- Equity Espresso

- Posts

- Three-Day Downtrend Snapped: ASX Rises as Materials & Energy Shine

Three-Day Downtrend Snapped: ASX Rises as Materials & Energy Shine

Good Evening,

Welcome to Equity Espresso. We’re here to catch you up on the day’s important stock market news in Australia and abroad. Here’s a sample of today’s top stories:

🪙 Perseus Rises

📈 Ackman’s Market Move

💳️ Zips Positive Cash Update

🎈 Ubers Skyward Turkish Journey

🤖 Micro A.I. Tech - Analyst Review

The Recap

ASX Breaks Losing Streak

The three-day losing streak was broken today as the ASX index rose marginally with a 12.8 point or 0.19% gain to finish Tuesday’s session at 6,856.90. It was a mixed day from a sector standpoint, with Materials (+0.85%) and Energy (+0.39%) the big movers as Iron Ore and Oil prices rebounded slightly, whilst Staples (-1.02%) fell the most.

The major news overnight was the 10-year treasury bond yields, which briefly crossed the 5.0% mark for the first time since 2007. The yield prices reversed after Hedge Fund Manager Bill Ackman announced in a post on ‘X’ that he had closed his short position against U.S. government bonds. The 30-year bond dropped by around 20 basis points.

Currently, 10-year treasury bond yields are trading at around 4.84%.

Persues Mining was one of the big movers today, climbing by 5.7% as it reported quarterly production numbers, which showed an improved cash margin thanks to lower costs. Zip Co. was another company that rose after it reaffirmed guidance that it would be positive cash EBTDA in FY24. We take a closer look at Zip’s result later in the newsletter.

Gold prices remain close to the elusive US$2,000 barrier, trading at around US$1,975. The price of Bitcoin shot up over 10% in the last 24 hours, hitting its highest point of 2023 of US$34,900.

Economic Data

The Judo Bank Flash Australia Manufacturing PMI read fell to 48 in October 2023 from 48.7 in September. This is the eighth successive monthly deterioration (below 50) in business conditions and the lowest figure in six months.

Outlook

Locally, RBA governor Michele Bullock speaks at an annual conference in Sydney tonight. The key data point of the week - September quarterly inflation, will be released tomorrow.

In the U.S., October's Services and Manufacturing PMI gets reported tonight. In the U.K., employment data will be released.

It’s a busy night on the quarterly earnings calendar, with Microsoft, Alphabet, Visa, HSBC, Coca-Cola and Novartis just some of the companies set to report.

Wall Street

It was a mixed performance overnight on Wall Street. The NASDAQ rose 0.27%, while the S&P 500 dropped by 0.17%. The 10-year treasury yields backed down from the 5% barrier after crossing this threshold for the first time since 2007.

In company news, Chevron has announced its plans to purchase Hess Corp in an all-stock deal worth $53 billion. The acquisition aims to expand Chevron's presence in the oil-rich region of Guyana.

Sponsor

Unlock Weekly Inspiration:

One Idea, One Question, One Exercise

Sign up for the ‘Your Next Breakthrough’ newsletter and receive

one idea, one question, and one exercise each week that could spark your next breakthrough.

Just five minutes each week that might change everything.

Sponsorship Opportunities

Do you want to advertise your business here?

Reach out to us at [email protected]

Quick Singles

🪃 Local News

Microsoft has announced a significant investment in Australia's digital infrastructure, cybersecurity, and skills to help the country capitalise on the artificial intelligence (AI) era.

Over the next two years, Microsoft will invest A$5 billion in expanding its hyper-scale cloud computing and AI infrastructure in Australia, marking its largest investment in the country in its forty-year history.

🌏 Around The Globe

Ride-hailing giant Uber is now offering hot air balloon rides over Turkey's popular Cappadocia region as part of its efforts to expand into the travel and tourism industry. Through the Uber app, users can reserve a place for €150 to enjoy a 1.5-hour sunrise flight, reaching an altitude of 3,000 feet (914.4 metres) over the UNESCO-protected volcanic landscape. A maximum of 20 places are available for each ride.

Tyson Foods has invested in Durch insect-protein company Protix, which turns black soldier flies into food for pets, poultry, and fish.

The Global Times are reporting that Chinese authorities have launched a tax probe into Foxconn, a major supplier of Apple's iPhones. Sources highlighted the audits come less than three months before Taiwan's presidential election.

Okta’s stock price continued to slide after confirming on Friday that one of its customer service tools had been hacked. The irony? Okta specialises in providing secure login credentials for other businesses.

