- Equity Espresso

- Posts

- Tech Titans Lead ASX's Surge, Mining Majors Reveal Earnings

Tech Titans Lead ASX's Surge, Mining Majors Reveal Earnings

Good Evening,

Welcome to the ASX News Daily Recap.

Lost track of today’s market updates? Don’t stress. We’re here to catch you up.

Here’s a sample of what you may have missed:

📈 U.S. Rates rise for the last time this cycle?

🖥️ Aussie Tech Leads the Way

🪨 Mining Giants Report

👜 ‘Free’ Gucci Gear

👽 Are We Alone?

The Recap

U.S Rates Rise - But Is This The Peak?

The Aussie market hit a five-month high today, with investors showing some cause for optimisation that the U.S. rate hike cycle might be getting close to the end. REITs and Tech stocks were the biggest winners of the day on our market, with both sectors benefiting from lower rates. Goodman Group (+2.83%), Scentre Group (+4.38%) and Stockland (+3.39%) all rose and led the way for REITs.

Some of the bigger Tech stocks to move the market today was Wisetech, which continues to eclipse all-time highs, up another 1.71% to $85.70. Xero (2.13%) and REA Group (2.61%) also had positive days, whilst Megaport rose by 14% on its quarterly update.

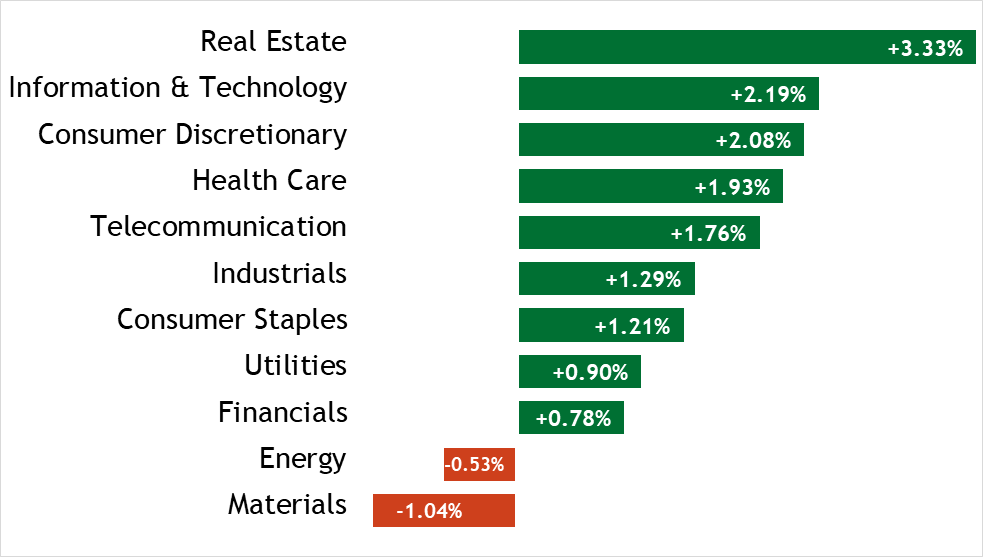

Energy (-0.53%) and Materials (-1.04%) returned some of their gains early in the week to be the only two sectors to finish in the red.

US Market Recap

We’re trading in what feels like foreign territory with the Dow Jones, making it 13 straight days in a row of green – the longest winning run since 20th January 1987 (let’s hope that’s not an omen!)

As expected, the FOMC raised the cash rate to a target of 5.25% - 5.5% – the highest point in 22 years. Fed chair Jerome Powell did little to quash the likelihood of further hikes saying it will be ‘data dependent’ and that the ‘full effects of tightening have not been felt yet.’ The U.S. 2-year bond yield dropped to 4.85%, so markets seem to be writing their own narrative!

The S&P500 started strong but ended the day 0.02% lower, whilst Meta’s positive earnings report wasn’t enough to drag the Nasdaq higher, with the tech-heavy sector falling by 0.12%

Economic News

The biggest news overnight from the U.S. was the FOMC and the expected rate hike. Here are the highlights:

Officials will remain ‘data dependent’ – with eight weeks until the next meeting in September

There are two job reports and two CPI reports before the next rate hike decision. The Fed will lean on both before deciding what to do next.

The process of bringing down inflation to 2% still ‘has a long way to go’

It’s unlikely we will see rate cuts this year.

The European Central Bank meets on Thursday, where it is expected that a 25 basis point rise will be announced.

