- Equity Espresso

- Posts

- Which Miners Should You Be Keeping an Eye on?

Which Miners Should You Be Keeping an Eye on?

Lynas, IGO, Silverlake and Gold Road were just some of the miners to report, as markets eagerly await the RBA decision tomorrow.

Good Evening,

Welcome to the ASX News Daily Recap.

Lost track of what happened on the market today? Don’t stress. We’re here to catch you up.

Here’s a sample of what you may have missed:

⚒️ Quarterly Mining Reports - Lynas, IGO, Gold Road & More

🥽 British Muesuem enters the Metaverse

🧈 SilverLake tanks on weak outlook

🤖 $1m salary to work at Netflix?

📈 All eyes on the RBA tomorrow

The Recap

Early ASX Rise Tapers Off, Leaving Market Slightly Higher

It was the last day to get your June quarterly in, with some waiting until today, much like a Grade 5 student completing their math homework as the teacher collects the tests from the class (do kids even use paper these days?). Anyway, several companies, particularly in the mining space, reported today - we got you covered in the Quick Singles section.

The ASX sprung out of the gate early following Wall Street's strong Friday session but ended the day on a whimper, finishing the day 0.09% higher to end July at 7,410.4.

Health Care (+0.63%) led the way from a sector perspective, with CSL(+0.66%), Sonic (+0.66%) and Cochlear (+0.05%) all trading slightly higher. Industrials (+0.34%) closely followed, with Transurban (+0.21%) and Brambles (+0.57%) ending the day in the green.

Consumer Staples (-0.75%) was the sector that fell the most today, with Woolworths (-1.30%) and Coles (-0.93%) both dropping. While Utilities (-0.47%) also fell after Origin Energy posted quarterly earnings today.

Locally, we’re expecting earnings reports from Credit Corp and James Hardie tomorrow - so stay tuned.

Wall Street

The U.S. stock market traded higher on Friday’s session, with all three key indices gaining. The Jobs and PMI report later in the week will be the key economic news on the calendar.

The S&P500 has returned 19.3% in the first 143 trading days of 2023, which places it as the 13th-best year!

Best starts to a year for the S&P 500 through 143 trading days... http

— Charlie Bilello (@charliebilello)

1:21 PM • Jul 30, 2023

Economic News

China reported purchasing managers index (PMI) for July today at 49.3, up slightly from 49.0 in June. This was slightly below the forecast of 49.2. The result is below the elusive 50-point mark, which separates expansion from contraction.

It’s a ‘live’ meeting as the RBA rate decision has economists split - according to Reuters, 55% of economists predict a rate hike when the RBA meets tomorrow.

The Bank of England meets on Thursday; where investors expect a rate hike, it is just a matter of whether it’s 25bps or 50bps, according to economists.

Charts and Prices

Index & Commodity Prices

ASX By Sector

ETF Watch

Quick Singles

Local News 🪃

4DX Medical fell by 6% today after reporting cash receipts for Q4 of $0.2m, with full-year cash receipts of $2.2m - up 413% from the PCP. Net Operating cash outflows flows for FY23 was $23.5m. 4DX reported cash on hand at the end of June-23 of $69.6m after completing a capital raise of $45m in June.

AMA Group maintained its’ FY23 normalised EBITDA guidance of $60-68m and said it expects a result near the middle of this range. Last year’s result was between $38–46m on a normalised operating basis. Shares were up by over 20% today.

Bubs Australia's fall from grace continues, reporting a quarterly revenue drop of 59%. Net Operating cash flows for the qtr. were ($12.9m). The share price was down by 2.5%

Gold Road Resources saw a drop in production of, you guessed it, gold, from 82,604 ounces in the March qtr. to 76,053 in June. AISC in the qtr. was $1,399 an ounce.

Origin Energy reported an 11% drop in revenue YoY due to lower oil prices from its Australian Pacific LNG Operations.

Pacific Current Group reported FUM of $204.4b as of June - an increase of 9.1% from the March qtr. Thanks to a rebound in global equity markets and stronger cash inflows. PAC remains the target of a takeover, with GQG Partners last week saying it would counter a $555m bid from Regal Partners.

