- Equity Espresso

- Posts

- Rate Cut Bets Cool But ASX Climbs

Rate Cut Bets Cool But ASX Climbs

Good Evening,

Welcome to Equity Espresso’s Daily Market Recap.

A bumper session on the Aussie share market saw the main ASX 200 index finish Tuesday’s session in positive territory, climbing by 77.8 pts. or 1.01% to close at 7,778.10. It was a sea of green for equities despite a more ‘hawkish’ view from RBA governor Michelle Bullock on interest rates.

The Reserve Bank of Australia held interest rates at a 12-year high of 4.35% after its June policy meeting today. Here are some of the highlights from the post-meeting press conference:

A rate cut was “not considered” by the board at the June policy meeting, saying it was instead “alert” to some upside risks.

One of these upside risks was the monthly CPI in April; it was a bit higher than expected.

The board did discuss the case for increasing interest rates at this meeting.

“We’re not ruling anything in or out at the moment,” she reiterated to journalists at the press conference.

No sector was left behind, with all 11 major sectors finishing the day higher, with Utilities (+2.36%) and Financials (+1.63%) leading the charge. Origin Energy (+3.48%) shares charged higher as it looks to break a 10-year high. Banks proved popular due to the increasing likelihood that interest rates won't come down anytime soon. Macquarie Group (+2.64%), NAB (+1.98%), and CBA (+1.98%) were some of the best performers in the banking sector.

In company news:

Fortescue Metals (-5.18%) was the worst performer on the ASX200, closing at $21.79 after a ‘block trade’ post-market close on Monday. The AFR reported that fund managers were offered shares in the iron ore giant at $21.60 a piece.

Beach Energy (-2.20%) dipped after revealing its strategic review, saying it will cut spending by more than $150 million a year from operating costs.

Kina Securities (-7.37%) ended the day lower after downgrading profit expectations due to a ‘customer fraud incident’, with expected losses of between A$4.7 million and $5.8 million.

ASX Indices | ASX Sector Performance |

Wall Street

Another record close for Wall Street’s main indices, with the S&P 500 (+0.77%) and NASDAQ (+0.95%) hitting new heights on Monday ahead of a busy week of economic data and Federal Reserve speeches which could shed light on monetary policy.

Market heavyweights Apple, Microsoft, and Tesla led the charge, while A.I. darling Nvidia (-0.68%) shares fell. The Philadelphia SE Semiconductor index hit an all-time high despite Nvidia shares losing ground. Broadcom (+5.41%) stock rose for the seventh straight session after it received a rating upgrade from Truist Financial to a Buy.

Consumer Discretionary (+1.43%) and Technology (+1.18%) were the biggest gainers among the 11 S&P 500 sector indexes, while Utilities (-1.14%) and Real Estate (-0.70%) led the declines.

AMC Networks (-35.14%) shares plunged after it announced plans to sell $125 million in convertible senior notes due 2029. Autodesk (+6.48%) shares rose after activists fund Starboard Value took a $500 million stake in the company.

U.S. Indices | Fear & Greed Index |

S&P500 Sector Performance

Economic Data

The Reserve Bank of Australia retained its cash rate at 4.35% during its June meeting, keeping borrowing costs unchanged for the fifth time since it was last raised in November 2023.

Eurozone wages rose 5.3% year-on-year in the first quarter of 2024, the biggest rise since the last quarter of 2022, following a 3.2% increase in the previous period.

Sponsor

The Ultimate Investor Toolbox

The only Financial Software Tool you will ever need.

From precise charts to comprehensive transcripts, Koyfin has it all covered. Why settle for the ordinary when you can access data beyond your wildest dreams?

Whether you're a seasoned investor or just starting out,

Koyfin is your go-to platform for everything finance.

Quick Singles

🌎️ Around The Globe

Adidas is investigating allegations of corruption in China after receiving an anonymous letter.

Done Global has become the target of the Department of Justice (DoJ), accused of submitting fraudulent claims for reimbursements. Executives from the ADHD startup, including founder Ruthia He, were arrested and charged with fraud.

Huawei Technologies is considering taking a cut of in-app purchases on its Harmony mobile operating system.

Hyundai Motor’s Indian division filed for an initial public offering (IPO) that is expected to be one of the nation’s largest. The company aims to raise $2.5 billion in the IPO, which could result in a potential listing at the end of the year.

McDonald's is discontinuing its artificial intelligence-driven drive-thru order-taking program and will deactivate it in all participating restaurants by July 26, 2024.

Stellantis is implementing a plan called "Death of Chrome" to prohibit the use of chromium 6 in plating new vehicles due to its high toxicity.

Markets

ASX Company Movers

Commodity Prices

Bonds

Forex

Global Health Check

What The?

| Researchers from Japan examined fossilised ants from around 100 million years ago. They found that these ants had specialised sensory equipment for chemical communication and detecting threats. This suggests that they lived in advanced social colonies with cooperative parenting and division of labour, similar to modern ants. |

Newsletter Recommendation

|

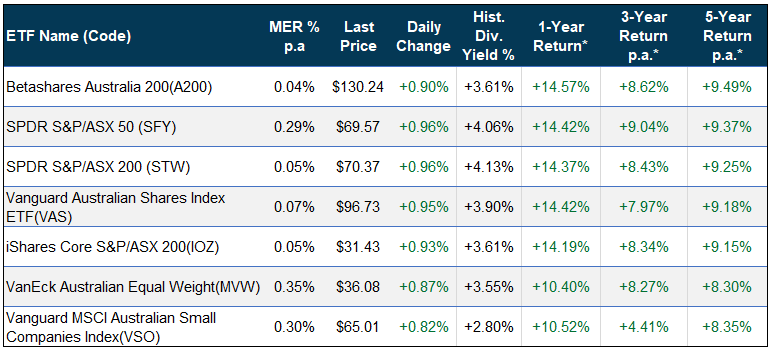

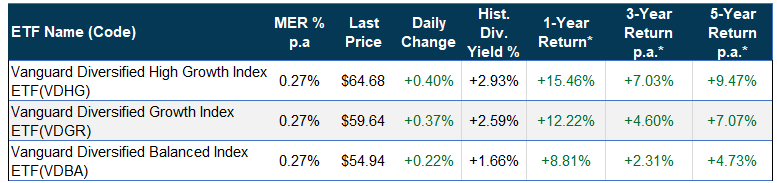

ETF Prices

🔍️ ETF Watch

Want to see how one of your ETFs compares to the rest?

Reply to this e-mail and tell us an ETF or two you want to be included in the tables below.

Australian Index

Australian Sectors

Global Indices & Sectors

Global Strategy

Property & Infrastructure

Fixed Income

Mixed Assets

*1-year, 3-year and 5-year returns are calculated as of 31 May 2024.

The Last Word

How are we doing?

We always love hearing from our readers and are constantly seeking feedback.

How are we doing with Equity Espresso?

Is there anything you’d like to see more of or less of?

Which aspects of the newsletter do you enjoy the most?

Hit reply and say hello - or leave us feedback in the poll below:

If you enjoyed this newsletter, forward this e-mail to a friend.

If you’re that friend, subscribe here.

DISCLAIMER: Please note that the information provided in this newsletter is for educational purposes only and should not be considered financial advice. It is not intended to encourage you to buy/sell assets or make economic decisions. We strongly recommend conducting your research before making any investment d