- Equity Espresso

- Posts

- Myer and Premier's Fashion Fusion?

Myer and Premier's Fashion Fusion?

Good Evening,

Welcome to Equity Espresso’s Daily Market Recap.

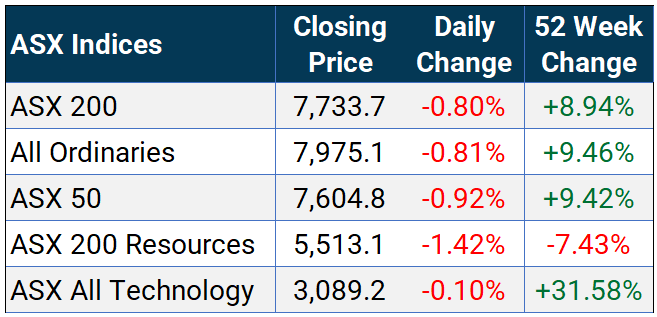

The Australian share market started the new week lower, wiping away most of last week’s gains as the ASX 200 index shed 62.3 pts. or 0.80% in a news day dominated by retail companies. Industrials (+0.71%) were the sole sector to close in the green, with Transburban Group (+1.04%) and Seven Group (+1.68%) two of the better performers.

The Energy (-1.86%) sector was the worst performer, with Woodside Energy (-2.00%) and Whitehaven Coal (-3.27%) seeing some of the more significant falls. Uranium stocks were hit hard, with Deep Yellow (-6.51%) and Boss Energy (-5.28%) seeing sharp falls.

Today's big news was from Myer (+20.16%), whose share price soared on the announcement that it was exploring a merger with Premier Investments (+6.88%) apparel business. The proposal involves an all-scrip merger, where Myer would acquire Premier's Apparel Brands in exchange for new Myer shares.Premier’s Apparel Brands division includes retailers Just Jeans, Jay Jays, Portmans, Jacqui E, and Dotti.

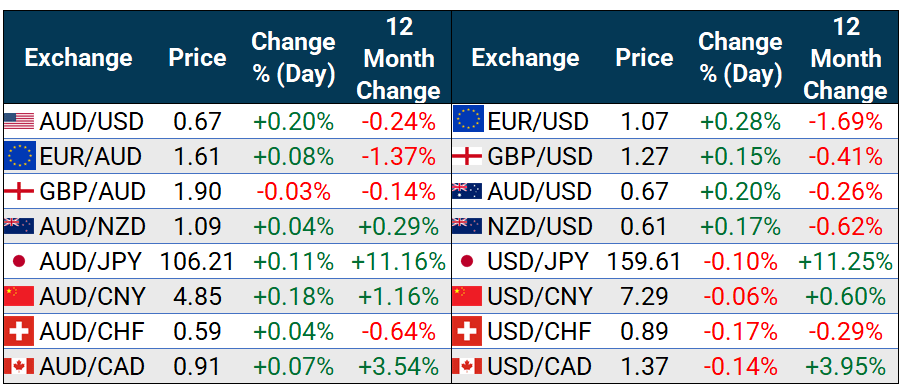

Is it time for Tokyo? Over the weekend, the Australian dollar hit a 10-year high against the Japanese yen, with A$1.00 worth around ¥107.00. The yen has continued to weaken against other major global currencies as interest rates remain significantly lower to stimulate economic growth. Meanwhile, against the US Dollar, the yen is close to hitting a 34-year low, with US$11.00 worth close to ¥160.00.

In company news:

Paladin Energy went into a trading halt this morning before announcing it intends to buy Candanian-based miner Fission Uranium in a deal worth $1.3 billion. Once the agreement is finalised, Fission shareholders will own 24% of Paladin, which has applied to the list on the Toronto Stock Exchange.

Resmed (-13.20%) shares plunged on news U.S. pharmaceutical Eli Lilly has applied for approval of its weight loss drug Zepbound for treating obstructive sleep apnea. Late-stage trials showed that Zepbound was more effective than a placebo in treating the disorder.

Cettire (-49.33%) shares were savaged after a trading update in which the online luxury retailer said the operating environment has become more challenging, with softening demand resulting in increased promotional activity. Cettire said it expects FY24 revenue to be between $735m - $745m (+77% to +79% vs. pcp.) and Adjusted EBITA to be between $32m and $35m (+24% and +36% vs. pcp.). The company also confirmed the launch of its direct platform in mainland China.

Star Entertainment (-4.08%) continues its freefall, reporting that it expects Q4 FY24 revenue to be 4.3% below the previous quarter and 3.3% below the pcp. The decline is due to decreased revenue from Premium Gaming Rooms.

