- Equity Espresso

- Posts

- RBA Hints at Potential Rate Increases

RBA Hints at Potential Rate Increases

Good Evening,

Welcome to Equity Espresso’s Daily Market Recap.

The second consecutive day of losses for the Australian market to start the new financial year. An afternoon slumber saw the ASX 200 index lose 32.5 points, or 0.4%, to 7,718.20 after the release of RBA minutes which confirmed what we kind of already knew - rate rises are back on the table.

Energy was the sole sector to finish in the green, rising by 2.00% thanks to a rise in Coal and Oil stocks. Whitehaven Coal (+5.7%) and Coronado Global Resources (+3.9%) gained ground again today on news that Anglo American’s coal project in Queensland was forced to halt production over the weekend due to an underground fire. Anglo (-2.78%) shares closed lower on Monday and were in the red again on Tuesday at the start of trading on the London Stock Exchange.

Oil prices rose about 2% to a two-month high on Monday, buoyed by hopes of increasing demand during the Northern Hemisphere's summer season and the ongoing risk of conflict escalation in the Middle East. Woodside Energy (+3.12%) shares were one of the biggest movers in the sector.

Real Estate (-1.42%) was the biggest detractor of the key sectors, with Goodman Group (-2.06%) and Charter Hall Group (-3.28%) seeing the sharpest drops.

Consumer Discretionary (-0.92%) was another sector to lose ground, with Lovisa (-3.67%), Idp Education (-2.15%) and The Lottery Corp. (-1.77%) falling the most.

Minutes from the Reserve Banks of Australia’s June meeting revealed the board discussed raising rates while also flagging its forecast for inflation to return to the mid-point of the target band by mid-2026 is at risk:

“Members acknowledged if inflation expectations were to rise materially from current levels, it could require significantly higher interest rates to bring inflation back to target.”

The TLDR is that rate rises are back on the table. Traders are pricing in a 32% rate rise at the next meeting in August. This was as low as 5% back on June 18….how quickly things can change.

In company news:

Bendigo & Adelaide Bank (-0.96%) CEO Marnie Baker will leave the company after 35 years with the group and will be replaced by Richard Fennell, the company's current Chief Customer Officer for Consumer Banking.

Liontown Resources (+7.30%) was the best performer on the ASX 200 after announcing it had secured a $379 million funding deal with South Korean battery company LG Energy Solutions.

Superloop (+1.29%) shares lifted after the company provided a trading update stating that its underlying EBITDA for FY24 is expected to be at or above the top end of the $51-$53 million guidance range.

ASX Indices | ASX Sector Performance |

Wall Street

All three major indices closed higher on Monday, with the NASDAQ (+0.8%) the best performer thanks to rises from Tesla (+6.05%) and Apple (+2.15%). Meanwhile, the S&P 500 (+0.27%) and Dow Jones (+0.13%) gained ground. Markets will be closed this Thursday for the Independence Holiday, with trading expected to be light on Friday.

Some of the key economic data investors will be watching this week revolves around labour:

Tuesday - Job Openings and Labor Turnover Survey (JOLTS) (May)

Wednesday - Nonfarm Employment Change (Jun)

Friday - Unemployment Rate (Jun)

Friday - Nonfarm Payrolls (Jun)

Boeing (+2.54%) and Spirit AeroSystems (+3.35%) shares both rose on news that Boeing will buy back the fuselage market in a $4.7 billion all-stock deal. Chewy (-6.6%) shares tumbled on news that Keith Gill, A.K.A “Roaring Kitty” or the “Gamestop Guy”, bought a 6.6% in the pet food e-commerce company.

Chewy’s third-largest shareholder

All three major U.S. indexes posted their seventh winning month in eight. The NASDAQ was the place to be, rising by 8.3% in Q2, while the S&P 500 was up 3.9%. To no one's surprise, Nvidia was the stock to hold, accounting for 31% of the S&P500’s returns in the year's first half.

U.S. Indices | Fear & Greed Index |

S&P500 Sector Performance

Economic Data

U.S. Manufacturing PMI declined to 48.5 in June, down slightly from the 48.7 read in May, which was also below forecasts of 49.1.

South Korea’s annual inflation rate slowed to 2.4% during June, after rising by 2.7% in May, below expectations of a 2.7% increase.

Sponsor

Trade Smarter with these Free, Daily Stock Alerts

It’s never too late to learn how to master the stock market.

You’ll receive daily trade alerts sent directly to your phone and email detailing the hottest stock picks.

The best part? There’s no cost to join!

Expert insights will be at your fingertips instantly.

Quick Singles

🌎️ Around The Globe

Apple smartphone shipments in China rose by nearly 40%, or 1.425 million units, to 5.028 million in May from a year earlier, according to data from the China Academy of Information and Communications Technology (CAICT).

Apple reportedly plans to produce new AirPods with camera modules by 2026. The new AirPods will feature an infrared camera that will integrate with Vision Pro and future Apple Vision headsets.

Chicken Soup for the Soul Entertainment, which owns movie rental company Redbox and the streaming service Crackle, filed for bankruptcy on Friday.

Lockheed Martin has been awarded a multi-year contract worth $4.5 billion for its air defence Patriot Missiles system.

Lumber prices dipped below $450 per thousand board feet in July, hitting a fourteen-month low due to a softened demand outlook for wood and housing construction materials.

