- Equity Espresso

- Posts

- JB Hi-Fi's Jolly Jump: ASX's Fifth Straight Win Despite Iron Ore Blues

JB Hi-Fi's Jolly Jump: ASX's Fifth Straight Win Despite Iron Ore Blues

Good Evening,

Welcome to Equity Espresso’s Market Recap.

The Australian share market climbed for the fifth consecutive day on Monday, erasing memories of last Tuesday's massive sell-off. The ASX 200 index rose 36 pts., or 0.46%, to finish at 7,813.70, with JB Hi-Fi the second-best performer to kick off a busy week of earnings results.

The Technology (+1.93%) sector continues to anchor the market extremes, leading the charge of the nine sectors in the green today thanks to a rise in NextDC (+3.39%) and Wisetech Global (+2.67%) shares.

The Discretionary (+1.91%) sector was the other big mover, thanks to a rise in JB Hi-Fi (+8.33%) after it announced a special dividend and provided an optimistic trading update for the new year. The company said sales were higher in its Australia (+5.6%) and New Zealand (+12.2%) business during July. JB’s rise helped lift other retailers in the sector, including Harvey Norman (+3.72%), Premier Investments (+2.86%) and Super Retail Group (+4.95%).

The Materials (-0.56%) sector slipped on Monday as Iron ore prices fell below US$100/t for the fourth time in two weeks. Rio Tinto (-1.37%) and Fortescue (-1.35%) saw the largest falls. Gold prices remain steady at around US$2,420, while Bitcoin prices tumbled over the weekend to trade just above US$58,000.

In company news:

JB Hi-Fi (+8.33%) led the day’s winners, announcing a $0.80 special dividend, and the acquisition of E&S Trading Co. FY24 saw a slight group sales decline (-0.4% to $9.59 billion) and a steeper Net Profit drop (-16.4% to $438.8 million).

Aurizon (-8.84%) shares fell after the company projected modest FY25 EBITDA growth of 2-7%. Despite announcing a $150 million buyback and reporting a 25% increase in statutory NPAT, the soft guidance overshadowed this year’s positive results.

Beach Energy (-12.63%) plunged on ab FY24 with a net loss of $475.3 million, driven by significant oil and gas field writedowns. Underlying Net Profit fell 11% to $341.3 million, despite 9% revenue growth.

CAR Group (+4.46%) shares nudged higher after reporting an adjusted revenue increase of 41% in FY24. The company saw double-digit revenue growth across all its geographic segments, with Australia seeing growth of 13%. Adjusted NPAT for the year rose 24% to $344 million.

Dicker Data (+5.02%) shares rose after announcing a quarterly dividend of $0.11 per share.

ASX Indices | ASX Sector Performance |

Wall Street

U.S. stocks ended higher on Friday, led by the NASDAQ (+0.5%) and S&P 500 (+0.5%), in an up-and-down week that saw a savage sell-off on Monday. Overall, markets ended the week where they started, gaining ground after fears of a recession and the unwinding of a global yen-funded carry trade.

The Communication Services (+0.97%) & Technology (+0.64%) sectors were again the best performers on the day. Eli Lilly (+5.45%) was one of the more significant movers on the day, along with Meta (+1.48%) and Apple (+1.39%). Materials (-0.10%) was the only sector to end the day in the red.

Sweetgreen (+33.17%) shares soared after the salad chain reported second-quarter revenue of $184.6 million, beating estimates of $181 million. The company raised its full-year guidance to between $670 million and $680 million. Doximity (+38.74%) was another company that surged after the digital health company reported first-quarter earnings of $0.28 per share, ahead of estimates of $0.22 per share.

U.S. Indices | Fear & Greed Index |

S&P500 Sector Performance

Economic Data

Russia’s annual inflation rate rose to 9.1% in July 2024, up from 8.6% in June, reaching its highest level since February 2023.

Canada’s Unemployment Rate was 6.4% in July 2024, unchanged from June but slightly below market expectations of 6.5%.x

US mortgage rates have fallen to a 15-month low, with an average 30-year fixed-rate mortgage at 6.47%.

Sponsor

The Rising Demand for Whiskey: A Smart Investor’s Choice

Why are 250,000 Vinovest customers investing in whiskey?

In a word - consumption.

Global alcohol consumption is on the rise, with projections hitting new peaks by 2028. Whiskey, in particular, is experiencing significant growth, with the number of US craft distilleries quadrupling in the past decade. Younger generations are moving from beer to cocktails, boosting whiskey's popularity.

That’s not all.

Whiskey's tangible nature, market resilience, and Vinovest’s strategic approach make whiskey a smart addition to any diversified portfolio.

Quick Singles

🌎️ Around The Globe

The U.K.’s Competition and Markets Authority has launched a "Phase 1" investigation into Amazon’s $4 billion investment in A.I. startup Anthropic to assess potential competition harm.

Apple is reportedly planning a new version of the Mac mini, its smallest desktop computer yet. This change is part of a broader overhaul of the Mac line, including AI-focused chips.

Amazon is partnering with TikTok and Pinterest to let users buy products on their platforms without leaving the social media apps. Users can link their social media profiles to their Amazon accounts and buy products directly from ads.

Barclays has raised the cap on bonuses for its top bankers. Senior bankers can now earn payouts of up to 10 times their base salary, up from a 2-1 ratio previously imposed by the E.U.

Google DeepMind has recently developed a robotic table tennis AI agent that has achieved "human-level speed and performance." This AI agent won 45% of matches against opponents with different skill levels.

Palantir has announced a partnership with Microsoft to sell secure cloud, analytics and artificial intelligence capabilities to the U.S. defence and intelligence communities.

Stellantis is laying off up to 2,450 factory workers from its Warren Truck assembly plant in Michigan after the automaker announced the end of production of its Ram 1500 Classic truck.

Markets

ASX Company Movers

Commodity Prices

Bonds

Forex

Global Health Check

ETF Prices

🔍️ ETF Watch

Want to see how one of your ETFs compares to the rest?

Reply to this e-mail and tell us an ETF or two you want to be included in the tables below.

Australian Index

Australian Sectors

Global Indices & Sectors

Global Strategy

Property & Infrastructure

Fixed Income

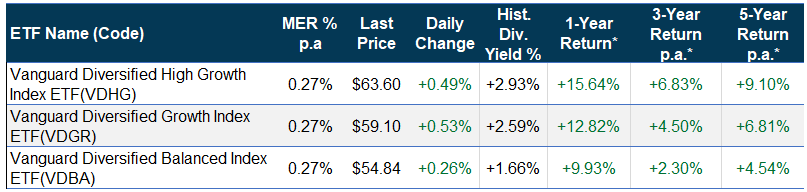

Mixed Assets

*1-year, 3-year and 5-year returns are calculated as of 30 June 2024.

The Last Word

How are we doing?

We always love hearing from our readers and are constantly seeking feedback.

How are we doing with Equity Espresso?

Is there anything you’d like to see more of or less of?

Which aspects of the newsletter do you enjoy the most?

Hit reply and say hello - or leave us feedback in the poll below:

If you enjoyed this newsletter, forward this e-mail to a friend.

If you’re that friend, subscribe here.

DISCLAIMER: Please note that the information provided in this newsletter is for educational purposes only and should not be considered financial advice. It is not intended to encourage you to buy/sell assets or make economic decisions. We strongly recommend conducting your research before making any investment.