- Equity Espresso

- Posts

- Qantas' High Court Hurdle: Appeal Dismissed Over Mass Layoffs

Qantas' High Court Hurdle: Appeal Dismissed Over Mass Layoffs

Qantas remains in the news for the wrong reasons after the High Court dismissed its appeal to overturn a Federal Cort ruling that it illegally sacked nearly 1,683 workers during the pandemic.

Good Evening,

Welcome to Equity Espresso

We’re here to catch you up on all the day’s news in Australia and abroad.

Here’s a sample of what you may have missed today:

📱 New iPhone Alert

♻️ Pact Groups Private Pursuit

⬇️ Viva Rumours Confirmed

✈️ Turbulent Times Continue for Qantas

🤝 Monadelphous & Liontown $100 Million Agreement

The Recap

Qantas Appeal Dismissed

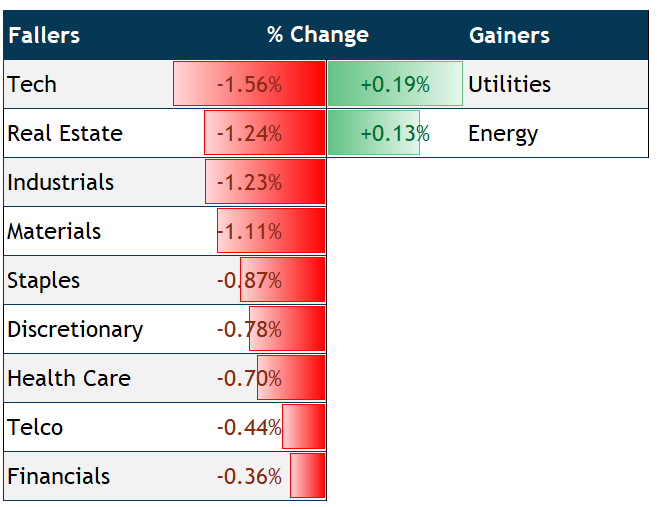

The Tech (-1.56%) sector took the biggest hit on the ASX200 index today, which fell by 47.8 pts. to 7,153.9 as risk-off sentiment took hold ahead of the U.S. inflation data read set to be released tonight.

Real Estate (-1.24%), Industrials (-1.23%) and Materials (-1.11%) all ended the day lower. Utilities (+0.19%) and Energy (+0.13%) both finished higher.

Qantas remains in the news for the wrong reasons after the High Court dismissed its appeal to overturn a Federal Court ruling that it illegally sacked nearly 1,683 workers during the pandemic.

The Federal Court determined that Qantas had outsourced its heavily unionised workforce to prevent them from exercising their right to engage in industrial action during future enterprise bargaining. However, Qantas contested that the dismissals were not unlawful because, at the time, the employees were not legally permitted to take industrial action since their enterprise agreement had either not yet expired or negotiations had not yet commenced between the involved parties.

ASX200 Stock Snapshot

Wall Street

The U.S. market fell with declines in technology companies as traders prepare for a vital inflation report that could provide more information on the Federal Reserve's future actions. The NADAQ100 experienced a drop, with Tesla losing 2.2% of its value and partially reversing its 10% increase from the previous day.

At the Wanderlust event, Apple launched its latest iPhones in the hope of attracting customers in a slowing smartphone market. The company introduced four new models: the iPhone 15, 15 Plus, 15 Pro, and 15 Pro Max. They’re made of titanium and have action buttons, and Apple promises they’re the most powerful smartphones it has ever made.

The starting price for the entry-level models remains at US$799, while the Pro version remains at US$999. However, the Pro Max will start at US$1,199, US$100 higher than last year's price. Apple has included new materials, camera upgrades, and improved performance in these models.

Exxon Mobil rose 2.9% as the price of oil continued to climb. Futures for U.S. benchmark West Texas Intermediate crude hit their highest level since November.