Toyota is set to unveil its first E.V., the Bozhi 3X SUV, with an advanced self-driving system next year in China as part of a joint venture with China's Guangzhou Automobile Group.

Tractor Supply is going right-wing, eliminating diversity, equity, and inclusion roles, withdrawing carbon emission goals, and reversing support for the LGBTQ community. Tractor Supply is a retail chain that sells home improvement equipment, livestock, and agricultural supplies for farmers and pet owners.

Markets

ASX Company Movers

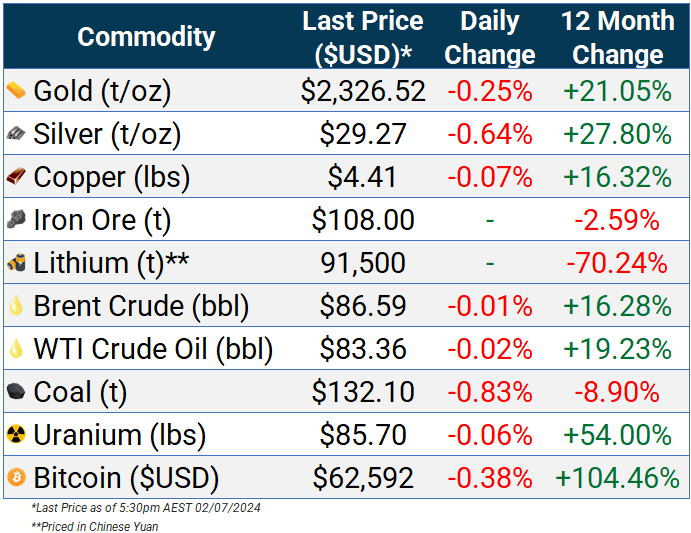

Commodity Prices

Bonds

Forex

Global Health Check

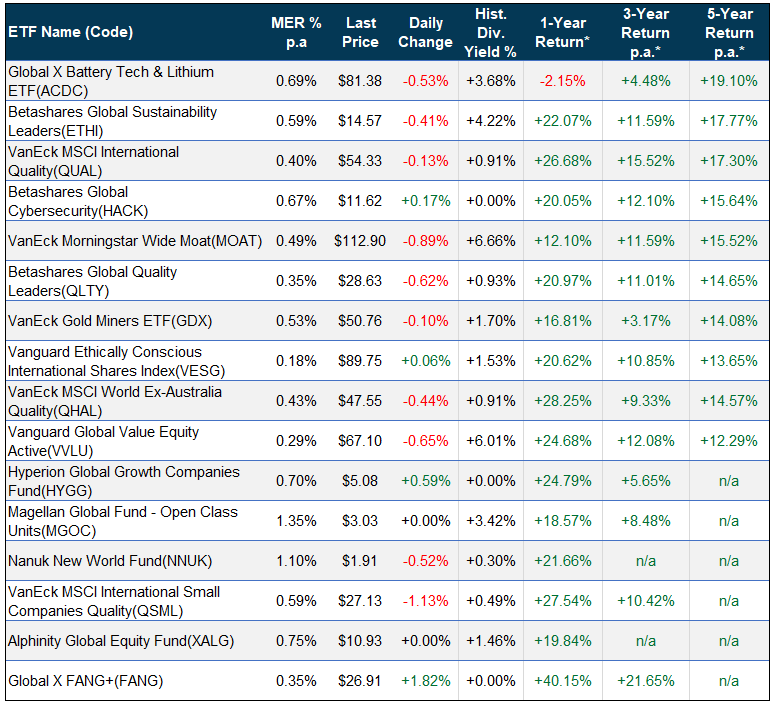

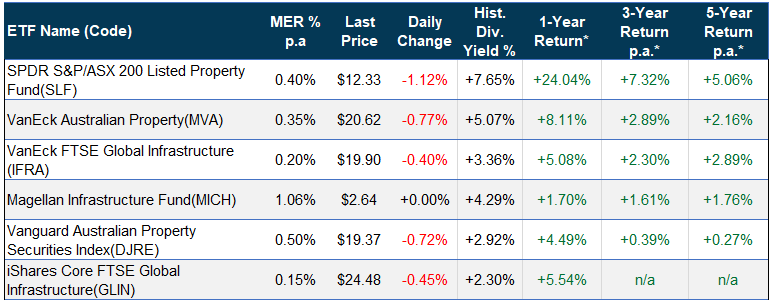

ETF Prices

🔍️ ETF Watch

Want to see how one of your ETFs compares to the rest?

Reply to this e-mail and tell us an ETF or two you want to be included in the tables below.

Australian Index

Australian Sectors

Global Indices & Sectors

Global Strategy

Property & Infrastructure

Fixed Income

Mixed Assets

*1-year, 3-year and 5-year returns are calculated as of 31 May 2024.

The Last Word

How are we doing?

We always love hearing from our readers and are constantly seeking feedback.

How are we doing with Equity Espresso?

Is there anything you’d like to see more of or less of?

Which aspects of the newsletter do you enjoy the most?

Hit reply and say hello - or leave us feedback in the poll below:

If you enjoyed this newsletter, forward this e-mail to a friend.

If you’re that friend, subscribe here.

DISCLAIMER: Please note that the information provided in this newsletter is for educational purposes only and should not be considered financial advice. It is not intended to encourage you to buy/sell assets or make economic decisions. We strongly recommend conducting your research before making any investment.