South Korean internet company Naver Corp. has won a contract to build and operate a cloud platform for Saudi Arabia, securing its first major high-tech export to the Middle East. In a statement on Tuesday, the company said it will build and operate so-called digital twins or virtual versions of five cities, including Riyadh, Medina and Mecca.

Enjoying The Recap?

Forward this email to a friend, family member, or work colleague who would benefit from getting caught up on the day’s news.

They can sign up with the link below. ⬇️

Markets

ASX200 Company Movers

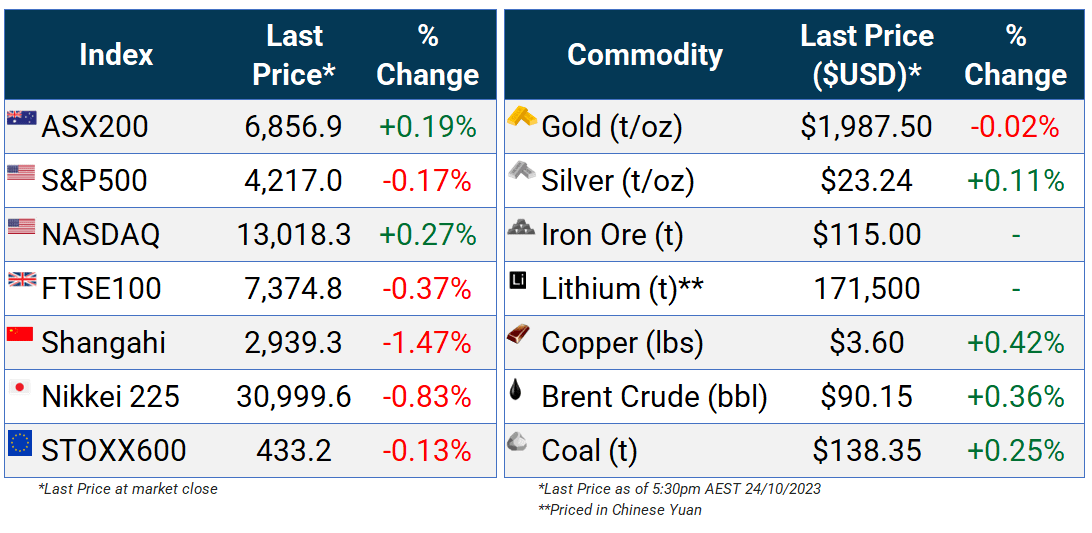

Index & Commodity Prices

Sector

Bond Prices

ETF Watch

ASX News

🗞️ Company Announcements

Ava Risk Group (AVA) shares fell after a Q1 trading update today, where it reported sales orders of $7.7 million, which was in line with the pcp. The companies detect segment saw orders of $3.6 million, down 36% on the same period last year. Ava said first-half revenue will be between $14.2 million and $15.2 million; however, the second half is expected to be stronger.

Ansell (ANN) held their AGM today, stating that trading for the first few months of FY24 is in line with expectations, maintaining its statutory EPS guidance to US$0.57 - $0.77. Ansell expects supply and demand in the industry to return to ‘normal’ levels by the second half of FY24.

Bubs Australia (BUB) - reported a 21.7% increase in Q1 group revenue to $24.3 million from the prior quarter (Q4 FY23), with the bulk of the growth in its USA business. China sales, however, were down 51% from the pcp.

Lynas Rare Earth's (LYC) shares rose by 12% after an announcement at market close that its Malaysian subsidiary had received a variation to its operating license. The license allows the continued processing and importation of Lanthanide Concentrate from Lynas' Mt. Weld mine in Western Australia at the Lynas Malaysia facility.

Monadelphous (MND) announced it had secured new contracts and extended current agreements totalling approximately $170 million. This included a new construction contract from Lynas Rare Earth for stage 1 of its Mt Weld Expansion project.

Redbubble (RBL) shares fell despite reiterating its FY24 guidance of a GPAPA margin between 23% and 26%, with operating expenses between $92 million and $100 million.

Perseus Mining (PRU) produced 132,804 ounces of gold during the September quarter at an AISC of US$937/oz. Gold sales for the quarter were down 17.5% to 115,954 ounces at an average sales price of US$1,936/oz. The West African gold miner reported an available cash and bullion position of US$594 million at the end of the quarter - an increase of US$72 million from June.

📱 Post of The Day

The tweet post that moved markets

We covered our bond short.

— Bill Ackman (@BillAckman)

1:45 PM • Oct 23, 2023

Deep Dive

Zip Co's 1Q FY24 Highlights

Zip Co. shares were one of the big movers early in the trading session before closing 6.7% higher to $0.32. The Zip share price has been on a steady downtrend; after hitting heights of $12.00 during the Buy Now Pay Later frenzy of 2021, it has fallen by 49%% in the last 12 months as unprofitable companies continue to get sold off heavily.