Economic News

The unemployment rate in the United Kingdom from May to July rose by 0.5 percentage points from the previous quarter, at 4.3%. The rise in joblessness was mostly caused by individuals who have been unemployed for up to 12 months. The economic inactivity rate increased by 0.1 percentage points from the previous quarter and is currently at 21.1% from May to July 2023.

Quick Singles

🪃 Local News

De Grey Mining announced that it had been granted the Mining Lease for the Hemi Gold Project by the WA Department of Mines, Industry Regulation and Safety (DMIRS). The lease is a positive step towards being granted production approval, which remains subject to approval.

Monadelphous secured a $100 million construction contract with Liontown Resources related to the construction of the miner’s wet plant at the Kathleen Valley Lithium project in WA. The works are expected to be completed by mid-2024

The shares of Pental Group saw a 30% surge after announcing plans to sell its Consumer Products division (except Duracell and Bondi Soap) and the Shepparton manufacturing plant for a total selling price of $60 million to Dulux Group.

Centurias Industrial REIT has sold $70 million of Melbourne property assets as part of a "strategic divestment" plan. The trust aims to repay its debts by selling Cargo Park, an industrial estate spanning 25,800 square metres, and a 4072 square metre industrial distribution centre.

Starpharma’s share price surged 42% after reporting encouraging interim outcomes of their cancer medication, DEP irinotecan.

🌏 Around The Globe

CVS's share price climbed 2.6% following an upgrade to outperform from ‘peer perform’ (Neutral) by Wolfe. The firm said the business could inflect over six to 12 months.

The stock price of Block advanced by 0.7% after Baird reaffirmed the stock's outperform rating and designated it as a bullish fresh pick. Baird believes the shares may have been oversold due to a temporary outage on Square, the company's payment processor.

The stock price of Oracle decreased by 13.5% following the release of their second-quarter earnings report, which showed lower-than-expected revenue of $12.45 billion.

German footwear maker Birkenstock has filed for an initial public offering in the U.S., reportedly seeking a valuation of $US8 billion.

With government subsidies, BMW will invest approximately $750 million to manufacture electric versions of its Mini Cooper and Mini Aceman models at its Oxford factory.

₿ Crypto Corner

Binance US President and CEO Brian Shroder has resigned from the company, according to a Bloomberg report. Binance U.S. is going through another round of layoffs, cutting over 100 positions, one-third of its staff.

The Reserve Bank of India is working with lenders to introduce new features to popularise its central bank digital currency, the e-rupe.

Markets

Index & Commodity Prices

Bond Prices

ASX By Sector

ETF Watch

Newsletter Recommendation

|

Movers and Shakers

✅ Biggest Gainers

Burgundy Diamond’s share price rose by 16.1% to $0.18 after an update on its diamond sales during the last quarter. Burgundy said it has secured diamond sales of ~US$90m for Q3 CY2023 to date, compared to ~US$81m for Q3 CY2022. The higher sales price comes despite selling 784,000 carats in Q3 CY2023 to date, down from the 901,000 total carats sold in Q3 CY2022.

Burgundy went on further to say it maintains a rough diamond pipeline inventory of approximately US$139m as of the end of August.

Pact Group shares rose 7.4% after announcing it will be privatised, with majority owner Kin Group making a $0.68 per share off-market takeover offer for the company's remaining stake. Pact Group closed at $0.675 on Tuesday. In a statement to the market today, Kin Group said that Pact’s success would be better realised under private ownership, eliminating the challenges and volatilities associated with being an ASX-listed entity.

Given Kin Group's significant stake in Pact, the likelihood of any competing offers emerging is slim. The company has also expressed its intention to delist Pact from the ASX as soon as feasible. Kin Group will dispatch more details about the offer to shareholders by September 27.

🔻Biggest Fallers

Viva Energy shares fell by another 2.4% today after it confirmed that majority shareholder Vitol Investment Partnership completed a block trade with two financial institutions to underwrite the sale of 248.6 million ordinary shares in Viva Energy Group, representing ~16% of the company. After the sale, Vitol Investment Partnership holds a ~30% interest in Viva, making it the largest shareholder. Vitol said it does not intend to reduce its shareholding further in the short to medium term.

