- Equity Espresso

- Posts

- ☕️ Takeover Talks, CEO Turmoil & Commodity Crunch

☕️ Takeover Talks, CEO Turmoil & Commodity Crunch

Good Evening,

Welcome to Equity Espresso’s Market Recap.

The Australian share market recovered from early losses on Monday, closing only slightly lower despite a weak start. The S&P/ASX 200 ended down 0.3% at 7,988.1 points, having opened more than 1% lower following disappointing U.S. jobs data on Friday that raised concerns about labour market strain.

The major banks saw declines of over 1% in early trade, but these losses were largely reversed as U.S. futures strengthened ahead of Wall Street's opening. The rate-sensitive REIT (+0.87%) sector emerged as the day's top performer, helping to offset losses in other sectors. Stockland (+2.16%) was a notable gainer after confirming discussions with the Australian competition regulator regarding the divestment of a residential community in NSW's Illawarra region.

The Discretionary (-0.82%) sector was the day’s worst performer, with Premier Investments (-3.86%) seeing a sharp fall following a weaker-than-expected trading update. The company also announced that it had fired Smiggle Managing Director John Cheston for “serious misconduct and a serious breach of his employment terms”.

Commodity markets continue to experience turbulence due to fears of economic slowdown in China and the U.S. Iron Ore fell below $US90/tonne, oil prices plunged 10% last week, and copper officially entered a bear market. These declines reflect weakening Chinese demand, oversupplied markets, and doubts about China's ability to meet its 5% growth target.

And finally, the ASX issued its quarterly rebalance for September. Guzman Y Gomez (+4.81%), Yancoal (+4.53%) and Westgold Resources (-3.47%) will all join the S&P/ASX 200 Index on September 23. They will replace Domain Holdings (-0.36%), Nanosonics (+0.28%), and Strike Energy (-2.70%), which will drop out.

Company News

ARB Group (+6.27%) U.S. associate ORW USA plans to acquire the 4 Wheel Parts business from Hoonigan for $30 million, pending court approval. This includes 42 retail stores and e-commerce sites.

Charter Hall Retail REIT (-0.27% ) and Hostplus have launched a joint off-market takeover bid for Hotel Property Investments, offering $3.65 per share for all remaining shares not already owned.

Hotel Property Investments' (+7.47%) shares jumped following a $3.65 per share joint takeover bid from Charter Hall and Hostplus. Despite the price jump, HPI's board has advised shareholders to reject the offer, stating it significantly undervalues the company. HPI shares closed at $3.74.

Domino's Pizza (-3.14% ) is facing a shareholder class action in the Federal Court of Australia. The lawsuit alleges misleading conduct and disclosure breaches regarding Domino's Japan market performance between August and November 2021. Domino's denies liability and will contest the claims.

Premier Investments (-3.86%) has fired John Cheston, managing director of the company's Smiggle business, for “serious misconduct and a serious break of his employment terms.”

Lovisa (-4.47%) shares fell on the news its incoming CEO, John Cheston, had been fired from his current role in Smiggle for serious misconduct.

Westpac (-0.72%) has appointed Anthony Miller, the current chief executive of Westpac’s business and wealth division, to lead the business starting in December of this year. Miller will replace current CEO Peter King.

ASX Indices | ASX Sector Performance |

Wall Street

U.S. stocks fell Friday following a disappointing jobs report. August added only 142,000 jobs, and July's figures were revised to 89,000. This data sparked uncertainty about Federal Reserve rate decisions, causing fluctuations in September rate cut expectations.

All major indexes declined, with the S&P 500 and Dow Jones recording their largest weekly drops since March 2023 and the Nasdaq since January 2022. Communication Services, Consumer Discretionary, and Technology sectors led the downturn across all S&P 500 sectors, reflecting concerns about economic softening and the Fed's ability to manage a soft landing.

DocuSign's (+3.97%) shares increased following the release of strong fiscal second-quarter results. The software company reported adjusted earnings of 97 cents per share on revenue of $736 million, surpassing analyst expectations of 80 cents per share and $727 million in revenue. Guidewire Software (+12.36%) stock surged following strong fiscal fourth-quarter results. The company reported 62 cents per share (excluding items) on revenue of $291.5 million, exceeding analyst expectations of 54 cents per share and $283.8 million in revenue. Additionally, Guidewire's full-year revenue forecast surpassed market projections, boosting investor confidence.