Starpharma - fell by over 30% today after announcing that AstraZeneca has decided to discontinue developing the cancer drug ‘AZD0466’. This came after an internal review prompted by a small number of asymptomatic adverse events that the company said were unrelated to Starpharma’s dendrimer drug delivery technology.

Around The Globe 🌏

Intel was spruiking A.I. in its earnings call on Friday, with the company saying it has plans to ship its first consumer chip with a built-in neural processor for machine learning tasks later this year. Intel shares rose by over 6% on Friday.

The new Apple iOS 17 dropped to developers with new features, including a new intelligent display mode, health features, interactive widgets, new Messages experience, Live Voicemail and offline Apple Maps.

Japan’s population dropped by nearly 800,000 in 2022, with falls in every prefecture (district/state) recorded for the first time ever.

Amazon is getting in on the act, with its Amazon Web Services (AWS) launching ‘HealthScribe’, which empowers healthcare software providers to streamline clinical documentation using the power of generative AI.

The Wall Street Journal reported that Netflix had lowered prices for ad placements on its cheaper, ad-supported tier subscriptions; some advertisers are now offering placements of $39 to $45 per 1,000 viewers, the WSJ reported, compared to a previous rate of around $45 to $55.

Ford’s projected losses on its first-generation E.V.s could total $4.5 billion this year – roughly 50% more than forecast just a few months ago. Tesla’s price-cutting and slower-than-expected uptake of EVs by consumers is hindering sales.

Remember Threads? CEO Mark Zuckerberg told employees that Meta Platforms executives are heavily focused on boosting retention on their new Twitter rival Threads after the app lost more than half of its users in the weeks following its launch.

Movers and Shakers

✅ Biggest Gainers

Lynas Rare Earth rose by 2.6% to $6.73 today after reporting better-than-expected operational performance in the June quarter, marking its highest-ever quarterly production of NdPr at 1,864 tonnes. Despite external market challenges, including reduced demand for NdFeB magnets and China's oversupply, Lynas achieved a sales revenue of $157.5m. Lynas also said it would withhold a portion of supply from the market in response to a price plunge for the vital ingredient in wind turbines, electronics and military applications.

Ecofibre (EOF) saw its share price double in morning trade before ending the day at a more modest 26.4% increase to $0.21. Ecofibre announced that it has entered a MoU for a 3-year supply relationship with Under Armour. The deal is expected to bring in annual revenue of AUD 9.0m at total production. The partnership will involve Ecofibre's Hemp Black division supplying specialty yarn for apparel use. EOF highlighted other developments, including a manufacturing agreement with Cruz Foam and progress with bio-based plastics.

🔻Biggest Fallers

Silver Lake Resources (SLR) posted record quarterly production of 81,616/oz of gold and 642t of copper, which took FY23 total output to 261,604/oz of gold and 1,483t of copper. However, gold production guidance for FY24 was 210,000 - 230,000/oz, at a cost of between $1,850 - $2,050/oz, which may have been the catalyst for the share price fall today. FY23 AISC was $1,598/oz. Silverlake shares fell by over 20% today to close at $0.89.

IGO Ltd (IGO) reported a record quarterly EBITDA of $363m and underlying FCF of $381m during the June quarter, driven by strong production at its Greenbushes Lithium mine. This wasn’t enough for investors, as the share price fell by 4.6% to $0.67. IGO also announced the introduction of a New Capital Returns Policy, where it will target a dividend payout of between 20-40% of underlying Free Cash Flow, if liquidity is under $1B

Crypto Corner

The British Museum Ventures into the Metaverse with The Sandbox

Remember all the Metaverse buzz? That was so 2021. Whilst the rest of us have moved onto the new shiny toy called A.I., organisations still appear to be investing in the Metaverse.

The 270-year-old British Museum, home to the Rosetta Stone and Parthenon Sculptures, continues to invest in the digital realm by partnering with the Ethereum-based metaverse game, ‘The Sandbox’.