Deep Dive

From Hurricanes to Diseases: The Perfect Storm Striking Florida's Orange Juice Industry

Over the past few years, there has been a significant increase in the price of this commodity. In May 2021, it was priced at around $1.05 per pound (/lb), but by May 2023, it had surged to nearly $2.80/lb, a whopping 167% increase. This is due to the high demand for the commodity, which has consistently outpaced the rather lacklustre supply.

The main issue at the heart of this gathering is the severe reduction in supply capacity in Florida. Known for being one of the world's most prominent orange-juice-producing areas, this state is the top producer in the U.S., covering an estimated 375,000 acres, providing over 32,000 jobs, and contributing around $6.6 billion to the economy.

However, predictions show that Florida's orange juice crop harvests will hit their lowest levels since the 1930s, with the U.S. Department of Agriculture (USDA) projecting that growers in the state will produce only 15.7 million boxes during the 2022-23 season, with each box weighing 90 pounds (41 kilograms). This would be a significant 62% decrease from last season's final production figure, which was already the lowest on record.

What caused the poor performance in Florida's orange juice industry? One could argue that the recent hurricanes, Ian and Nicole, had a significant impact. These hurricanes hit the state's shores during the final quarter of last year, just a few years after Hurricane Irma devastated the orange farming industry. Similar to the destruction in 2017, the recent hurricanes damaged citrus groves across the state, causing existing fruit to fall to the ground and stripping leaves off trees, preventing the growth of new fruit.

Other extreme weather events, including freezing temperatures in January 2022, further hindered production by damaging budding trees. Furthermore, a damaging disease known as Huanglongbing, or citrus greening disease, has been severely impacting crop yields for over a decade by spreading through citrus trees and affecting virtually every Florida citrus grove.

Daily Quiz

Test Your Knowledge

Initial Public Offerings

Yesterday’s Daily Quiz Question: Which of these recent IPOs have had the largest market return?

Answer: Airbnb. Well done to the 72% who got this correct

Airbnb was listed on the U.S. Stock Exchange on December 10 at a listing price of $68.00, gaining over 110% on the first day alone. After reaching highs of $200 in early 2021, it trades at $147.50, returning holders a 116% return.

A Little Extra

📉 Going Down?

Top 10 shorted stocks on the ASX - as of September 7

Pilbara Resources (PLS) - 9.88%

Flight Centre (FLT) - 9.80%

Syrah Resources (SYR) - 9.52%

Elders Limited (ELD) - 9.11%

IDP Education (IEL) - 8.55%

Brainchip (BRN) - 7.46%

Select Harvests (SHV) - 7.31%

Mesoblast (MSB) - 7.28%

Core Lithium (CXO) - 7.28%

Appen (APX) - 7.25%

📊Broker Ratings

What do the brokers have to say?

Eroad (ERD) - Upgrade to Buy from Hold (Bell Potter)

Incitec Pivot (IPL) - Downgrade to Sell from Neutral (Citi)

Select Harvests (SHV) - Downgrade to Neutral from Buy (UBS)

👨💼 Director Transactions

What are the insiders doing? (On-market only)

💲Dividends

Companies trading ex-dividend today

Accent Group (AX1)

Brambles (BXB)

Breville Group (BRG)

Dusk Group (DSK)

EVT (EVT)

IGO (IGO)

Ive Group (IGL)

Joyce Corporation (JYC)

Maas Group Holdings (MGH)

Medibank Private (MPL)

📅 Economic Calendar

Data to keep an eye on this week

DISCLAIMER: None of the information provided in this newsletter should be constituted as financial advice. This newsletter is strictly for educational purposes only. It should not be taken as investment advice or a solicitation to buy or sell assets or make financial decisions. Please do your research.