven Coal (-3.97%) were the worst performers on the day.

Materials (-0.86%) and Real Estate (-0.86%) also fell, while Staples (+0.65%) saw gains thanks to positive moves from Coles Group (+1.31%) and Treasury Wines (+1.90%).

In company news:

South32 (-12.57%) plunged after announcing it had written-down $818million of its alumina and nickel assets

Droneshield (-20.92%) continue to free-fall after posting its June quarterly cash report. Operating cash outflows for the quarter were $18.9 million although, first-half revenues of $24.1 million were up 110% on the pcp.

Dropsuite (+10.75%) shares jumped after reporting a 31% lift in its annual recurring revenue to $39.9 million from the pcp.

ASX Indices | ASX Sector Performance |

Wall Street

U.S. stocks continued their decline on Friday’s session with ongoing disruption caused by a software glitch, adding to market uncertainty. The tech outage has disrupted global operations in multiple industries across airlines, banks, and healthcare, amongst others, after the glitch in cybersecurity firm Crowdstrike caused Microsoft's Windows operating system to crash.

All three of Wall Street’s main indices fell with the Dow Jones (-0.93%) falling the most followed by the NASDAQ (-0.81%) and the S&P 500 (-0.71%).

Crowdstrike (-11.1%) shares fell while rival cybersecurity companies Palo Alto (+2.2%) and SentinelOne (+7.8%) made gains.

U.S. Indices | Fear & Greed Index |

S&P500 Sector Performance

Economic Data

Canada’s Retail Sales were estimated to have fallen by 0.3% during June from the previous month after a 0.8% fall in May.

Japan’s Inflation rate was 2.8% in June, holding steady for the second consecutive month, sitting at its highest levels since February.

The People's Bank of China slashed key lending rates to new record lows at the July meeting, cutting the 1-year loan prime rate (LPR), by 10bps to 3.35%.

Sponsor

Take a demo, get a Blackstone Griddle

Financial operations heating up? BILL Spend & Expense can help you take control. Automate expense reports, set budgets across teams, and get real-time insights into company spend. Take a demo to learn how and we'll give you a 28" Blackstone Omnivore Griddle—so you can take control of your next barbecue, too.

Quick Singles

🌎️ Around The Globe

Amazon Prime Day set a new record of $14.3billion in U.S. online sales, up 11% from 2023.

Ford Motor is planning to invest around $3 billion to expand production of its Super Duty trucks, adding 100,000 pickup trucks per year.

Meta is exploring buying up to around a 5% stake, around $5 billion in eyewear leader Essilor Luxottica, the parent company of Ray-Ban.

Nigeria has fined Meta Platforms $220 million after investigations showed data-sharing on social platforms violated local consumer, data protection and privacy laws.

Nvidia is working on a version of its new flagship A.I. chips for the China market that would be compatible with current U.S. export controls, according to a report by Reuters.

OpenAI released a cheaper version of ChatGPT, called GPT-4o mini, a more cost-effective AI that can regenerate images and text.

Markets

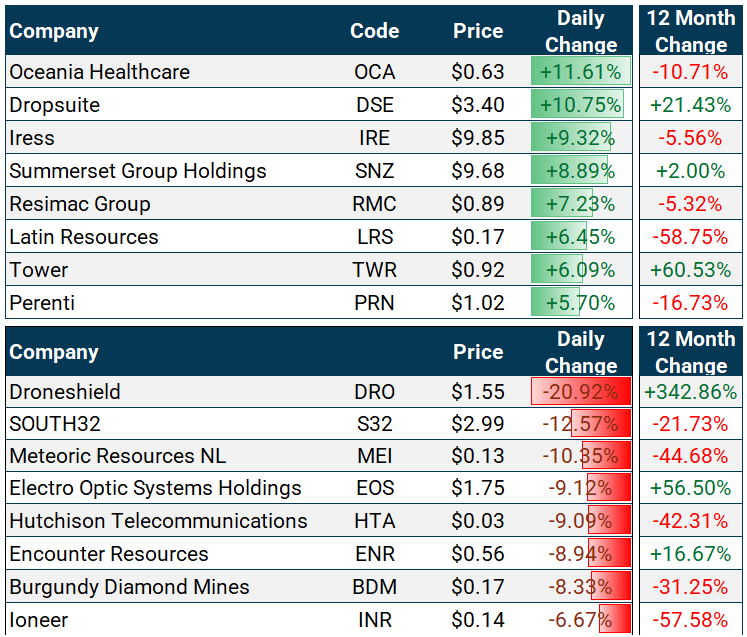

ASX Company Movers

Commodity Prices

Bonds

Forex

Global Health Check

The Last Word

How are we doing?

We always love hearing from our readers and are constantly seeking feedback.

How are we doing with Equity Espresso?

Is there anything you’d like to see more of or less of?

Which aspects of the newsletter do you enjoy the most?

Hit reply and say hello - or leave us feedback in the poll below:

If you enjoyed this newsletter, forward this e-mail to a friend.

If you’re that friend, subscribe here.

DISCLAIMER: Please note that the information provided in this newsletter is for educational purposes only and should not be considered financial advice. It is not intended to encourage you to buy/sell assets or make economic decisions. We strongly recommend conducting your research before making any investment.