In a strategic alliance with the museum's licensing partner, French startup LaCollection, The British Museum plans to unveil a series of NFT digital collectibles. These digital treasures are designed to mirror the vast and diverse collections housed within the museum's walls, providing a fresh, immersive experience for art and history lovers globally.

But the museum's digital aspirations don't end there. Venturing further into the Metaverse, The British Museum is set to establish its own immersive domain within The Sandbox's online game world.

Sebastien Borget, COO and Co-Founder of The Sandbox expressed his enthusiasm for the partnership, emphasising its unparalleled opportunity. "This collaboration allows players from every corner of the globe to delve into the rich tapestry of human history, art, and culture that The British Museum curates," he remarked.

This isn’t the first time the British Museum has ventured into the realm of digital innovation. The institution has previously joined forces with LaCollection, launching three NFT collections, including digital postcards of iconic works by artists like Katsushika Hokusai and Joseph Mallord William Turner.

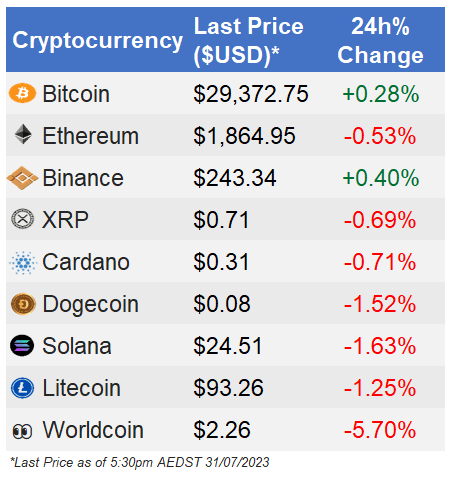

Crypto Price Watch

What The?

From time to time, we share something from a little left-field

Hypocrisy? Or Time To Update Your Resume To A.I. Expert?

The ongoing writers' strike controversy has taken a wild turn. The Writers Guild of America (WGA) went on strike on October 10, 2022, after failing to reach a new contract with the Alliance of Motion Picture and Television Producers (AMPTP). The core of the dispute? The role of artificial intelligence (A.I.) in the entertainment industry and its potential to replace human creativity. Other issues include pay, residuals, and healthcare.

Looking For An A.I. Job?

Netflix added fuel to the fire after a recently advertised position for an A.I. expert with a salary of up to US$900,000 (A$1,348,000)! This move has been met with backlash from Hollywood unions, as they strike over concerns about A.I.'s impact on the entertainment industry. The underlying fear is that A.I., with its algorithms and machine learning capabilities, might soon dictate content creation, sidelining human writers and actors.

The job listing is one of several AI-related positions on Netflix's job page. We had a look at the job requirements so you can conveniently tailor your CV (L.A.-based applicants only!):

Technical Expertise: Strong background in machine learning, A.I. and natural language processing

Problem-solving skills: Identify and solve complex problems and can think critically and creatively.

Passion for AI. The candidate is passionate about A.I. and its potential to revolutionise the entertainment industry and is excited to work on cutting-edge A.I. projects.

The outrage isn't just about the potential of A.I. taking over creative roles. The disparity in pay has also been a significant point of contention. While A.I. roles at Netflix are being offered salaries in the high six figures, many actors struggle to earn enough to qualify for essential health insurance benefits.

Broker Reports

McMillan Shakespeare (MMS) upgraded to an Outperform (Macquarie) - P.T. $17.92

Smartgroup Corp (SIQ) upgraded to an Outperform from Neutral (Macquarie) - P.T. $10.00

Maas Group cut to natural (Goldman Sachs) - P.T. $2.90

Pointbet (PBH) cut to neutral (Credit Suisse) - P.T. $1.70

Economic Calendar

DISCLAIMER: None of the information provided in this newsletter should be constituted as financial advice. This newsletter is strictly intended for educational purposes only. It should not be taken as investment advice or a solicitation to buy or sell assets or make financial decisions. Please do your research.