U.S. Indices | Fear & Greed Index |

S&P500 Sector Performance

Economic Data

The U.S. economy added 142,000 jobs in August 2024, more than a downwardly revised 89,000 in July but below forecasts of 160,000.

U.S. Average Hourly Earnings increased by 14 cents, or 0.4%, to $35.21 in August 2024, following a 0.2% rise in July and slightly above forecasts of a 0.3% rise.

China's Annual Inflation rate increased to 0.6% in August 2024 from 0.5% in July, falling short of market forecasts of 0.7%.

Saudi Arabia’s GDP contracted 0.3% YoY in Q2 of 2024, compared to preliminary estimates of a 0.4% fall, following a 1.7% decline in Q1.

Sponsor

These daily stock trade alerts shouldn’t be free!

The stock market can be a rewarding opportunity to grow your wealth, but who has the time??

Full time jobs, kids, other commitments…with a packed schedule, nearly 150,000 people turn to Bullseye Trades to get free trade alerts sent directly to their phone.

World renowned trader, Jeff Bishop, dials in on his top trades, detailing his thoughts and game plan.

Instantly sent directly to your phone and email. Your access is just a click away!

Quick Singles

🌎️ Around The Globe

Big Lots, the U.S. discount home goods retailer, has filed for Chapter 11 bankruptcy protection and secured $707.5 million to support operations. The company plans to sell its business to Nexus Capital, a private equity firm that will act as a "stalking horse bidder" in a court-supervised auction process.

Boeing has announced a tentative agreement with a union representing over 32,000 workers in the U.S. Pacific Northwest, potentially averting a strike scheduled for September 13.

OPEC+ agreed to delay planned oil output increases for October and November, responding to falling crude prices. The group, which includes OPEC and allies led by Russia, may further pause or reverse hikes if necessary. This decision affects 180,000 bpd out of 5.86 million bpd currently withheld.

Snap faces a lawsuit from New Mexico's attorney general, accusing the platform of facilitating sexual abuse and failing to protect minors. The suit alleges Snap's disappearing messages feature makes it attractive to predators.

Tesla has announced plans to launch its Full Self-Driving (FSD) product in Europe and Asia in early 2025, subject to regulatory approval. This move aims to expand Tesla's autonomous driving technology globally.

Verizon Communications plans to acquire Frontier Communications for $20 billion to expand its fibre network and compete with AT&T. Frontier's 2.2 million fibre subscribers across 25 states. This will complement Verizon's existing 7.4 million Fios connections, strengthening Verizon's position in the internet market.

Markets

ASX Company Movers

Commodity Prices

Bonds

Forex

Global Health Check

Newsletter Reccomendation

|

ETF Prices

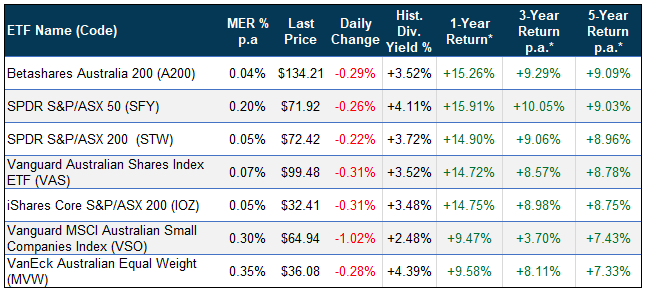

🔍️ ETF Watch

Want to see how one of your ETFs compares to the rest?

Reply to this e-mail and tell us an ETF or two you want to be included in the tables below.

Australian Index

Australian Sectors

Global Indices & Sectors

Global Strategy

Property & Infrastructure

Fixed Income

Mixed Assets

*1-year, 3-year and 5-year returns are calculated as of July 31 2024.

The Last Word

How are we doing?

We always love hearing from our readers and are constantly seeking feedback.

How are we doing with Equity Espresso?

Is there anything you’d like to see more of or less of?

Which aspects of the newsletter do you enjoy the most?

Hit reply and say hello - or leave us feedback in the poll below:

If you enjoyed this newsletter, forward this e-mail to a friend.

If you’re that friend, subscribe here.

DISCLAIMER: Please note that the information provided in this newsletter is for educational purposes only and should not be considered financial advice. It is not intended to encourage you to buy/sell assets or make economic decisions. We strongly recommend conducting your research before making any investment.