ASX Indices | ASX Sector Performance |

Wall Street

The S&P 500 (-0.16%) and NASDAQ (-0.18%) closed Friday's session marginally lower, weighed down by Nvidia (-3.22%) for a second consecutive day, dragging down the technology sector. The Dow Jones (+0.04%) bucked the trend, rising by the finest of margins thanks to a lift in McDonald’s (+2.20%) and Salesforce (+1.35%) stock price.

Technology (-0.84%) was the biggest detractor of the major S&P 500 sectors, followed by Energy (-0.68%). Consumer Discretionary (+1.02%) and Communication Services (+0.66%) were the best performers.

Sarepta Therapeutics (+30.14%) shares surged after the U.S. Food and Drug Administration approved the expanded use of the company's gene therapy, Elevidys, for Duchenne muscular dystrophy (DMD). Children affected by DMD generally lose the ability to walk by 12 years of age. The treatment can be used for patients aged four and older. Hertz Global (+15.95%) shares popped after it announced an increase in its bond offering to $1 billion after initially planning to raise $750 million. Asana (+15.30%) shares got a nice Friday bump after announcing a share buyback of $150 million that is expected to be completed by June 2025.

U.S. Indices | Fear & Greed Index |

S&P500 Sector Performance

Economic Data

U.S Existing Home Sales fell by 0.7% MoM to 4.11 million units in May, the lowest mark in four months, just about in line with forecasts of 4.10 million.

U.S. Composite PMI rose to 54.6 in June, hitting its highest point since April 2022, up from 54.5 in May. The service sector showed the largest improvement, with a PMI of 55.1.

U.K Retail Sales soared 2.9% MoM in May, a reversal from the 1.8% fall in April, which was also higher than forecasts of 1.5%.

Sponsor

Learn how to become an “Intelligent Investor.”

Warren Buffett says great investors read 8 hours per day. What if you only have 5 minutes a day? Then, read Value Investor Daily.

Every week, it covers:

Value stock ideas - today’s biggest value opportunities 📈

Principles of investing - timeless lessons from top value investors 💰

Investing resources - investor tools and hidden gems 🔎

You’ll save time and energy and become a smarter investor in just minutes daily–free! 👇

Quick Singles

🌎️ Around The Globe

Anthropic released its latest artificial intelligence model, Claude 3.5 Sonnet. The company claims it is twice as fast as previous versions and performs better than competitors “on a wide range of evaluations.”

Boyd Gaming has approached Penn Entertainment to express interest in acquiring the company, which currently has a market value of more than $9 billion.

Golden Goose is postponing its IPO, with the luxury Italian brand citing “significant deterioration” in market conditions as the reason for the delay.

Ilya Sutskever, one of OpenAI’s co-founders, has launched a new company called Safe Superintelligence Inc. (SSI). The company aims to create a safe A.I. model that is more intelligent than humans.

McDonald's will roll out $5.00 meal deals from June 25 for a limited time at some restaurants across the U.S. The value deal will include a McDouble or McChicken sandwich, small fries, four-piece Chicken McNuggets, and a small soft drink for $5.00.

Sony Music is in the process of acquiring Queen’s music catalogue for around $1.27 billion.

Snap has agreed to pay $15 million to settle a gender discrimination lawsuit after a three-year investigation that found the company failed to “ensure that women were paid or promoted equally.”

Markets

ASX Company Movers

Commodity Prices

Bonds

Forex

Global Health Check

What The?

| Paleontologists have potentially discovered a new triceratops-like dinosaur species, dubbed Lokiceratops. A 78-million-year-old fossil suggests that the dinosaur family saw the evolution of region-specific horn and skull shape. |