In today’s update, Zip reported that it was cash EBTDA positive during the first quarter of FY24, going on further to say it expects to achieve this for the entirety of FY24.

Financial Summary

Transaction Volume: $2.3b (+11.0% YoY)

Quarterly Revenue: $204.4m (+31.9% YoY)

Revenue Margin: Improved to 8.9% from 7.5% in 1Q23

Transaction Numbers: 18.0m for the quarter (+6.1% YoY)

Cash Transaction Margin: Improved to 3.5% for the quarter (a rise from 2.4% in 1Q23)

Active Customer Numbers: Stood at 6.1m by the quarter-end

U.S. Bad Debts: Approximately 1.3% of TTV, below the target range of 1.5% - 2.0%

CEO Commentary

Cynthia Scott, Zip Group CEO, highlighted the positive cash EBITDA milestone achieved with 1Q24.

“Zip delivered a positive cash EBTDA result as a Group for 1Q24, a significant milestone, reflecting the strength of the ANZ business, further strong momentum in US TTV, ongoing margin expansion and continued cost discipline. Zip continues to expect to achieve a positive Group cash EBTDA result for 2H24, and following a particularly strong start to the year, Zip now expects to achieve a positive Group cash EBTDA result for FY24.”

Outlook and Additional Insights

Zip displays solid top-line numbers in its core markets, particularly the Americas part of the business. The Americas segment saw a 45.7% increase in revenue to $97.8 million, supported by a 25.4% lift in ANZ revenue to $104.1 million. Considering current growth rates, it won’t be long until North America becomes the largest part of the business.

Despite this growth, Zip reported a modest decline in active customers across both regions, now at 6.1 million, a 1.8% decrease YoY.

Additionally, Zip's net bad debts as a percentage of total transaction value reduced from 2.34% a year earlier to 1.99% for the current period. Zip remains committed to innovation, aiming to offer customers better ways to manage their finances and budget responsibly.

Newsletter Reccomendation

One-click subscribe

|

Analyst Report

Unith Limited - Buy

Code: UNT | Market Cap: $18.9m | Current Price: $0.021

Price Target: $0.08 - $0.127 Sector: Communication Services

Broker: Pitt Street Research

Technology company Unith Limited has developed the Talking Heads platform, featuring digital avatars for one-on-one conversations with humans.

Broker Highlights:

The A.I. tailwind - The broker cites a Bloomberg Intelligence report earlier this year that predicts that the generative A.I. market would grow to US$1.3tn over the next decade. The most significant driver of the growth would be generative A.I. infrastructure.

Unith has recently secured several deals, including with the Alliance of Public Health, Ensuring and Xite Holdings. It also collaborates with an anonymous Big 5 Tech Company.

In its Q1 update last week, Unith reported a 24.5% quarter-on-quarter increase in revenue from its B2C AI-subscription products. They also onboard 337,000 new users during the period. The broker expects this growth rate to continue over the coming quarters.

Recommendation

Pitt Street Research reiterates their value of Unith at a $65.2m base case and $103.7m bull case, equating to 8.2c per share and 12.7c per share under the company’s current number of shares on issue.

You can access the report for free here.

Daily Quiz

❓️ Test Your Knowledge

Yesterday’s Daily Quiz Question. Which ASX miner owns the Kathleen Valley Lithium mine?

Answer: Liontown Resources. Liontown acquired the mine from gold miner Rameilius Resources in 2016. Liontown raised over $1 billion in debt and equity last week to fund production, which is set to commence in mid-2024. Well done to the 40% who got the question correct.

A Little Extra

📉 Going Down?

Top-10 shorted stocks on the ASX - as of October 18

Weekly Movers ⬆️

| Weekly Movers ⬇️

|

📊 Broker Ratings

What do the brokers have to say?'

BlueScope Steel (BSL) - Upgrade to Buy from Neutral (Citi)

👨💼 Director Transactions

What are the insiders doing? (On-market trade only)

💲Dividends

Companies trading ex-dividend today

GQG Partners (GQG) - $0.0259

Lion Selection Group (LSX) - $0.015

Bank of Queensland (BOQ) - $0.21

Morphic Ethical Equities Fund Ltd (MEC) - $0.035

Acrow Formwork and Construction Services (ACF) -$0.027

DISCLAIMER: None of the information provided in this newsletter should be constituted as financial advice. This newsletter is strictly for educational purposes only. It should not be taken as investment advice or a solicitation to buy or sell assets or make financial decisions. Please do your research.