- Equity Espresso

- Posts

- Six Appeal: ASX Win Streak, Gold's New High, A2 Milk Sours

Six Appeal: ASX Win Streak, Gold's New High, A2 Milk Sours

Westpac, Lendlease & Nuix were just some of the companies reporting earnings. See how they fared ⬇️

Good Evening,

Welcome to Equity Espresso’s Market Recap.

The ASX 200 index overcame a sluggish morning to eke out a 9.3-point or 0.12% gain, closing at 7,980.40. This marks the sixth consecutive positive session and eighth gain in nine days, as the market continues to recover from a sharp 465.1-point drop experienced over two days at the month's start.

Despite markets moving higher, only four major sectors traded in the green, with Utilities (+1.67%) and Financials (+0.82%) as the best performers. Origin Energy (+2.48%) was the standpoint performer, rebounding after last week’s sharp fall. Westpac (+2.50%) was the best performer of the big banks after it reported a net profit of $1.8 billion during Q3, up 6% compared to the first half of 2024 quarterly average.

Consumer Staples (-0.83%) was the worst performer after a sharp fall from A2 Milk (-18.69%) after it said trading conditions in China remained challenging. More on that below. The Materials (-0.59%) sector also fell, with James Hardie (-2.46%), Bluescope Steel (-3.07%) and Mineral Resources (-3.73%) losing the most ground.

Gold stocks saw gains after the precious metal's price hit a new record of US$2,500/t. Northern Star Resources (+1.69%), Evolution Mining (+2.68%) and Westgold Resources (+1.70%) were some of the beneficiaries.

In company news:

A2Milk (-18.69%) shares plummeted following a grim outlook for its Chinese market. The dairy company forecasted mid-single-digit revenue growth for FY25, citing challenging trading conditions and infant formula supply constraints. A2Milk warned investors to expect a decline in market value through FY25.

Audinate (+19.89%) popped after reporting full-year earnings, with revenue increasing 28.4% to US$60.0 million and gross profit rising 33.2% to US$44.5 million. The company saw strong growth across software sales, chip deliveries, and Dante units while improving its gross margin to 74.3%.

Bluescope (-3.07%) increased its final dividend despite a 20% drop in net profit to $806 million for 2023-24. Revenue fell 6% to $17 billion, affected by weak Australian housing construction and low margins in Asia. The North American operations saw a slight decline, while the company expects first-half 2024-25 EBIT between $350-420 million.

Lendlease (-0.79%) reported a deepened full-year loss of $1.5 billion, with revenue falling to $9.2 billion. Despite significant impairments and devaluations, the company projects a return to profitability in FY2025, forecasting earnings per share between 54¢ and 62¢. This turnaround strategy includes business model overhaul and strategic asset sales.

Nuix (+25.50%) shares surged after reporting a $5 million profit for FY24, reversing last year's $5.6 million loss. EBITDA rose 60% to $55.9 million, with underlying EBITDA up 39% to $64.4 million. Annualised contract value increased 14% to $211 million, while revenue grew 21% to $220 million.

Reece Group (-3.91%) fell despite lifting its NPAT by 8% to $419.2 million for FY24 in a tough market as renovators trim back spending and approvals for new home builds slow. Total revenues were up 3% to $9.1 billion, while it increased its final dividend payout to 17.75¢ per share, up from 17¢ a year ago.

Suncorp Group (+1.34%) reported a 12% increase in net profit to $1.2 billion for the year ending June 30, rebounding from three challenging years. The insurer's recovery was driven by premium hikes, lower-than-expected natural hazard costs, and improved investment returns due to higher interest rates.

Westpac Group (+2.49%) reported a $1.8 billion unaudited net profit for the quarter ending June 30, up 6% from its average first-half quarterly return. Core net interest margin improved to 1.82%. Customer deposit growth of $15.4 billion and loan growth of $14.7 billion outperformed the Australian household deposits and housing loans market.

ASX Indices | ASX Sector Performance |

Wall Street

U.S. stocks ended higher on Friday, wrapping up the best one-week performance of the year. All three major indices made gains, led by the Dow Jones (+0.24%), followed by the NASDAQ (+0.21%) and the S&P 500 (+0.20%).