Newsletter Recommendation

|

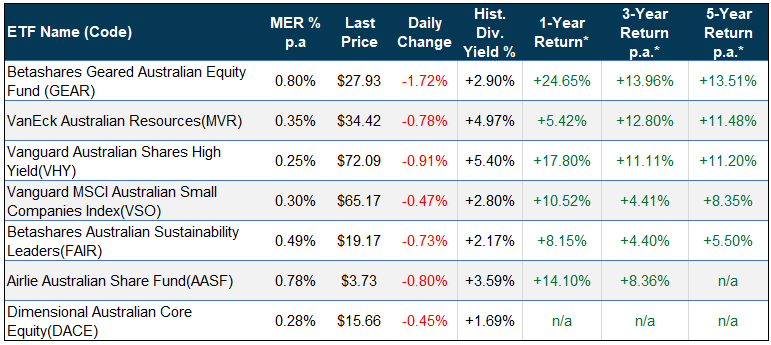

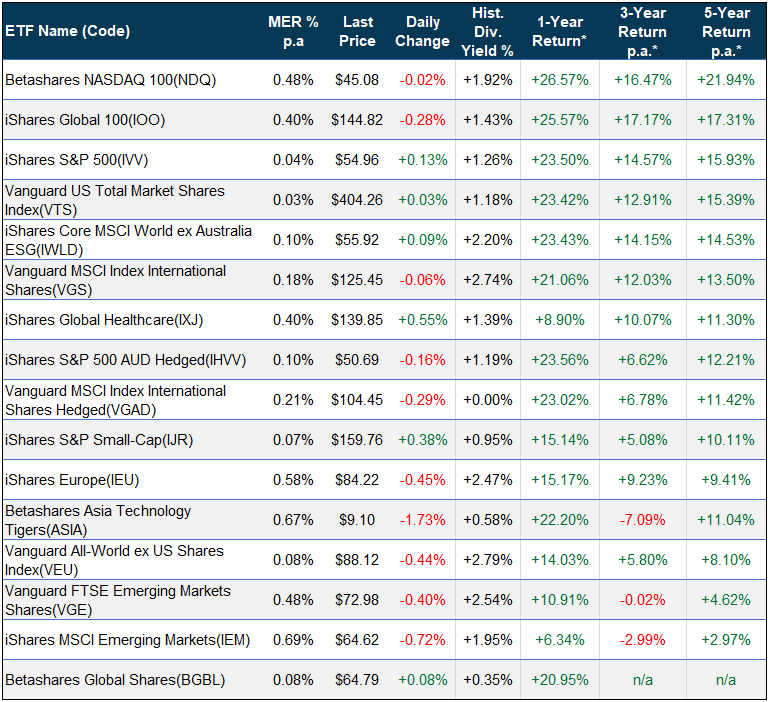

ETF Prices

🔍️ ETF Watch

Want to see how one of your ETFs compares to the rest?

Reply to this e-mail and tell us an ETF or two you want to be included in the tables below.

Australian Index

Australian Sectors

Global Indices & Sectors

Global Strategy

Property & Infrastructure

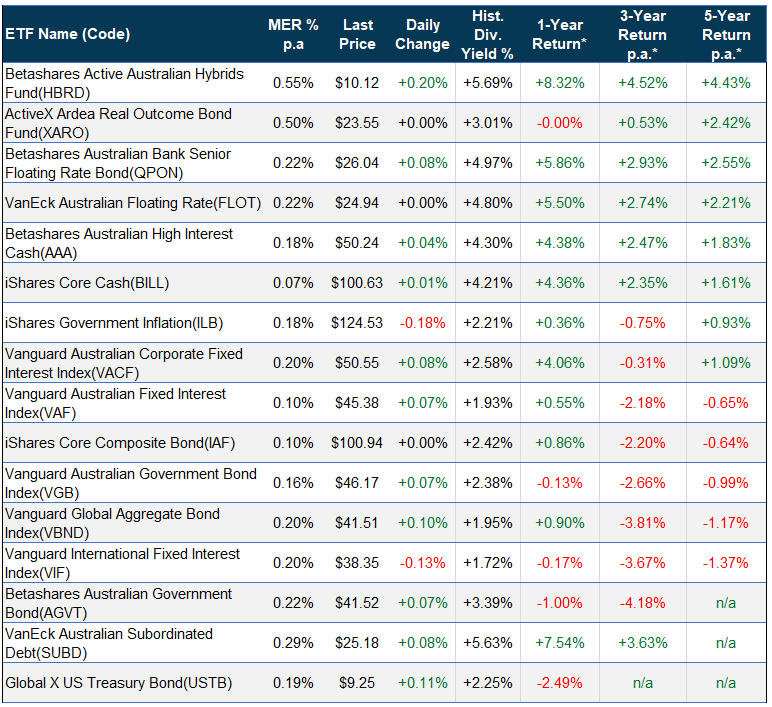

Fixed Income

Mixed Assets

*1-year, 3-year and 5-year returns are calculated as of 31 May 2024.

The Last Word

How are we doing?

We always love hearing from our readers and are constantly seeking feedback.

How are we doing with Equity Espresso?

Is there anything you’d like to see more of or less of?

Which aspects of the newsletter do you enjoy the most?

Hit reply and say hello - or leave us feedback in the poll below:

If you enjoyed this newsletter, forward this e-mail to a friend.

If you’re that friend, subscribe here.

DISCLAIMER: Please note that the information provided in this newsletter is for educational purposes only and should not be considered financial advice. It is not intended to encourage you to buy/sell assets or make economic decisions. We strongly recommend conducting your research before making any investment d