Charts and Prices

Index & Commodity Prices

ASX By Sector

ETF Watch

Quick Singles

Local News 🪃

Fortescue Metals closed 3.4% lower despite reporting that iron ore shipments reached the top end of guidance, according to its June quarter results. Quarterly Iron ore shipments were recorded at 48.9 million tonnes which contributed to shipments of 192 million tonnes in the year to June. The miner had told investors to expect full-year iron ore shipments to be between 187 million and 192 million tonnes.

Insignia Financial reported that funds under management and administration increased 1.3 per cent to $295 billion and achieved its target inflows of $667 million for FY23. Shares closed $6.9% higher to $2.9

Karoon’s share price was flat today after reporting that oil production in the June quarter decreased by 15% to 1.68 million barrels, mainly due to a six-week shutdown in Brazil’s operation. Karoon finished FY23 with revenue of $US566.5million in revenue, an increase of 47%

Perpetual reported net outflows during the June quarter of $5.1 billion, with a total AUM of $212.1 billion at the end of the period, an increase of 0.8% from the March qtr. Shares ended the day 1.5% lower at $25.90

ProMedicus signed a seven-year, $24 million contract with the US-based Memorial Sloan Kettering Cancer Centre. The PME share price rose by 1.5% to $67.94

St.Barbara produced 77,125 ounces of gold in the June quarter at an all-in-sustaining cost of $2145 per ounce. Shares closed 5.6% lower to $0.25

Around The Globe 🌏

UPS inked a tentative deal with its team of delivery drivers, avoiding a strike of the 340,000-strong labour force, which, if it happened, is estimated to have cost the U.S. economy roughly $7 billion

The Wall Street Journal reported that TikTok plans to launch a U.S. e-commerce business selling Chinese-made products this August.

London-based oil company Shell reported a second-quarter profit fall from last year's heights. However, the company pledged extra share buybacks and raised its dividend.

French multinational Thales said it is set to buy U.S. Cybersecurity company Imperva in a deal worth $3.6 billion.

Earnings Results

Meta was up by over 8% in after-hours trading, with its artificial intelligence tools helping drive better recommendations on its Facebook and Instagram social apps. EPS for the quarter was $2.98 vs. est. of $2.92

Coca-Cola rose after increasing full-year guidance and reporting Q2 EPS of $0.78, above expectations of $0.72 from $12B in revenue.

Service Now reported quarterly revenue of $2.15B, which beat analysts’ expectations—Q3 revenue guidance of between $2.19B - $2.20B and Adj. EPS of $2.37 was ahead of forecast.

Luxury brands juggernaut LVMH fell by over 5% in Wednesday trade despite posting a 17% increase in second-quarter sales to $21.21B, a touch in front of expectations. The brand’s flagship Vuitton and Dior division grew revenue by 21% vs. the prior year. EPS was $16.93, above forecasts of $15.30

Boeing – rose by over 8% in after-hours trade after reporting FCF of $2.58B in Q2 on the back of $19.8B in sales.

Earnings Calendar

Another busy day on the calendar tomorrow:

Thursday: Intel, Mastercard, McDonald’s, Comcast, Ford, Roku

Friday: ExxonMobil, Chevron, P&G

Top Story

Rising Volumes, Dipping Prices: Rio Tinto's Mixed Bag of Fortunes

Rio Tinto shares dropped by 2.5% to close at $117.80 after the global mining giant reported that its half-year profit fell by 34% from last year on the back of weaker commodity prices, with underlying earnings of $US5.7 billion and a dividend payout falling short of analyst expectations.

The primary contributors to the decline in commodity prices were lower iron ore, reduced copper & aluminium, and alumina pricing.

Rio did, however, report improved operational performance, with a 5% lift in Iron Ore production volumes against last year.

FY23 Financial Performance Summary ($US) vs. FY22

Underlying EBITDA of $11.7m, down by -25%

Underlying Profit of $5.1m, down by -43%

Underlying EPS $3.52, down by -34%

Ordinary Dividend $1.77 p/s, down by -34%

Free Cash Flow $3.7m, down by -47%

Rio said that the 2024 and 2025 share of capital investment could reach up to $10.0 billion annually. This includes up to $3.0 billion for growth, depending on opportunities, and around $3.5 billion for sustaining capital. The company expects FY23 capital investment to be $7.0 billion.