It was the seventh straight positive session for the S&P500 and NASDAQ as stocks recouped losses from two weeks triggered by recession fears. Eight of the 11 sectors rose, led by Financials (+0.62%) and Utilities (+0.40%), while Industrials (-0.19%) and Energy (-0.14%) companies fell.

Bayer (+10.37%) shares rose after the company won a legal victory in its lawsuit over claims that exposure to its Roundup weed and grass killer led to cancer. Bavarian Nordic (+17.83%) surged after it submitted data to the European Union’s drug regulator to extend Mpox (monkeypox) vaccine use for teens.

U.S. Indices | Fear & Greed Index |

S&P500 Sector Performance

Economic Data

U.S. Consumer sentiment rose to 67.8 in August 2024, up from 66.4 in July. This was above forecasts of 66.9, making it the first increase in five months.

U.S. Building Permits fell by 4.0% to 1.396 million in July 2024, the lowest point in four years and below market estimates of 1.43 million.

Sponsor

Earnings Hub - Your Earnings Calendar Go-To

Earnings Expectations & Actuals

Listen to Earnings Calls Live (or replay)

Earnings Alerts delivered via Text or Email

Quick Singles

🌎️ Around The Globe

Amazon is among six companies selected for a U.K. trial integrating drones that fly beyond visual line of sight into airspace. The experiment will test Prime Air drones' safety and accuracy when operating without direct visual contact from their controllers.

Bank of America has secured a landmark partnership with FIFA, becoming the first-ever global banking sponsor for the 2026 World Cup.

Lockheed Martin is buying Terran Orbital at an enterprise value of $450 million, below its previous bid of $600 million in March.

Shake Shack is partnering with Serve Robotics to introduce autonomous food delivery in Los Angeles. Customers ordering via Uber Eats may soon receive their meals from four-wheeled, cart-shaped robots navigating city sidewalks.

Spanx founder Sara Blakely is launching Sneex, a line of comfortable "hy-heel sneakers" that combine stiletto looks with sneaker comfort. Hand-crafted in Spain, the hybrid shoes range from $395 to $595 and aim to revolutionise high-heel wear.

Subway has reportedly called an emergency meeting with franchisees to discuss improving traffic and regaining market share despite falling sales.

Markets

ASX Company Movers

Commodity Prices

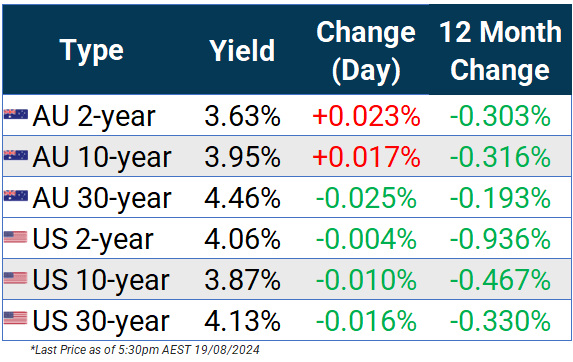

Bonds

Forex

Global Health Check

ETF Prices

🔍️ ETF Watch

Want to see how one of your ETFs compares to the rest?

Reply to this e-mail and tell us an ETF or two you want to be included in the tables below.

Australian Index

Australian Sectors

Global Indices & Sectors

Global Strategy

Property & Infrastructure

Fixed Income

Mixed Assets

*1-year, 3-year and 5-year returns are calculated as of 31 July 2024.

The Last Word

How are we doing?

We always love hearing from our readers and are constantly seeking feedback.

How are we doing with Equity Espresso?

Is there anything you’d like to see more of or less of?

Which aspects of the newsletter do you enjoy the most?

Hit reply and say hello - or leave us feedback in the poll below:

If you enjoyed this newsletter, forward this e-mail to a friend.

If you’re that friend, subscribe here.

DISCLAIMER: Please note that the information provided in this newsletter is for educational purposes only and should not be considered financial advice. It is not intended to encourage you to buy/sell assets or make economic decisions. We strongly recommend conducting your research before making any investment.