- Equity Espresso

- Posts

- RBA's Waiting Game

RBA's Waiting Game

Good Evening,

Welcome to Equity Espresso’s Market Recap.

The Australian share market rebounded on Tuesday despite another significant sell-off on Wall Street, gaining back some of yesterday’s losses. The ASX 200 index closed 31 pts. or 0.4% higher to 7,680.60 after the Reserve Bank of Australia kept the cash rate on hold at 4.35%.

Seven of the 11 major sectors finished the day higher, led by gains in Discretionary (+1.60%) and Real Estate (+0.96%) stocks. Wesfarmers (+2.27%), Goodman Group (+2.18%) and Aristocrat Leisure (+2.53%) were some of the big movers today.

Energy (-1.99%) was the worst performer on the day. Woodside Energy (-5.14%) shares sunk after the company announced it plans to acquire OCI Clean Ammonia Holding B.V. and its lower-carbon ammonia project for $2.4 billion.

The Reserve Bank of Australia (RBA) maintained its cash rate at 4.35% for the sixth consecutive meeting.

While inflation remains above the 2-3% target range, the RBA expects it to reach the midpoint by December 2026, six months later than the previous forecast. The bank cited increased government spending as a factor.

The RBA emphasised the need for vigilance against inflation risks and ruled out rate cuts this year. It said it would continue monitoring global economic conditions, domestic demand, inflation, and the labour market to inform future policy decisions.

In company news:

Audinate (-36.8%) shares were crunched after the company stated that it expects FY25 revenue to decline from the current year while gross profit will be “marginally lower.” The company provided unaudited results today, in which it said it expects revenue to be around US$60.0 million.

Coronado Global Resources (-0.78%) fell slightly after reporting a 10% fall in revenue to $1.3 billion in the half-year of FY24 due to lower coal prices.

Treasury Wines (+0.95%) shares rose despite the company announcing a $290 million post-tax non-cash impairment related to its premium brands division. The winemaker also said it plans to divest its Commercial brand portfolio, which includes its lowest-cost wines.

ASX Indices | ASX Sector Performance |

Wall Street

It was another terrible night on Wall Street. All three major indices closed significantly lower, with the NASDAQ (-3.4%) seeing the sharpest fall. The S&P 500 (-3.0%) and the Dow Jones (-2.6%) also finished lower, closing at their lowest levels since early May. Recession fears in the U.S. continue to drive investors out of equity markets, which began after last Friday's weaker-than-expected employment data.

All 11 major indices closed the day lower, with Technology (-3.78%), Communication Services (-3.35%), and Consumer Discretionary (-3.07%) the worst performers.

Apple (-4.8%) shares fell after Berkshire Hathaway halved its stake in the company, with Berkshire's cash holdings soaring to $277 billion. Crypto stocks were hit hard after the price of Bitcoin fell below US$50,000 before rebounding to trade at US$55,000. Shares in MicroStrategy (-9.60%) and Coinbase (-7.32%) declined.

Kellanova (+16.23%) shares hit a 52-week high following reports that candy maker Mars is exploring a takeover of the company.

U.S. Indices | Fear & Greed Index |

S&P500 Sector Performance

Economic Data

The Reserve Bank of Australia (RBA) kept its cash rate unchanged at 4.35% for the sixth consecutive month during its August meeting today, which was in line with market expectations.

Switzerland Retail sales fell by 2.2% year-on-year in June, well below market forecasts of a 0.5% rise. This follows a 0.2% drop in May.

Sponsor

Take a demo, get a Blackstone Griddle

Financial operations heating up? BILL Spend & Expense can help you take control. Automate expense reports, set budgets across teams, and get real-time insights into company spend. Take a demo to learn how and we'll give you a 28" Blackstone Omnivore Griddle—so you can take control of your next barbecue, too.

Quick Singles

🌎️ Around The Globe

Airbnb may start offering luxury amenities like personal chefs and massages to lure customers back from hotels.

Chinese tech giants, including Huawei and Baidu, are stockpiling high bandwidth memory (HBM) semiconductors from Samsung Electronics in anticipation of U.S. curbs on exports of the chips to China.

A U.S. judge ruled that Google violated antitrust law by spending billions to create an illegal monopoly and become the world's default search engine.

Meta is reportedly paying millions to celebrities such as Awkwafina, Judi Dench, and Keegan-Michael Key to use their voices in the company's A.I. projects, including Facebook, Instagram, and Meta’s Ray-Ban smart glasses.

Nvidia has reportedly delayed the production of its new Blackwell B200 chips by at least three months longer than planned due to a design flaw that was discovered unusually late in the production process.

Markets

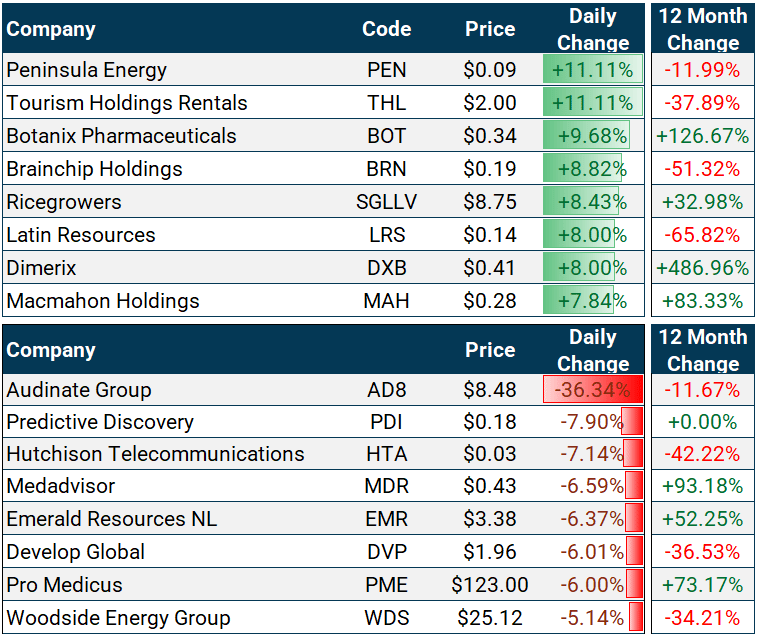

ASX Company Movers

Commodity Prices

Bonds

Forex

Global Health Check

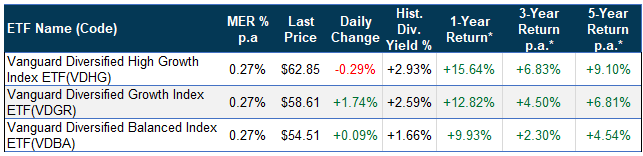

ETF Prices

🔍️ ETF Watch

Want to see how one of your ETFs compares to the rest?

Reply to this e-mail and tell us an ETF or two you want to be included in the tables below.

Australian Index

Australian Sectors

Global Indices & Sectors

Global Strategy

Property & Infrastructure

Fixed Income

Mixed Assets

*1-year, 3-year and 5-year returns are calculated as of 30 June 2024.

The Last Word

How are we doing?

We always love hearing from our readers and are constantly seeking feedback.

How are we doing with Equity Espresso?

Is there anything you’d like to see more of or less of?

Which aspects of the newsletter do you enjoy the most?

Hit reply and say hello - or leave us feedback in the poll below:

If you enjoyed this newsletter, forward this e-mail to a friend.

If you’re that friend, subscribe here.

DISCLAIMER: Please note that the information provided in this newsletter is for educational purposes only and should not be considered financial advice. It is not intended to encourage you to buy/sell assets or make economic decisions. We strongly recommend conducting your research before making any investment.