Movers and Shakers

✅ Biggest Winners

Pacific Current Group (PAC) must feel like the popular girl at the dance today, with two suitors submitting take-over bids for the asset management company. Investment Manager Regal Partners made an unsolicited bid on Wednesday to acquire all PAC shares for $555 million at an implied value of $11.12 per share. GQG Partners announced this morning that it intends to submit a non-binding indicative proposal to acquire all PACs shares, although no amount was provided. PAC shares rose by 32% today to close at $10.31

Megaport (MP1) had an excellent day for investors, ending the session 14.4% higher to $10.62 after reporting that FY24 normalised EBITDA would be above previously advised guidance of $41m - $46m. FY23 normalised EBITDA came in at $20.6m, at the upper end of expectations. Megaport reported that its’ ARR grew by 6% from the previous quarter and 39% from the PCP.

🔻Biggest Losers

Regis Resources (RRL) tumbled 10.7% to $1.87 after providing a weaker outlook today in its quarterly report, with the gold producer expecting production of between 415koz - 455koz in FY24, after producing 458.4koz in FY23. June’s quarterly gold production was 122.5koz at an AISC of $1,851/oz. Regis said costs are expected to rise in FY24 - guiding between $1,995/oz - $2,315/oz.

Macquarie Bank (MQG) took a hit today, with the share price falling by 4.3% to $175.03 after the investment bank cited weaker trading conditions, impacting net Profit in the first quarter of financial 2024, which was substantially down on the pcp. Macquarie said its Macquarie Asset Management (MAM) and banking and financial services division posted a combined 1Q24 net profit contribution substantially down on 1Q23 “primarily due to lower investment-related income from green energy investments in MAM.”

Crypto Corner

From Pixels to Products - Guccis Special Offer for NFT Holders

Gucci, the well-renowned global fashion brand, merges the digital realm with tangible luxury, creating buzz within the NFT community.

Gucci is offering its NFT owners distinct physical products: an elite wallet and an elegant bag, not available to the general public. These exclusive offerings are reserved for the Gucci Vault Material NFT holders, underscoring Gucci’s commitment to innovation.

A year prior, Gucci launched its 'Gucci Grail NFTs', a distinguished digital avatar collection in collaboration with the narrative NFT project, 10KTF.

The 10KTF platform, spotlighting the fictional tailor Wagmi-san, allowed prominent NFT holders from communities like BAYC, Cryptopunks, and World of Women to enhance their digital avatars with signature Gucci attire.

The intrigue deepened when Gucci introduced its Material NFTs, limited to 2,896 tokens. These NFTs, displaying Gucci's iconic designs, remained enigmatic until the brand recently announced that they could be traded for one of the two exclusive physical items at no cost.

This initiative showcases Gucci's strategic approach to integrating digital assets with real-world luxury, offering NFT enthusiasts a product and a significant piece of the brand's evolutionary journey.

Crypto Price Watch

What The?

From time to time, we find something from out of this world we have to share

👽 Truth or Hoax? Are they out there, or maybe they’re already here? 🪐

In a groundbreaking revelation, ex-intelligence official David Grusch unveiled to the House oversight committee that the U.S. government has been involved in a secret multi-decade UFO program that collected and attempted to reverse engineer crashed UFOs. Grusch, who was responsible for analysing unexplained anomalous phenomena (UAP) within a Department of Defense agency until 2023, highlighted that "non-human" beings were discovered and emphasised that he was denied access to some secretive UAP programs. This revelation comes from whistleblower accusations Grusch made in 2022, suggesting the government concealed information on alien space crafts.

The committee also heard testimonies from others, most notably retired U.S. Navy pilot Commander David Fravor. Fravor recounted an incident in 2004 when he observed an object resembling a "Tic Tac," which demonstrated erratic movements, hovering near the ocean surface and travelling vast distances in seconds. Another retired navy pilot, Ryan Graves, reported frequent sightings of UAPs, describing them as "dark grey or black cubes inside clear spheres."

Critics said that Grusch seemed less detailed in his testimonies than in his media interviews, leading some to question the validity of his more sensational claims.

The Governments response?

The Pentagon refuted Grusch's allegations, asserting that no evidence was found to support claims regarding the possession or reverse-engineering of extraterrestrial materials.

Broker Reports

ASX downgraded to Underweight from Equal-Weight (Morgan Stanley) - P.T. $55.55

Beach Energy downgraded to Neutral from a Buy (Citi) - P.T. $1.65

NextEd Group upgraded to Buy from Hold (Bell Potter) - P.T. $1.70

Red5 upgraded to a Speculative Buy from Hold by Ord Minnett - P.T. $0.23

Economic Calendar

DISCLAIMER: None of the information provided in this newsletter should be constituted as financial advice. This newsletter is strictly intended for educational purposes only. It should not be taken as investment advice or a solicitation to buy or sell assets or make financial decisions. Please do your research.